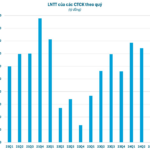

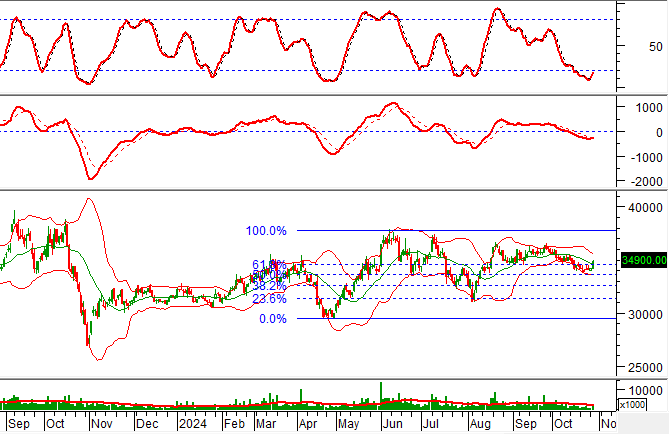

Technical Signals for the VN-Index

During the trading session on the morning of October 29, 2024, the VN-Index gained points, and trading volume showed a slight increase, indicating a return of optimistic sentiment.

Currently, the Stochastic Oscillator indicator continues to head downward and deeper into the oversold region. If buy signals reappear in the upcoming sessions, the recovery prospects will be further reinforced.

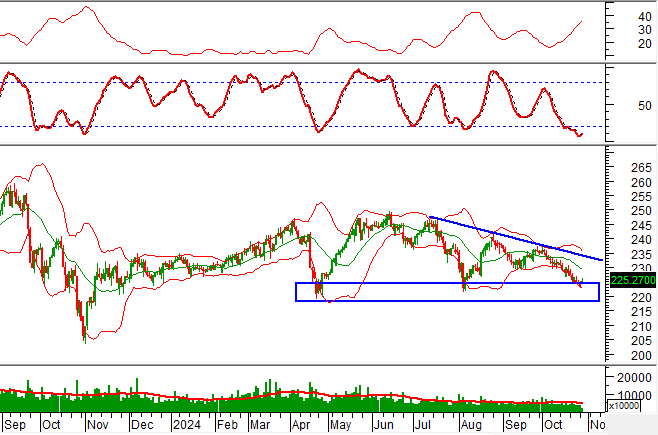

Technical Signals for the HNX-Index

On October 29, 2024, the HNX-Index rose, and trading volume increased slightly, reflecting improved investor sentiment.

Additionally, the index is retesting its old low from April 2024 (around the 220-225 point range) while also coinciding with the lower edge of a Descending Triangle pattern. If this pattern holds, a recovery phase may return in the upcoming period.

DPM – PetroVietnam Fertilizer and Chemicals Corporation

On the morning of October 29, 2024, DPM’s share price increased, and trading volume surpassed the 20-session average, indicating investor optimism.

Moreover, the stock price has risen above the Middle line of the Bollinger Bands and broken out of its short-term downward trendline. This suggests that a recovery is in sight.

Additionally, the stock price is retesting the 61.8% Fibonacci Projection level (approximately 34,500-35,500) while the Stochastic Oscillator indicator provides a buy signal in the oversold region. Successfully surpassing this resistance level would further strengthen the short-term bullish scenario.

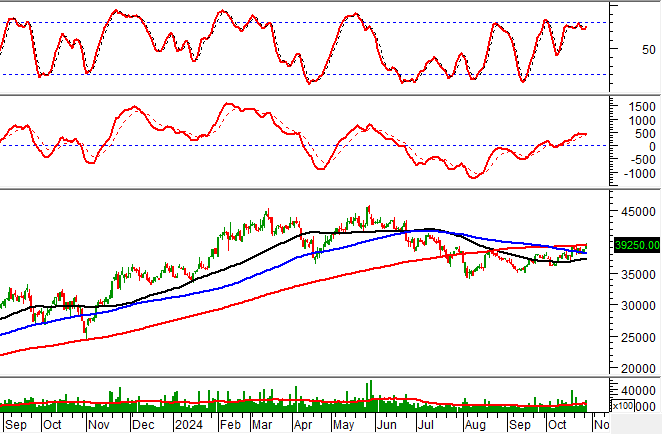

SZC – Sonadezi Chau Duc JSC

On October 29, 2024, SZC’s share price rose, and a Rising Window candlestick pattern emerged, accompanied by above-average trading volume, indicating active participation from investors.

Furthermore, the stock price continues to retest the SMA 200-day moving average, while the MACD indicator maintains an upward trajectory after previously giving a buy signal. Should the share price break above this resistance level, the medium and long-term uptrends are likely to resume in the following sessions.

Technical Analysis Team, Vietstock Consulting Department

The Cautious Sentiment Persists

The VN-Index showed promising gains despite trading volume remaining below the 20-day average. This indicates a persistent cautious sentiment among investors. For the upward momentum to be sustained, an improvement in trading volume is necessary in the coming days. The Stochastic Oscillator is currently dipping into oversold territory, and a buy signal from this indicator, coupled with a volume boost, would reinforce a more positive short-term outlook.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

The Retail Investors Return to Net Buying on October 24th

The proprietary trading arms of securities companies recorded a net buy value of VND 55 billion across the market.