On the afternoon of October 28th, SJC gold bar prices surged to a new high as listed by SJC Company, with buying and selling prices at 87 million VND per tael and 89 million VND per tael, respectively. This marks the highest price for SJC gold bars in recent months, reflecting an increase of approximately 13 million VND per tael since the beginning of the year.

The price of 99.99% gold rings also reached an all-time high, with buying prices around 87.5 million VND per tael and selling prices at 88.9 million VND per tael, a staggering 26 million VND increase compared to the beginning of the year.

The surge in domestic gold prices can be attributed to the influence of global gold prices, as the precious metal continuously sets new historical peaks in the international market. At 11:45 am Vietnam time, the global gold price stood at 1,731 USD per ounce, merely 30 USD away from the all-time peak of 2,758 USD per ounce.

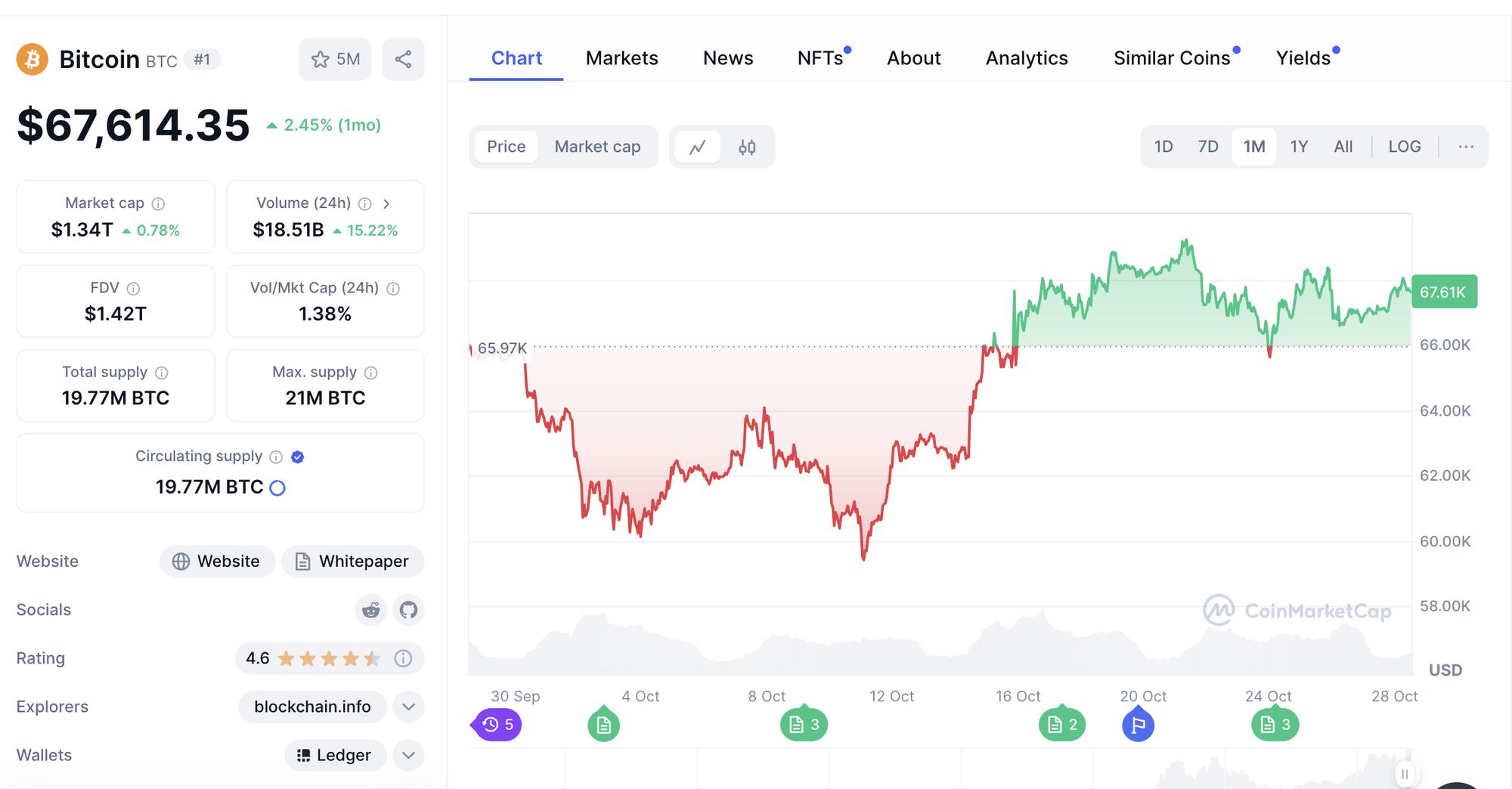

Bitcoin, the popular cryptocurrency, is also trading at a record high of 67,591 USD per coin, surpassing its previous peak of 65,000 USD established in November 2021. This equates to approximately 1.7 billion VND per coin, an unprecedented value for the digital currency.

Bitcoin surges past the 65,000 USD mark, reaching a new historical peak.

Even the USD/VND exchange rate has been on a sharp upward trajectory in recent weeks. As of this morning, commercial banks are buying USD at 25,194 VND and selling at 25,464 VND, reflecting an increase of nearly 700 VND compared to the beginning of the month (+2.8%).

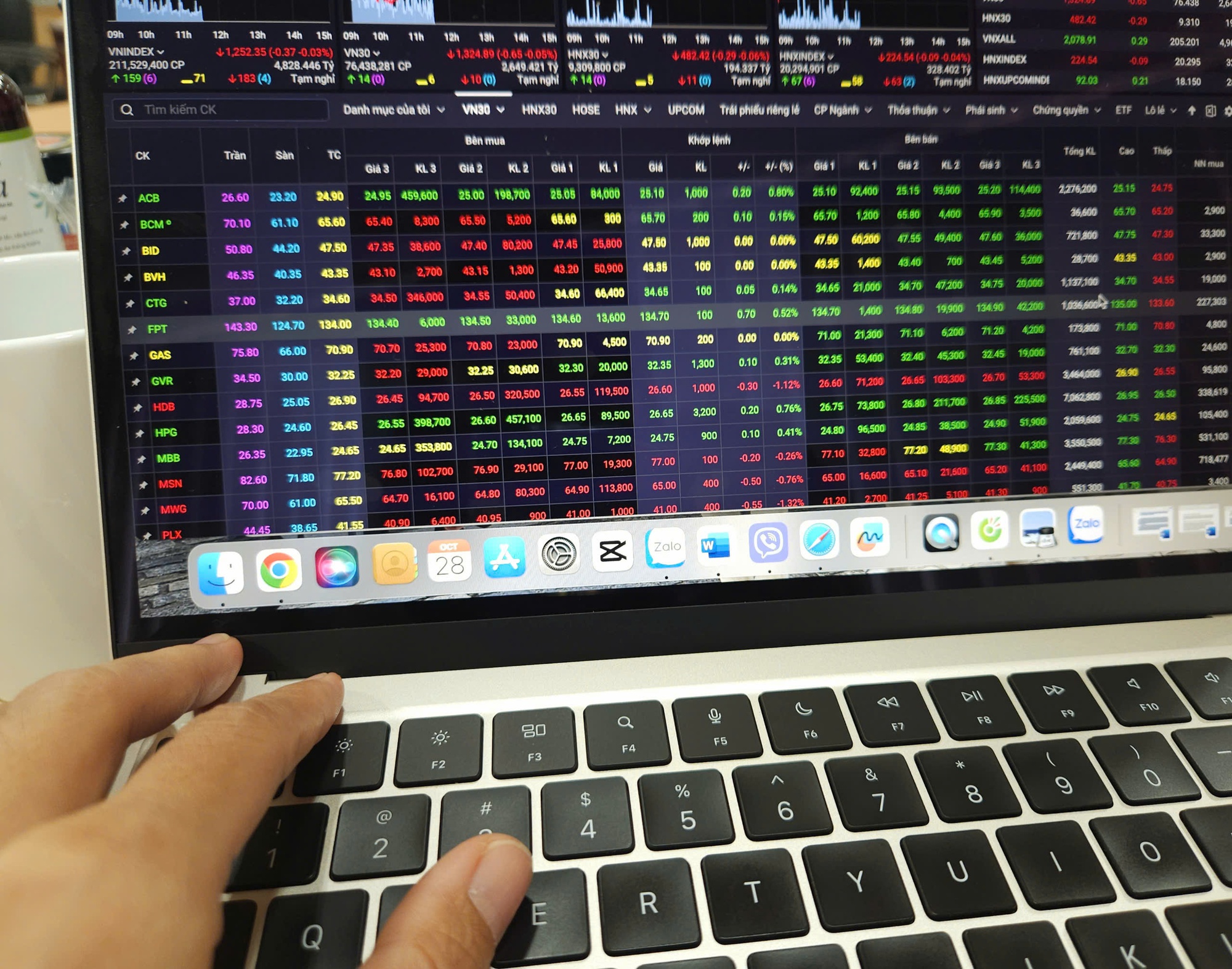

In contrast, the Vietnamese stock market has been lackluster, hovering around the 1,250-point mark, disappointing investors. The VN-Index closed the trading session on October 28th at 1,252.35 points, a slight decrease of 0.37 points from the previous session, while the HNX Index also dipped by 0.29 points to 482.42 points.

Market liquidity has been subdued, with the trading value on the HOSE floor falling significantly to 4,800 billion VND compared to the previous day, as foreign investors continue to net sell for multiple sessions.

Some investors have expressed their reluctance to trade, opting instead to divert a portion of their intended investment in stocks towards savings or purchasing SJC gold bars, given the underwhelming market performance.

Global and domestic gold prices reach new heights.

The recent surge in the value of other assets, such as gold, Bitcoin, and the USD/VND exchange rate, may be exerting pressure on the stock market, causing it to suffer collateral damage.

Mr. Bui Van Huy, Ho Chi Minh City Branch Director of DSC Securities Company, offered his insights, stating that with the upcoming US presidential election, a potential win for Donald Trump could trigger significant market fluctuations, similar to what occurred during his previous term.

It is understandable that investors would approach the market with caution, and in such cases, gold and Bitcoin can serve as safe-haven assets to some extent. Additionally, the appreciation of the USD and the USD/VND exchange rate invariably influences the stock market.

“The recent increases in gold and Bitcoin prices, along with the rising exchange rate, have had a noticeable impact on diverting investment funds away from the stock market.

When investing in a market that is facing challenges or exhibiting narrow price fluctuations, investors may experience boredom and a lack of excitement.

On the other hand, when other investment avenues are showing promising returns and attracting attention, it is only natural for investors to redirect their funds, which is evident in the current scenario” – explained Ms. Nguyen Thi Thao Nhu, Senior Director of Individual Customers at Rong Viet Securities Company.

The Vietnamese stock market has been struggling to break through the 1,250-point mark and has failed to surpass 1,300 points multiple times this year, disappointing investors.

Several stock market experts concur that the allure of other investment avenues, such as cryptocurrencies (Crypto) and real estate, has likely influenced the shift away from the stock market.

However, if the stock market corrects to more reasonable levels and stock prices align with the true value of the businesses, investors may reconsider redirecting their investments back into the stock market.

“The profits from the stock market can potentially outperform those of other assets, such as gold and Bitcoin, especially considering that these assets have already witnessed substantial increases and carry inherent risks” – added Ms. Thao Nhu.

“Equities Next Week (Oct 28 – Nov 1): Testing Investors’ Patience”

The gloom that has enveloped the stock market in recent days has cast a shadow over investor sentiment, with the VN-Index consistently shedding points to hover perilously close to the 1,250 mark.

The Great Bank Heist: How Did the Tycoons’ Assets Vanish into Thin Air?

Last week, a number of banks, including Eximbank, ACB, and Techcombank, witnessed a notable dip in their stock prices, despite having reported robust financial results.