Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 479 million shares, equivalent to a value of more than 11.9 trillion VND; HNX-Index reached over 40 million shares, equivalent to a value of more than 701 billion VND.

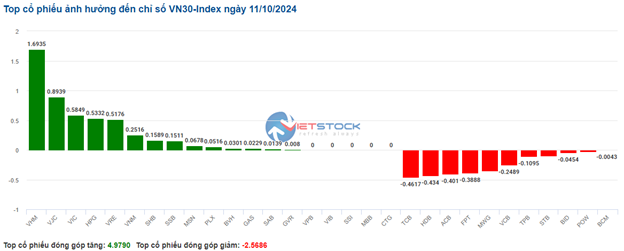

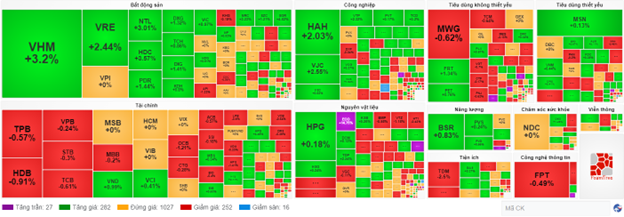

Selling pressure continued to dominate at the beginning of the afternoon session, but buyers returned, helping the VN-Index to recover quickly and maintain its green status until the end of the session. In terms of impact, VHM, VJC, MSN, and VIC were the codes with the most positive impact on the VN-Index, with an increase of more than 2.7 points. On the contrary, FPT, VCB, BID, and LPB were the codes with the most negative impact, taking away 2 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on 10/11/2024 |

Similarly, the HNX-Index also had a fairly positive performance, with the index being positively impacted by the codes DNP (+7.04%), MBS (+0.68%), PVI (+0.85%), and HUT (+0.61%)…

|

Source: VietstockFinance

|

The industry sector was the group with the strongest increase of 1.76%, mainly driven by the codes HAH (+3.22%), VTP (+4.51%), VJC (+2.74%), and VSC (+2.03%). This was followed by the real estate and telecommunications sectors, with increases of 1.28% and 0.9%, respectively. On the contrary, the information technology sector saw the biggest decline in the market, falling by -1.44%, mainly due to the code FPT (-1.48%), CMG (-0.93%), VTE (-12.07%), and POT (-1.12%).

In terms of foreign trading, foreigners net sold more than 357 billion VND on the HOSE exchange, focusing on the codes VHM (216.23 billion), FPT (90.86 billion), SSI (75.18 billion), and VPB (61.76 billion). On the HNX exchange, foreigners net sold more than 65 billion VND, focusing on the code PVS (30.71 billion), TNG (19.12 billion), SHS (14.93 billion), and IDC (7.76 billion).

| Foreign trading net buying and selling dynamics |

Morning Session: VN-Index returns to negative territory

The market continuously fluctuated around the reference level, and the efforts of the real estate group were still unable to stimulate demand. In fact, selling pressure increased significantly towards the end of the morning session. At the midday break, the VN-Index fell slightly by 0.03%, settling at 1,285.93 points; HNX-Index decreased by 0.07%, falling to 231.12 points. Although the index was relatively balanced at the reference level, the number of declining stocks outnumbered advancing stocks, with 326 declining stocks compared to 266 advancing stocks.

The trading volume of the VN-Index reached over 233 million units, equivalent to a value of nearly 5.7 trillion VND. The HNX-Index recorded a volume of nearly 18 million units, with a value of nearly 318 billion VND.

The Vingroup trio of VHM, VIC, and VRE mainly supported the market this morning, pushing the VN-Index up by more than 2 points. On the other hand, VCB, MWG, and BID exerted the most significant pressure, taking away more than 1.5 points from the VN-Index.

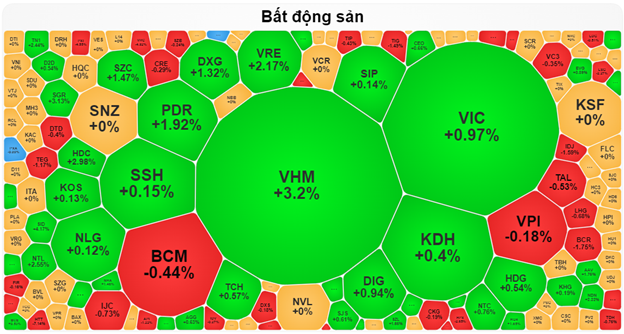

The real estate sector is currently the main destination for investment capital. Positive demand helped many stocks in this sector to break out strongly, such as VHM (+3.2%), VRE (+2.17%), PDR (+1.92%), DXG (+1.32%), SZC (+1.47%), NTL (+2.55%), HDC (+2.98%),…

Source: VietstockFinance

|

This was followed by the transportation sector, which increased by more than 1%. Green dominated the large-cap stocks in this sector, including ACV (+1.19%), VJC (+3.3%), HAH (+1.91%), VTP (+1.46%), and VSC (+1.45%).

Meanwhile, sellers dominated in most of the “blue-chip” stocks. Although the decline was mostly below 1%, the number of declining stocks outweighed the large-cap group, causing significant pressure on the overall index. The information technology group ranked last as FPT (-0.56%) and CMG (-1.31%) corrected after a positive session yesterday.

Foreigners net bought slightly more than 45 billion VND on the HOSE exchange this morning. The most notable stock was VHM, which was net bought at nearly 108 billion VND, far exceeding the value of other stocks. On the HNX exchange, foreigners net sold nearly 53 billion VND at the end of the morning session, with strong selling pressure concentrated in the PVS stock, with a value of more than 25 billion VND.

10:30 am: Financial group “loses steam,” investment capital flows into the real estate sector

As of 10:30 am, the VN-Index increased slightly by 1.61 points, trading around 1,288 points. The HNX-Index decreased by 0.23 points, trading around 231 points.

The VN30-Index recovered quite positively, although stock differentiation was still evident. Specifically, VHM increased by 1.69 points, VJC increased by 0.89 points, VIC rose by 0.58 points, and HPG gained 0.53 points. Conversely, only a few stocks continued to face selling pressure, including TCB, HDB, ACB, and FPT, which took away more than 1.7 points from the overall index.

Source: VietstockFinance

|

Real estate stocks are currently leading the index’s upward trend, with the sector recording the strongest increase of 1.19%. Specifically, green dominated most of the stocks in this sector, with VHM rising by 2.85%, VRE climbing by 2.71%, NTL surging by 3.01%, and HDC advancing by 2.78%… Only a small number of stocks remained unchanged, including VPI, NVL, KBC, and CKG, while a few stocks continued to face selling pressure, such as IDC, TIG, BCM…, but the decline was not significant.

Following the real estate sector, the industrial sector also maintained a good upward trend despite the differentiation in stock performance. Stocks like HAH rose by 1.55%, VJC increased by 2.74%, VTP gained 0.49%, and VCG climbed by 0.27%… On the other hand, PC1 fell by 0.36%, C69 dropped by 1.32%, MST declined by 1.75%…, but the selling pressure was not overwhelming.

In contrast, the financial sector performed relatively poorly, with red dominating the sector. Stocks in this sector faced selling pressure, including TPB, which fell by 0.57%, HDB decreasing by 0.91%, VPB slipping by 0.24%, and TCB dropping by 0.41%…

Compared to the opening, buyers maintained a slightly stronger position, although differentiation was still evident, with more than 1,000 stocks unchanged. There were 282 advancing stocks (27 stocks hitting the ceiling price) and 252 declining stocks (16 stocks hitting the floor price).

Source: VietstockFinance

|

Opening: Investors remain cautious

At the start of the trading session on October 11, as of 9:30 am, the VN-Index fluctuated around the reference level, reaching 1,288.82 points, with 20 stocks hitting the ceiling price, 246 advancing stocks, 1,170 unchanged stocks, 164 declining stocks, and 8 stocks hitting the floor price.

On October 10, the spot gold price rose by 0.6% to $2,623.58 an ounce, ending a six-day losing streak. Gold futures climbed by 0.5% to $2,639.30 an ounce.

The consumer price index (CPI) in the US rose slightly more than expected in September, but the annual inflation rate was the smallest in more than three and a half years. Another report showed that weekly jobless claims rose to 258,000 in the week ending October 5, 2024, higher than the expected 230,000.

As of 9:30 am, the energy sector led the market with positive momentum right from the start of the session. Notable stocks in this sector included BSR, which rose by 2.07%, PVD increasing by 1.46%, PVS climbing by 0.73%, PVC advancing by 0.77%, and PVB gaining 0.33%…

Next was the information technology sector, with stocks like FPT rising by 0.42%, CMG increasing by 0.19%, and ITD climbing by 0.4%… The remaining stocks in this sector were mostly unchanged.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three consecutive sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pulled back to very low prices, allowing sellers to offload their positions. Apart from the first few minutes when the VN-Index was slightly positive, the market plunged throughout the morning session, closing at its lowest point with four times as many losers as gainers.