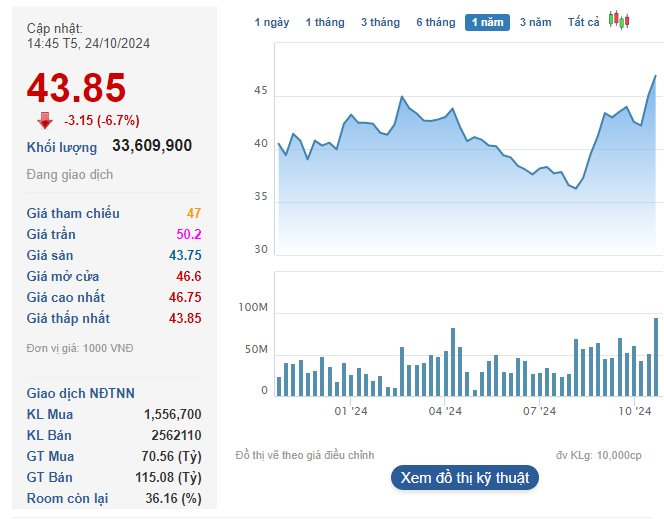

Vinhomes’ stock plummeted by 6.7% to 43,850 VND per share on October 24th, marking the second consecutive session of significant losses since Vinhomes began repurchasing its treasury stocks. The market capitalization swiftly declined by over 19,000 billion VND in just two sessions, settling at approximately 191,000 billion VND.

Prior to this downturn, the stock had rallied nearly 40% from its all-time low in early August, peaking at a one-year high of 48,250 VND per share on October 22nd, right before the treasury stock transaction took place.

As per the plan, Vinhomes aims to repurchase up to 370 million treasury stocks (accounting for 8.5% of the total circulating shares) through matching and/or negotiated contracts from October 23rd to November 21st, 2024. According to regulations, Vinhomes will place a minimum order for 11.1 million shares and a maximum order for 37 million shares each day during the trading period.

On the first day of the treasury stock purchase, October 23rd, Vinhomes successfully acquired a total of over 19.1 million treasury stocks, accounting for 5.17% of the registered amount, as per HoSE.

The stated purpose of the buyback by Vinhomes is that the market price of VHM shares is currently lower than the company’s actual value, and the repurchase is intended to safeguard the interests of the company and its shareholders. As per regulations, Vinhomes will place a minimum order for 11.1 million shares and a maximum order for 37 million shares each trading day.

On October 23rd, the first day of the treasury stock purchase, VHM witnessed vigorous trading activity with a matched volume of 33.3 million units. The corresponding matched value reached nearly 1,600 billion VND, the highest on the exchange. Additionally, VHM saw two negotiated transactions totaling over 4.1 million units, both at the reference price (48,250 VND per share). The total negotiated value was close to 200 billion VND.

The estimated cost of this transaction for Vinhomes could exceed 17,000 billion VND. If successful, it would be the largest treasury stock purchase in the history of Vietnam’s stock market. The company assures that the repurchase plan will be funded by available cash and operating cash flow from the sale of certain projects, thus having only a limited impact on the company’s liquidity and debt ratios.

The Astonishing Number of Vinhomes Shares Bought on the First Day of the Biggest Deal in Vietnam’s Stock Market History

Vinhomes is committed to purchasing a minimum of 11.1 million shares daily and will acquire up to 37 million shares during the trading period, as per the regulations.

“A Favorite Among Investors: PNJ Ranked in Top 3 for 2024”

PNJ has been voted as the Best Investor Relations Company among large-cap enterprises in 2024. This recognition is a testament to our unwavering commitment to adhering to information disclosure regulations and safeguarding the rights and interests of our shareholders.