The intraday pullbacks or sideways movements followed by stronger downward moves are typical effects of selling pressure in a downtrend. The market and stocks have not yet declined to a safe buying point. However, there are signs that selling pressure eased today.

The market opened flat in the morning, with indices dropping slightly and stock breadth relatively balanced. However, liquidity was the clearest signal as it remained very weak. With only small buying interest, prices struggled to rise, and it was only due to restrained selling that they didn’t fall further. When the losing side emerged, the immediate increase in selling pressure exposed the weakness of the buying side.

In the absence of any clear negative news, the corrective trend needs to self-balance supply and demand. This can only happen when the loose supply needing to cut losses is mostly or entirely exhausted, balancing the small buying interest. Throughout the downward trend, there will be sessions or intraday periods of stabilization, sideways movement, or even upward moves. However, the “lifespan” of such developments is typically short-lived. In contrast to an uptrend, where strong markets cause profit-taking that creates intraday pullbacks before continuing upward, the same is true for the current downtrend. Each time the selling side reduces its intensity, the market appears to stabilize, but it cannot last beyond the session.

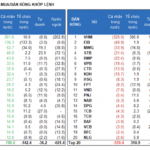

Currently, investor sentiment is dominated by disappointment, and short-term trades are losing money, so hot money will stop flowing. The decrease in liquidity is a suitable signal. It will take many sessions like this to determine if the supply is genuinely decreasing. Today, the matched volume on the two exchanges was around 13 trillion VND. In the recent past, the 12-13 trillion VND range was considered low, and 10 trillion VND could be the bottom for liquidity. As there is no news to fuel fear, the market is just moving normally within a typical corrective phase.

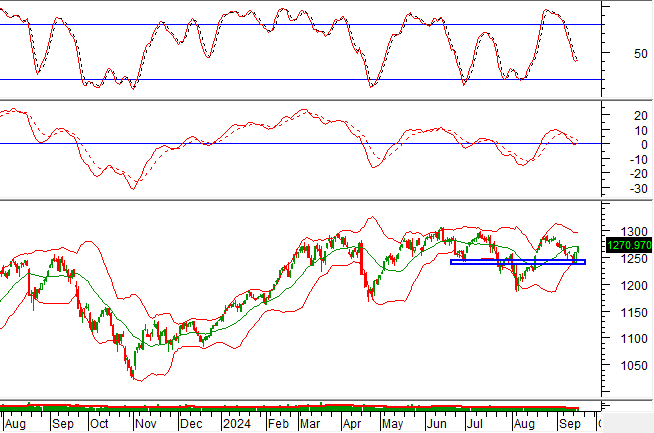

As liquidity enters a phase of exhaustion, it is a good opportunity to observe the selling pressure on targeted stocks. When market sentiment is pushed to an extreme, whether euphoria or panic, it becomes difficult to observe. Next week, when the VN Index adjusts to a better support area, it will be a chance to see which stocks are receiving money early. Until then, it is best to halt basis trading and focus on derivatives to profit.

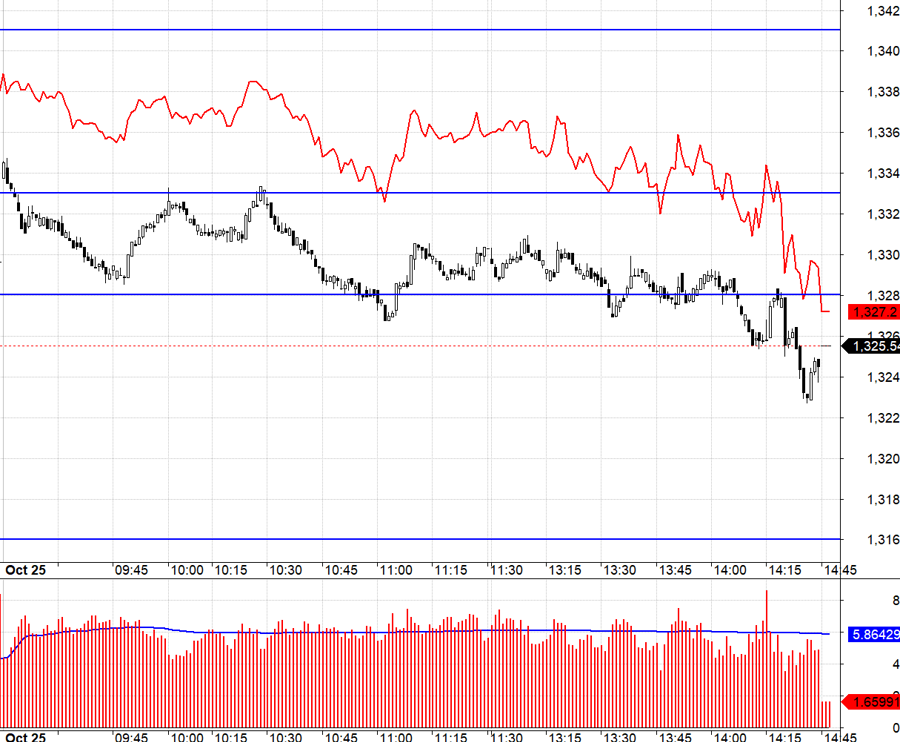

F1 today maintained an even wider basis than yesterday, like a piece of fat dangling in front of a cat. With extremely low liquidity, passive demand, and a wide positive basis, the only option is to Short. VN30 tested 1333.xx for the second time without success, a good Short entry point with a “safety net” of a +5-point basis. VN30’s subsequent small bounces couldn’t get close to 1333.xx, and F1 never touched the stop loss point. Unfortunately, when VN30 broke below 1328.xx, it failed to gain momentum, and the expected expansion to 1316.xx didn’t materialize. Nonetheless, F1 paid the price with a narrower basis at the session’s end.

Selling pressure showed signs of easing this afternoon, with weak but calm trading. Next week, selling may continue to decrease, and it may be possible to start cautious buying. The strategy is to employ a flexible Long/Short approach with derivatives, paying close attention to the basis.

VN30 closed today at 1325.54. The nearest resistance levels for the next session are 1328, 1333, 1341, 1348, and 1356. Support levels are 1317, 1312, 1303, and 1295.

“Stock Market Blog” reflects the personal views and opinions of the author and does not represent those of VnEconomy. VnEconomy respects the author’s perspective and writing style and does not hold responsibility for the investment views and opinions expressed. VnEconomy and the author disclaim any responsibility for issues arising from the investment opinions and recommendations presented.

“Stock Liquidity Hits 18-Month Low, Shares Stage a Surprise Comeback”

The combined trading value of the Ho Chi Minh Stock Exchange (HoSE) and Hanoi Stock Exchange (HNX) reached VND 9,782 billion today, hitting an 18-month low since May 9, 2023. During this period, there have only been three instances of trading values falling below the VND 10,000 billion mark. The extremely low trading value indicates a significant decrease in selling pressure, allowing buying forces to drive prices upwards quite favorably towards the end of the session.

The Savvy Investor: Navigating the Low-Liquidity Turnaround

Individual investors today bought a net of VND 370.2 billion, of which they net bought VND 351.5 billion in matched orders.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

Gold, Bitcoin Hit All-Time Highs, Soaring USD, Stocks Take a Hit?

The recent surge in the prices of other assets such as gold, Bitcoin, and the USD/VND exchange rate is putting a dampener on the stock market.