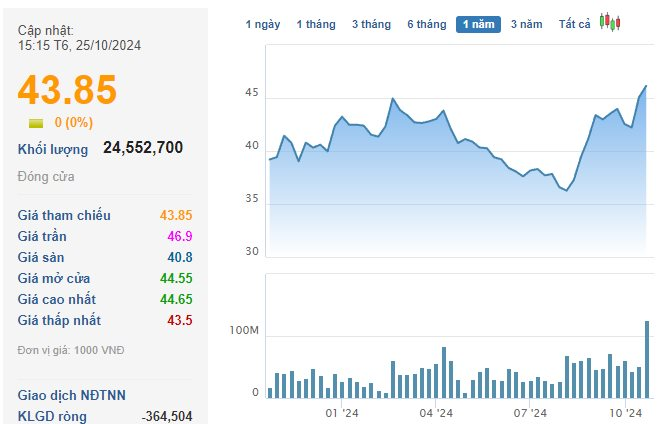

According to the latest update from the Ho Chi Minh City Stock Exchange (HoSE), as of the close of the October 25, 2024, session, Vinhomes (VHM) had purchased a total of over 41.3 million treasury shares, accounting for 11.16% of the registered amount.

As per the previously announced plan, Vinhomes intended to buy back up to 370 million treasury shares (accounting for 8.5% of the total outstanding shares) through matching or negotiated orders from October 23 to November 21, 2024. The company cited that the reason for the buyback was that the market price of VHM shares was lower than the company’s actual value, and the repurchase would protect the interests of the company and its shareholders. According to regulations, Vinhomes would place orders to buy a minimum of 11.1 million shares and a maximum of 37 million shares each trading day during the transaction period.

In the initial sessions of the transaction, trading in VHM shares was relatively active, with matching orders for tens of millions of units per session, ranking among the top in the market and doubling or tripling the volume compared to the previous period. At the close of October 25, the market price stood at VND 43,850/share, a decrease of about 9% compared to before the treasury share purchase initiative. Temporarily calculating based on the closing price, Vinhomes spent nearly VND 1,900 billion to buy treasury shares in the first three sessions.

Earlier, in September, Vinhomes had announced the results of seeking shareholders’ opinions on the purchase of up to 370 million VHM shares. The repurchase was subsequently approved by shareholders, with a 99.91% approval rate of the total valid votes. The estimated total amount of money that Vinhomes may have to spend on this deal could reach over VND 17,000 billion. If successful, this would be the largest treasury share purchase deal in the history of Vietnam’s stock market, and Vinhomes’ charter capital would decrease by VND 3,700 billion, from VND 43,543 billion to VND 39,843 billion. The company affirmed that the share buyback plan would be financed by available cash and operating cash flow from the sale of certain projects. Therefore, the repurchase of shares would only have a limited impact on the company’s liquidity and debt ratios.

What’s So Special About Stocks That Have Recently Upgraded to the HOSE Exchange?

Over 204 million shares of DSC Securities have been officially listed on the HOSE, amidst a strong surge in the company’s third-quarter profits.