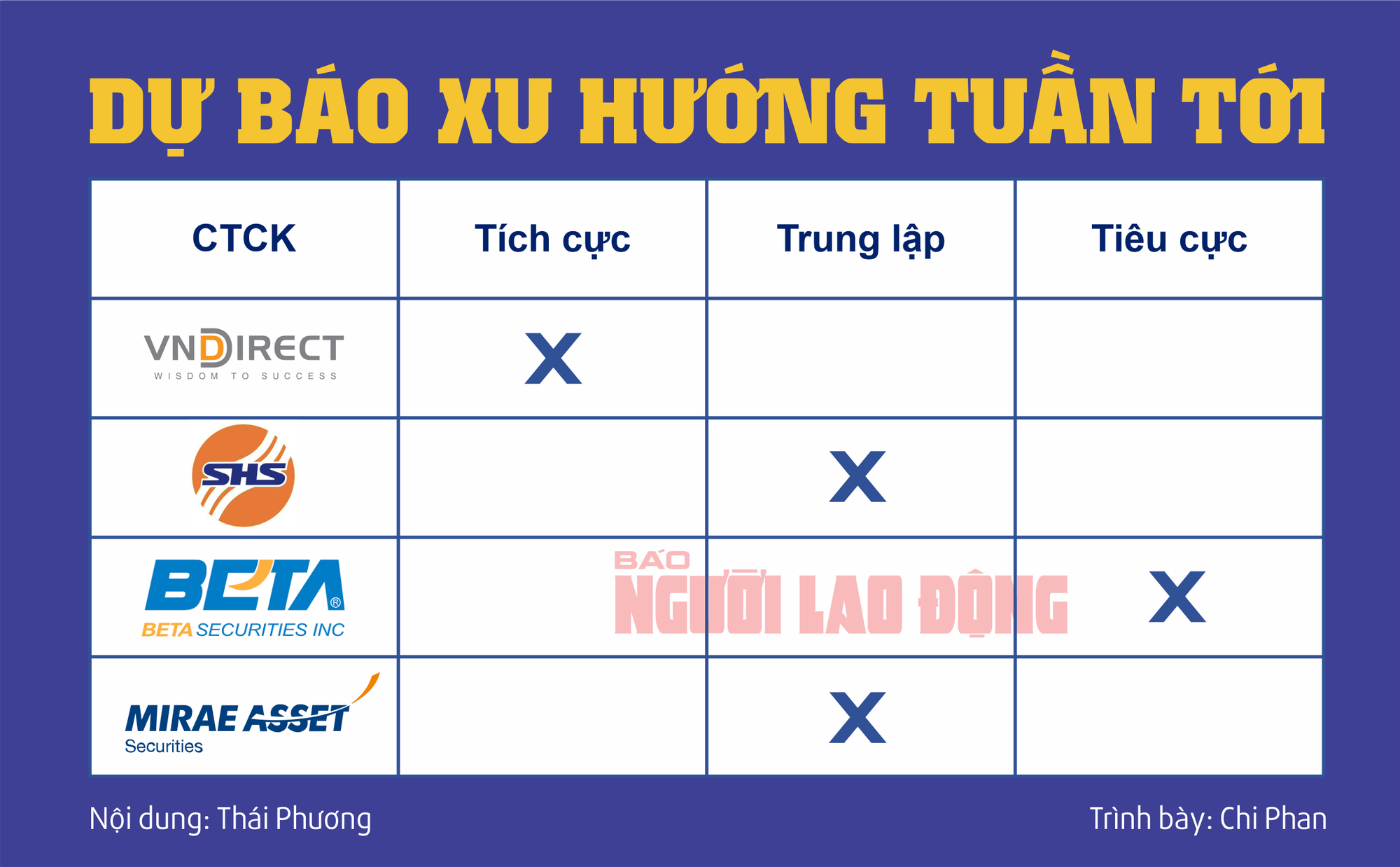

Market experts anticipate an early bottom-fishing force for good stocks.

At the end of the trading session on October 25th, the VN-Index fell by 32.74 points (-2.55%) to 1,252.72; the HNX-Index decreased by 4.58 points (-2%) to 224.63, and the Upcom index fell to 91.82.

Banks were the main drag on the market indices, with notable declines in stocks such as BID, CTG, and TCB…

The total matched transaction value of the VN-Index reached 70,409 billion VND, slightly lower than the previous week. Foreigners continued to net sell more than 1,000 billion VND, focusing on HPG, MSN, and STB…

The market is going through a clear weakening phase as buying power is not strong enough to counter the increasing selling pressure. The market’s gloom has negatively affected investors’ sentiment, leading to reduced liquidity.

On various investment forums and groups, many investors expressed discouragement and even started “turning off their apps,” temporarily halting their trading activities.

The Great Bank Heist: How Did the Tycoons’ Assets Vanish into Thin Air?

Last week, a number of banks, including Eximbank, ACB, and Techcombank, witnessed a notable dip in their stock prices, despite having reported robust financial results.

The Latest and Largest Shareholder Unveiled in Renowned Bank

The Credit Institutions Act of 2024 mandates that banks disclose personal information, ownership ratios, related-party information, and ownership ratios of related parties for shareholders holding 1% or more of the bank’s charter capital. Several banks have recently published their shareholder lists, shedding light on the ownership structure and key stakeholders. This move towards transparency is a positive step for the industry, providing valuable insights into the complex web of investments and relationships that underpin the financial sector.