Vietnam Ventures Limited has just sold over 1 million shares, equivalent to a 43% execution rate out of the previously registered amount of over 2.4 million shares. The fund explained that the remaining registered shares were not sold due to unfavorable market conditions.

The transaction was executed from September 27 to October 26, 2024, via [method], with an estimated transaction value of VND 38 billion, based on the average closing price of VND 36,220 per share during that period.

As a result of this transaction, Vietnam Ventures Limited’s ownership in KDH decreased from nearly 9.2 million shares (a 1.01% stake) to over 8.1 million shares (a 0.9% stake), continuing the downward ownership trend witnessed over the past period.

Prior to this sale of KDH shares, Vietnam Ventures Limited also sold over 9.5 million shares out of a registered amount of nearly 12 million shares from August 22 to September 20, 2024. Before that, the fund sold over 1.3 million shares out of 13.3 million registered shares from July 11 to 16, 2024. Thus, in just a few months, this VinaCapital-owned fund has sold over 11.9 million KDH shares.

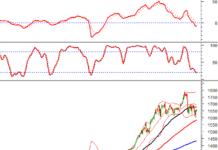

On the stock market, KDH shares have generally maintained a recovery trend since November 2022 but have slowed down in recent months, coinciding with Vietnam Ventures Limited’s continuous share sales to reduce ownership. As of the latest trading session on October 29, 2024, KDH shares closed at VND 33,500 per share.

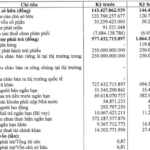

Source: VietstockFinance

|

Recently, KDH has also witnessed multiple insider purchases of ESOP shares. In mid-August 2024, the Company’s Board of Directors approved the implementation of an ESOP share issuance plan of 10.8 million shares (a 1.19% issuance ratio) at a price of VND 17,000 per share, with the subscription period from October 8 to 18, 2024.

Several insiders successfully purchased ESOP shares, including Chairwoman Mai Tran Thanh Trang and her sister Mai Tran Thuy Trang, Vice Chairman Ly Dien Son and his son Ly Tuan Kiet, CEO Vuong Van Minh and his sister Vuong Thi Ngoc Anh, Deputy CEO Le Hoang Khoi, and others.

Huy Khai

What Will Fuel the VN-Index’s Growth in the Coming Period?

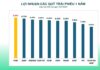

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”