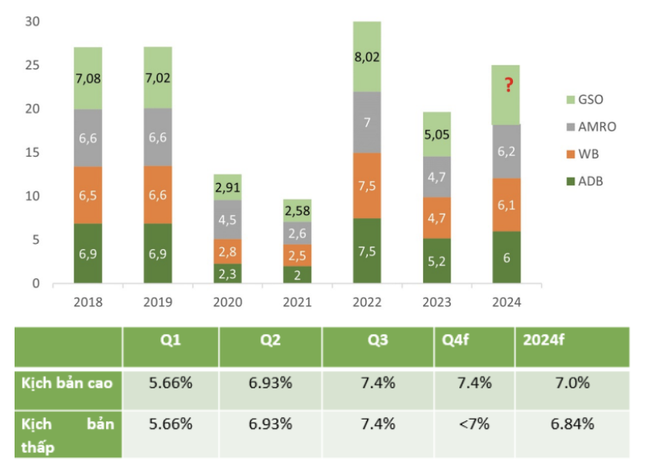

Today (October 15th), the Institute of Economics and Policy Research (VEPR) released its quarterly economic report for the third quarter, updating two growth scenarios for the fourth quarter and the whole year.

In the high-growth scenario, the fourth-quarter growth is expected to remain flat at 7.4%, with the full-year growth projected to reach the new target of 7% set by the government.

In the low-growth scenario, fourth-quarter growth is anticipated to be below 7%, with GDP fluctuating around 6.84%.

Forecasted and actual growth rates of Vietnam over the years, and VEPR’s two growth scenarios for 2024.

Summarizing the current economic landscape, Dr. Nguyen Quoc Viet, Vice President of VEPR, stated that GDP growth for the first nine months reached 6.82%, a 1.5-fold increase compared to the same period last year, mainly driven by the industry and services sectors. On the demand side, trade is on a recovery path, and foreign direct investment (FDI) inflows serve as the primary growth driver. Vietnam achieved a significant trade surplus of US$20.8 billion, the highest in the 2020-2024 period.

Revenue collection exceeded plans, while public spending decreased compared to the same period in 2023, resulting in a continued budget surplus, providing room for fiscal policies such as tax exemptions, reductions, and extensions, especially in the context of industries and sectors affected by Typhoon Yagi.

The US dollar exchange rate at domestic commercial banks has continuously decreased. The growth rate of money supply and credit growth has recovered quite well, positively contributing to promoting growth and investment, although it is still lower than the pre-COVID-19 pandemic average.

Dr. Nguyen Quoc Viet, Vice President of VEPR.

“The economy has many positive highlights, but there are still risks and challenges ahead,” said Dr. Viet.

According to Dr. Viet, the Purchasing Managers’ Index (PMI) declined, falling below 50 points in September. The ratio of withdrawing businesses to entering businesses remains high. Domestic consumption and public investment disbursement have not met expectations.

Economist Pham Chi Lan attributed the third-quarter growth to exports and the performance of FDI enterprises. For many years, domestic consumption and investment have not significantly contributed to growth.

Additionally, the business environment still poses risks and challenges, with conditions for business and administrative procedures tending to increase due to weakened reform momentum from ministries and sectors. Data on the business sector reflects this situation, as the number of businesses withdrawing from the market has remained high over the past nine months, with 163,700 businesses ceasing operations, a significant increase since 2020.

The New Blueprint for Economic Growth This Year

The Institute of Economic and Policy Research believes that gross domestic product (GDP) this year could reach the Government’s 7% growth target. However, the institute also cautions that there are risks in the fourth quarter regarding growth structure and low market demand.

“Resolute in the Pursuit of 7% Growth, Despite the Super Typhoon’s Challenges”

The outlook for Vietnam’s economy remains positive, with forecasts from both domestic and international economic organizations predicting high-growth scenarios that could even surpass the upper target of the 2024 GDP goal. Despite the potential setbacks caused by Super Typhoon Yagi, Prime Minister Pham Minh Chinh remains steadfast in his ambition to achieve a remarkable 7% growth rate for the year.