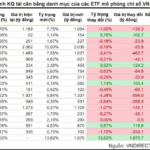

In a recent update report, Mirae Asset Securities (MASVN) stated that based on the newly announced index constituents, VN30 and VNFinlead remain unchanged in terms of stock constituents, with only some adjustments in calculation weights for the reference funds.

Meanwhile, for funds using VNDiamond as a reference index, there were more significant adjustments as the index added MWG without removing any stocks. This brings the total number of stocks in the index to 19.

The VN30, VNDiamond, and VNFinLead indices will come into effect from 11/4/2024, and ETFs tracking these indices will mostly be traded during the week of 10/28-11/01, with a structure lock on 11/01/2024.

Specifically, in the group of ETFs tracking the VNDiamond basket, there are currently 5 ETFs following the VN Diamond index: DCVFM VNDiamond ETF, MAFM VNDiamond ETF, BVF VNDiamond ETF, KIM Growth Diamond ETF, and ABF VNDiamond ETF. Due to the dominance of VFMVN Diamond with 95% trading weight, MASVN provides forecasts only for this group of funds.

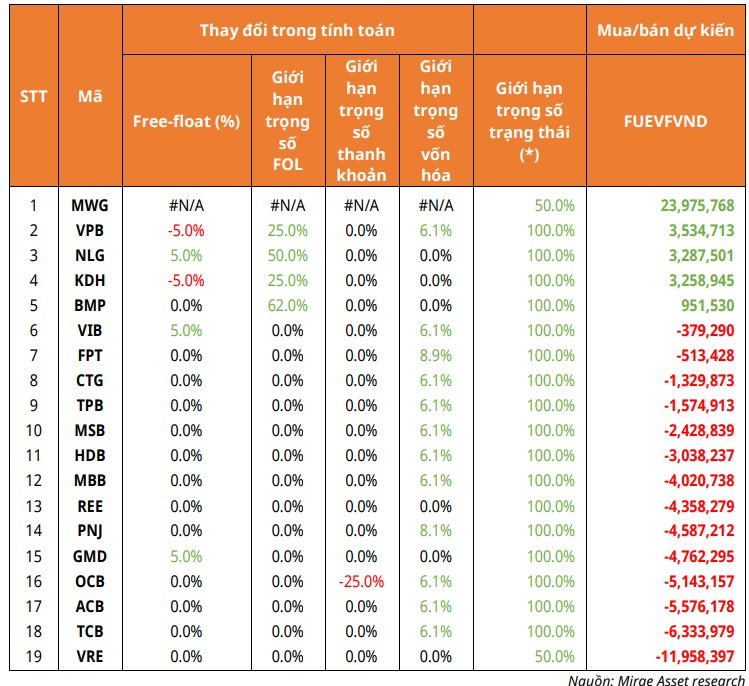

Accordingly, Mirae Asset projects that MWG and VPB are expected to be purchased by the funds with respective volumes of 23.9 million and 3.5 million shares. Two other real estate stocks that are forecast to be bought significantly are NLG (+3.3 million shares) and KDH (+3.3 million shares).

On the other hand, as VRE is on the watchlist for potential exclusion, it may be sold off with nearly 12 million shares in the upcoming restructuring. Additionally, the funds are expected to offload TCB (-6 million shares), ACB (-5.6 million shares), OCB (-5 million shares), and others.

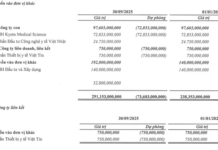

Trading Portfolio of VNDiamond ETFs

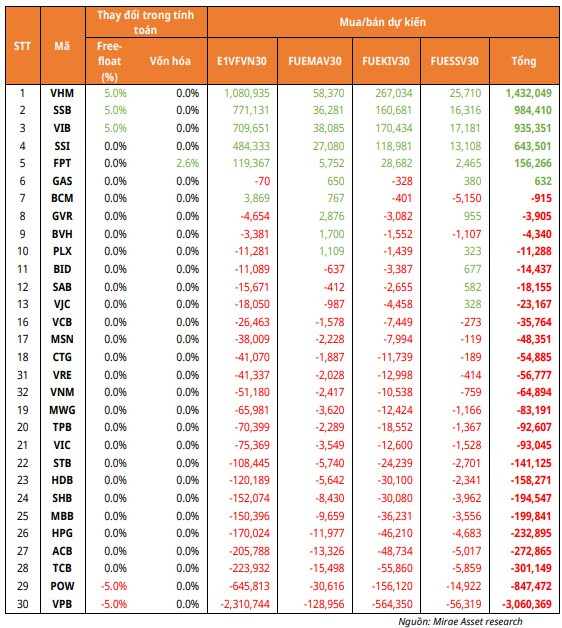

Regarding the ETFs tracking the VN30 index, there are currently 4 funds using VN30 as a reference index: E1VFVN30, FUEMAV30, FUEKIV30, and FUESSV30. With an estimated total asset value of over 9,500 billion VND. In this period, the VN30 index has no changes in stock constituents but only in the calculation components.

MASVN analysts forecast that VHM and SSB will top the buying list of the funds, with respective volumes of approximately 1.4 million shares and 980,000 shares. Conversely, VPB is likely to be sold off with more than 3 million shares, while POW may also face selling pressure with over 840,000 shares.

Trading Portfolio of VN30 ETFs

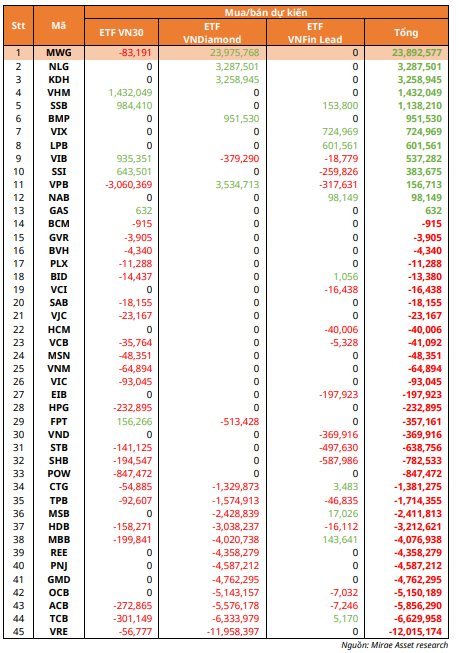

For the ETF tracking the VNFinLead index, there were no changes in stock constituents during this period. MASVN predicts that NAB and HCM will be purchased in quantities of 269,000 and 226,000 shares, respectively. Conversely, SHB and VIB may be sold off, with corresponding volumes of 301,000 and 255,000 shares.

Consolidated Transactions of VN30, VNDiamond, and VNFinLead ETFs

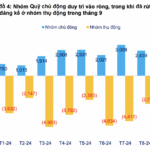

The Individual Investor’s Struggle: How Funds Consistently Come Out on Top

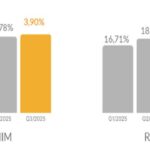

As of early 2024, an impressive 38 out of 61 equity funds tracked by FiinTrade have outperformed the VN-Index, with the top performers surging ahead by over 33%.