Market liquidity decreased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 580 million shares, equivalent to a value of more than 13.4 trillion dong; The HNX-Index reached over 42.2 million shares, equivalent to a value of more than 736 billion dong.

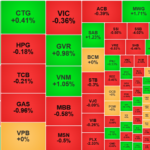

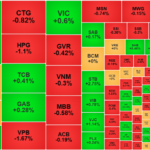

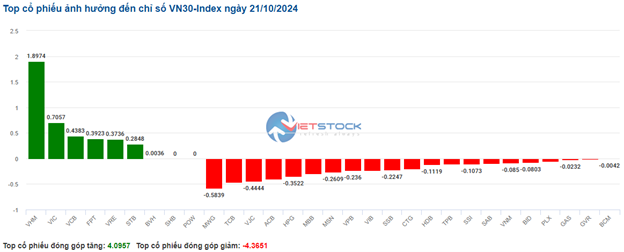

The VN-Index opened the afternoon session with a pessimistic sentiment and sellers gradually dominated, causing the index to plunge and close in the red. In terms of impact, CTG, BID, GVR, and VCB were the most negative stocks, taking away more than 2.9 points from the index. On the other hand, stocks such as VHM, EIB, VIC, and VRE had the most positive impact and contributed 3.7 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index on October 21, 2024 |

Similarly, the HNX-Index also had an unoptimistic performance, with the index negatively impacted by MBS (-2.01%), SHS (-2.61%), NTP (-3.55%), and PVS (-1.03%)…

|

Source: VietstockFinance

|

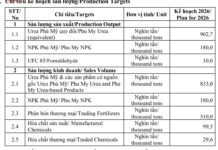

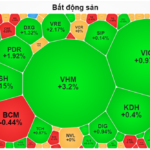

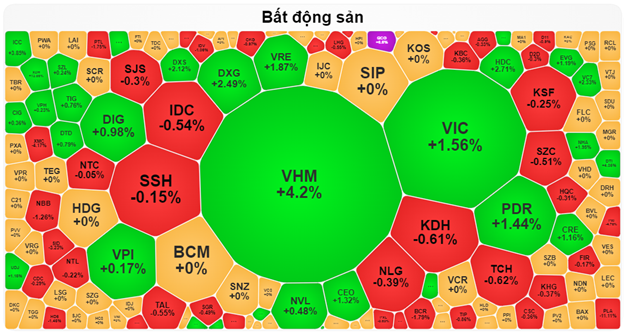

The energy sector recorded the sharpest decline in the market at -1.96%, mainly due to oil and gas stocks BSR (-2.23%), PVD (-1.71%), PVS (-1.03%), and PVB (-2.45%). This was followed by the telecommunications and materials sectors, which fell by 1.83% and 0.92%, respectively. In contrast, the real estate sector witnessed the strongest recovery in the market, rising by 1.11% with green signals from stocks such as VHM (+5.64%), VRE (+1.87%), VIC (+1.08%), and QCG (+6.6%).

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, focusing on stocks such as STB (129.83 billion dong), FPT (63.66 billion dong), HPG (56.02 billion dong), and SSI (53.91 billion dong). On the HNX exchange, foreign investors net sold more than 6 billion dong, mainly offloading MBS (4.87 billion dong), PVS (2.98 billion dong), NTP (2.28 billion dong), and VTZ (1.17 billion dong).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Continued Sideways Trading

The VN-Index fluctuated around the reference level throughout the morning session, with significant efforts from the real estate group helping the index close in positive territory. At the midday break, the VN-Index edged up 0.16% to 1,287.47 points. In contrast, sellers dominated the HNX exchange, causing the HNX-Index to decline by 0.43% to 228.22 points. In terms of market breadth, declining stocks outnumbered advancing stocks, with 356 losers and 238 gainers.

Liquidity slightly decreased, with the VN-Index‘s trading volume reaching over 233 million units in the morning session, equivalent to a value of more than 5.4 trillion dong. Meanwhile, the HNX-Index recorded a trading volume of over 20 million units, with a value of nearly 328 billion dong.

The Vingroup trio (VHM, VIC, and VRE) strongly supported the market, helping the VN-Index gain nearly 3 points (with VHM contributing more than 2 points). Additionally, VCB, EIB, and VNM also added more than 1 point to the overall index. On the other hand, CTG, SAB, and VJC were the stocks with the most negative impact, but their effect was not significant.

The real estate sector was the main highlight of the morning session. The group’s 1.4% gain was mainly due to buying interest in several large-cap stocks, including VHM (+4.2%), VRE (+1.87%), VIC (+1.56%), PDR (+1.44%), DXG (+2.49%), DXS (+2.12%), CEO (+1.32%), and HDC (+2.71%).

Source: VietstockFinance

|

The information technology sector was the only other group to remain in positive territory during the morning session. However, most stocks in this sector were either at the reference level or slightly in the red, with CMG (+1.73%) being the most notable contributor.

In contrast, the telecommunications group witnessed the sharpest decline of 1.24% due to the negative performance of VGI (-1.77%), ELC (-0.8%), and FOC (-0.84%). Other sectors also recorded declines, although they were less than 1%.

After a continuous net selling streak, foreign investors returned to net buying, with a net purchase value of nearly 86 billion dong on the HOSE exchange in the morning session, mainly due to strong buying interest in VHM (net buying of 120 billion dong). On the HNX exchange, foreign investors remained net sellers, but the net selling value was relatively small at nearly 4 billion dong.

10:40 am: Real Estate Sector Continues to Support the Market

Sellers continued to dominate the market, causing the main indices to fluctuate below the reference levels. At the same time, liquidity increased compared to the previous session, indicating a cautious market sentiment ahead of strong resistance levels. As of 10:30 am, the VN-Index fell slightly by 0.3 points, trading around 1,285 points. The HNX-Index dropped by 1.08 points, trading around the 228-point level.

The breadth among the VN30 basket was tilted towards decliners. Specifically, MWG, TCB, VJC, and ACB faced strong selling pressure, respectively taking away 0.58 points, 0.46 points, 0.44 points, and 0.4 points from the VN30-Index. Conversely, stocks such as VHM, VIC, VCB, and FPT maintained their recovery momentum, contributing more than 3.4 points to the index.

Source: VietstockFinance

|

The telecommunications group continued to face selling pressure, recording the largest decline in the market at 1.24%. Specifically, VGI fell by 1.62%, CTR decreased by 0.15%, VTK dropped by 2.15%, and MFS slipped by 0.69%… On the other hand, some stocks in the sector managed to stay in positive territory, including TTN (+5.76%), VNB (+3.74%), and VNZ (+0.07%)…

Following closely, the energy sector also witnessed a decline, with most stocks in the group trading in negative territory. Specifically, BSR fell by 0.89%, PVS decreased by 0.51%, PVD dropped by 0.57%, and PVB slipped by 1.05%… The remaining stocks in the sector were mostly unchanged.

On the bright side, the real estate sector demonstrated a strong recovery and played a crucial role in supporting the market. Buying interest was concentrated in large-cap stocks, including VRE (+2.4%), DXG (+1.25%), VIC (+1.67%), PDR (+0.24%), and DIG (+0.74%).

Notably, VHM stood out with a gain of over 4% shortly after the market opened in the morning session, accompanied by an increase in trading volume compared to the 20-day average, reflecting a positive investor sentiment. Additionally, the MACD indicator continued its upward trajectory and remained above the zero line after generating a buy signal, indicating the presence of bullish momentum.

Currently, the stock’s price is trending within a short-term bullish price channel after consecutive golden crosses between the SMA 50-day and SMA 100-day moving averages. This bullish setup is further reinforced by the ADX indicator, which is trending upwards and has crossed above the 25 level.

Source: https://stockchart.vietstock.vn/

|

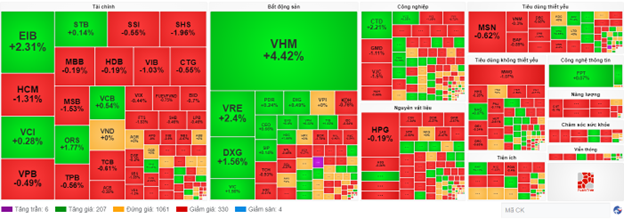

Compared to the start of the trading day, the market continued to fluctuate within a narrow range, with over 1,000 stocks unchanged and selling pressure outweighing buying interest. Among them, there were 330 declining stocks and 207 advancing stocks.

Source: VietstockFinance

|

Market Open: Sideways Trading from the Start

At the beginning of the October 21 trading session, as of 9:30 am, the VN-Index edged higher amid cautious sentiment, fluctuating around the reference level. However, the index received positive contributions from the information technology and real estate sectors.

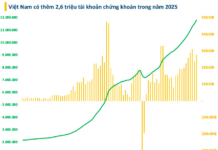

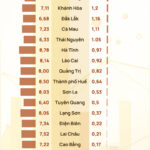

On October 20, at the National Conference to propagate and implement the Resolution of the 10th Plenum of the 13th Party Central Committee, Prime Minister Pham Minh Chinh stated that Vietnam’s GDP growth in 2024 is estimated at around 7%, surpassing the target set by the National Assembly (6-6.5%). Based on the achievements in the first years of the term, the estimated average economic growth rate for the 2021-2025 period is about 6% per year.

According to the latest data from the World Bank, Vietnam’s economy has grown from $346 billion in 2020, ranking 37th globally, to $433 billion in 2023, ranking 34th in the world.

Large-cap stocks, including VHM, VCB, and VIC, led the market’s advance, contributing more than 1.5 points to the index. Conversely, stocks such as CTG, VJC, and MSN weighed on the market, dragging the index down by more than 0.5 points.

The morning session was dominated by declining stocks, with several large-cap stocks in the telecommunications services sector falling from the beginning of the session, such as VGI and CTR, which dropped by 1.47% and 0.15%, respectively. On the other hand, stocks like TTN, YEG, VNZ, ELC, VTK, FOC, and others traded in positive territory.

Conversely, the real estate sector took the lead in the market’s recovery during the morning session. Notable gainers in this sector included VHM, which rose nearly 2%, VRE (+0.8%), DXG (+1.25%), HDG (+0.18%), NHA (+1.56%), and others.

The Rising Pessimism

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern and breaching the middle line of the Bollinger Bands. The MACD and Stochastic Oscillator indicators continue on a downward trajectory, reinforcing the sell signal. Moreover, persistent foreign net selling sends a cautious message to investors about the market’s outlook in the near term.

The Ultimate Headline:

“Warning Signs: Are Negative Signals Brewing?”

The VN-Index witnessed a significant decline, forming a Black Marubozu candlestick pattern and breaking below the previous low from early October 2024 (around the 1,265-1,270 point level). This strong bearish move reflects the prevailing pessimistic sentiment among investors. Moreover, the trading volume remains below the 20-day average, indicating that buying interest is still limited. The MACD indicator continues to flash a sell signal and has dropped below zero, suggesting that the downward trend is likely to persist in the near term.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.