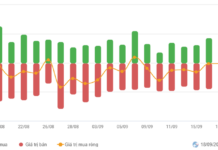

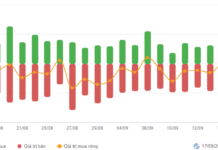

Gold ring prices have been on a record-breaking streak, reaching unprecedented highs. By the week’s end, Doji quoted gold ring prices at 87.9 – 88.9 million VND per tael. There were times when gold ring prices reached 88 – 89 million VND per tael, on par with gold bar prices.

According to experts, when gold ring prices are consistently hitting historical highs, investors should exercise caution and refrain from investing based on herd mentality.

Economist Dinh Trong Thinh notes that plain gold rings were traditionally purchased as gifts, but now many people buy them as a means of asset accumulation. However, with gold prices surging to unprecedented levels, he advises against buying or selling large quantities of gold.

” For buyers, purchasing at such high prices can fuel a bandwagon effect. As for sellers, gold rings are currently in short supply, so they may sell now but find it challenging to buy back later “, he says.

Gold ring prices reach an all-time high. Is it a good investment?

Gold expert Tran Duy Phuong shares a similar sentiment, suggesting that people refrain from buying gold unless necessary. Those who have already profited from gold purchases in the past should consider selling once they achieve their desired returns.

” Buying domestic gold now runs the risk of ‘chasing the peak’ if global prices suddenly plummet in the short term. On the other hand, if you sell to lock in profits and prices continue to rise, you shouldn’t regret it because gold ring profits since the beginning of the year have been attractive, ranging from 25 – 30% “, advises Mr. Phuong.

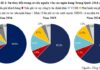

Economist and Dr. Dinh The Hien believes that while gold prices have soared recently, large-scale gold investments are not prevalent. Some estimates suggest that approximately 500 tons of gold are held by the public.

In the past, investors could spend tens of billions of dong on real estate, take out bank loans to purchase land and securities, and then cash out a few months later.

Conversely, it is uncommon for an investor to spend billions of dong on gold, indicating that significant capital shifts from other investment channels to gold in large quantities are unlikely.

Gold is a preferred choice for those with a conservative investment mindset, and it is a popular form of savings. However, given the substantial sums involved, it is unlikely that investors will funnel all their idle capital into gold to ride the waves or seek short-term profits.

“Predicting gold prices is incredibly challenging at the moment. Prices fluctuate hourly in the international market. Moreover, given the substantial gains in gold prices since the beginning of the year, the likelihood of a short-term correction is high, and the potential for further near-term gains is relatively low “, says Mr. Hien.

Commenting on the recent surge in gold ring prices, economist Nguyen Tri Hieu attributes it to global influences and the stability of gold bar prices due to regulations, while gold rings bear the brunt of the volatility. Additionally, the demand for gold among Vietnamese remains robust, as it is viewed as a form of savings and investment.

The scarcity of gold bars and rings in the market could be attributed to individuals hoarding gold, anticipating higher prices before selling. Meanwhile, the State Bank of Vietnam has not authorized gold businesses to import gold materials for over a decade. Furthermore, the discovery and disruption of gold smuggling rings by law enforcement have contributed to the limited supply of gold materials in the market.

” If the gold ring market continues to feverishly ‘overheat,’ I believe the State Bank of Vietnam will likely intervene “, predicts Mr. Hieu.

Mr. Nguyen Quang Huy, from the Finance and Banking Faculty of Nguyen Trai University, attributes the surge in domestic gold ring prices to both international factors and the domestic investment landscape.

In the domestic market, the challenges in acquiring SJC gold bars have prompted people to turn to gold rings, driving up demand and prices daily. Many shops have temporarily halted gold ring sales and are only buying to boost their supply.

” One measure to cool down the gold ring market is to increase the supply of SJC gold bars, making them more accessible to the public. This would help balance the supply and demand dynamics between different types of gold and alleviate the pressure on gold ring prices “, explains Mr. Huy.

The Golden Challenge: Navigating the Complex World of Buying and Selling Gold

The SJC gold bar and gold ring prices have reached new heights, yet very few jewelry stores are willing to buy.