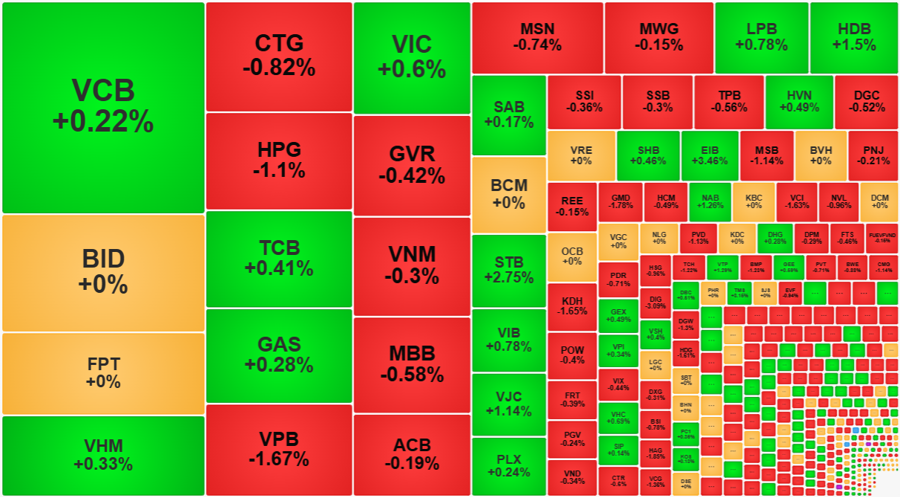

The VN-Index witnessed a notable surge in the afternoon session, even coming close to the peak of 1294 points reached during the morning session. However, in the last 15 minutes of continuous matching, a flood of sell orders pushed prices down across the board. The ATC session delivered the final blow, causing the index to dip below the reference level.

VPB, HPG, and CTG exerted significant downward pressure on the VN-Index during the sharp decline. HPG witnessed a decline of almost 1% in just a few minutes. Despite substantial buying interest in the ATC session, which stemmed the fall in price, HPG continued to slide, eventually closing 1.1% lower than the reference price. VPB remained in negative territory throughout the afternoon session but managed to recover slightly with the broader market. In the last 15 minutes and during the ATC session, VPB’s decline intensified, reaching 1.44%, and it ultimately closed 1.67% lower than the reference price. CTG, on the other hand, went from green to red, falling over 1.2% after 2:15 PM, and ended the day 0.82% lower than the reference price.

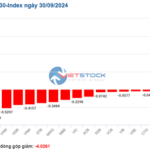

Several other large-cap stocks also witnessed sharp declines in the final minutes of trading. The breadth of the VN-Index illustrates this shift: at its afternoon peak around 2:15 PM, there were 200 gainers and 169 losers, but by the close, this had reversed to 157 gainers and 211 losers. Fortunately, the largest stocks, acting as “shock absorbers,” helped mitigate the decline: VCB rose 0.22%, VHM by 0.33%, TCB by 0.41%, GAS by 0.28%, and VIC by 0.6%. While these stocks also retreated, the magnitude was relatively modest. The VN30 basket closed with 12 gainers and 13 losers, and the index dipped 0.01%.

The banking sector, despite including VPB, CTG, and MBB among the top losers, remained relatively robust. Only 9 out of 27 bank stocks closed below the reference price, and several smaller banks posted gains of over 1%, including EIB, STB, BVB, VAB, HDB, ABB, and NBB. STB stood out with its unexpected strong performance in the afternoon session. After a modest gain of 0.72% in the morning session, STB surged in the afternoon, reaching a peak increase of 5.35%. However, it, too, succumbed to the downward pressure in the final minutes, plunging over 2.3% and ultimately closing 2.75% higher than the reference price. The banking sector contributed 6 of the top 10 stocks that propped up the VN-Index.

Trading volume in the banking sector signaled a resurgence of activity, with bank stocks on the HoSE exchange witnessing a 30% increase in trading compared to the previous day. It’s worth noting that the market’s upward turn in the previous afternoon session was also led by bank stocks. Today’s trading volume of 5,962 billion VND in bank stocks was the highest in the past 13 sessions. The six most liquid stocks on the market were all from the banking sector: STB, VIB, TPB, EIB, VPB, and MBB, each trading over 400 billion VND, with STB leading the way at nearly 1,163 billion VND. In terms of market share, the banking sector accounted for 42.8% of the total matched value on the HoSE exchange.

Other sectors exhibited a mixed performance, with stocks seeing both gains and losses. At the end of the day, the HoSE exchange had 157 gainers and 211 losers. The overall price level weakened significantly compared to the morning session, with 67 stocks falling by more than 1% (compared to 44 in the morning), and the trading volume of these stocks accounted for 18.9% of the market. Notable losers included DIG, which fell 3.09% with a trading volume of 107.4 billion VND; HDC, down 2.27% with a volume of 40.3 billion; HAG, down 1.85% with a volume of 37.6 billion; GMD, down 1.78% with a volume of 91.5 billion; and KDH, down 1.65% with a volume of 60.4 billion…

While there were 49 stocks that rose by more than 1%, their trading was highly concentrated. Just the top five stocks in this group accounted for the majority of the group’s trading volume, including STB, EIB, HDB, SZC, and VJC.

Foreign investors turned slightly net buyers in the afternoon session, purchasing a net amount of 28.3 billion VND compared to net selling of 182.7 billion VND in the morning session. Several stocks witnessed substantial foreign buying: MWG (+70.8 billion VND), YEG (+59.5 billion VND), VPB (+20.6 billion VND), EIB (+27.4 billion VND), and FPT (+22 billion VND). On the selling side, notable stocks included MSB (-34.9 billion VND), VHM (-34.2 billion VND), VCI (-27.5 billion VND), CTG (-23.3 billion VND), and HCM (-22.6 billion VND).

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three consecutive sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pulled back to very low prices, allowing sellers to offload their positions. Apart from the first few minutes when the VN-Index was slightly positive, the market plunged throughout the morning session, closing at its lowest point with four times as many losers as gainers.

“Undervalued Banking Stocks: Unlocking the Potential for Robust Growth”

“We recommend accumulating bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. The aforementioned banks have strong and sustainable growth motivations and are undervalued compared to their potential; these include ACB, CTG, MBB, TCB, and VPB. These financial institutions have robust fundamentals and are well-positioned to capitalize on Vietnam’s growing economy and thriving business sector. With their diverse revenue streams and expanding digital presence, these banks are poised to deliver stable returns and outperform the market. This accumulation strategy is a prudent approach to investing in Vietnam’s financial sector, offering a balanced risk-reward proposition for investors with a long-term horizon.”

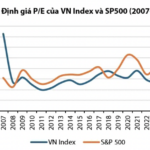

Why is the S&P 500 Hitting Record Highs While the VN-Index is Stuck Below 1200 Points?

Although the Compound Annual Growth Rate (CAGR) of EPS for the VN-Index (8.4%) outperforms that of the S&P 500 (7.6%) since 2016, the S&P 500 has witnessed a more remarkable surge, attributable to a more significant re-rating. Specifically, the S&P 500’s average P/E valuation has escalated from 15.3 times to 21 times, representing a substantial increase of 37%. In contrast, the VN-Index’s re-rating has been relatively modest, rising gently from 15.4 times to 16 times, a mere 4% increase.

The Market Beat: A Tale of Diverging Fortunes

At the close, the VN-Index witnessed a slight dip of 2.98 points (-0.23%), settling at 1,287.94; while the HNX-Index shed 0.8 points (-0.34%) to close at 234.91. The market breadth tilted towards decliners, with 436 stocks falling against 272 advancing stocks. The VN30-Index basket saw a balanced performance, with 19 decliners, 8 advancers, and 3 stocks remaining unchanged, maintaining a green-red equilibrium.