I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 10/30/2024

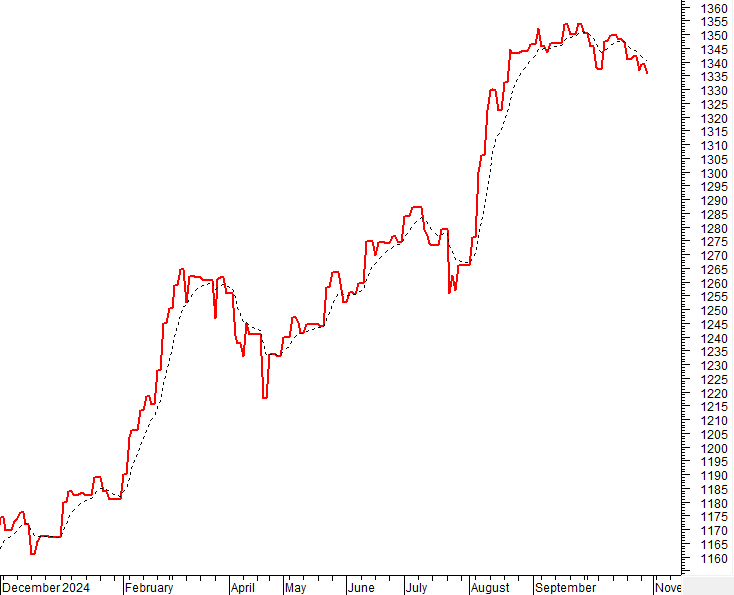

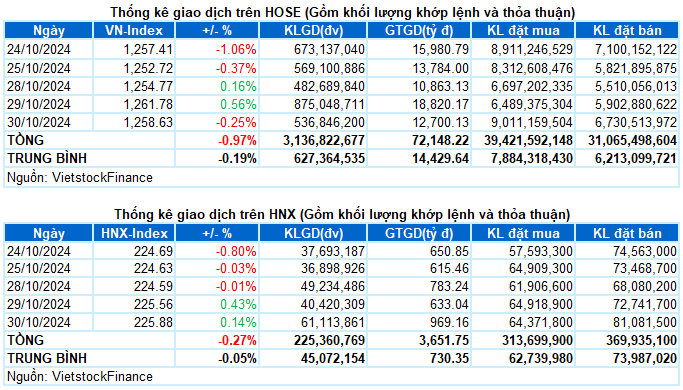

– The main indices rose and fell in opposite directions during the October 30 session. VN-Index closed the session down 0.25%, at 1,258.63 points; meanwhile, HNX-Index reached 225.88 points, up slightly by 0.14% compared to the previous session.

– The trading volume on the HOSE reached over 475 million units, down 3.2% from the previous session. Trading volume on the HNX increased by 9.4%, reaching over 40 million units.

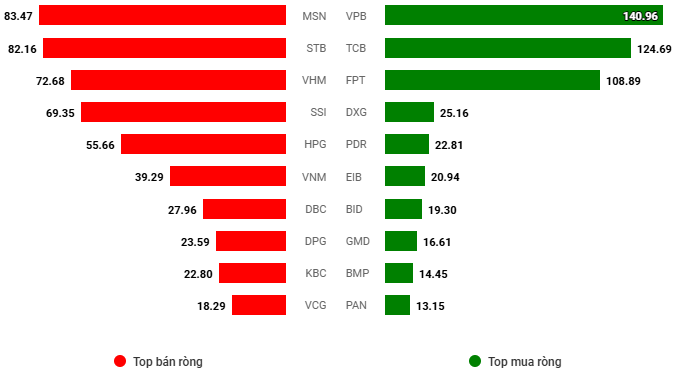

– Foreign investors net sold on the HOSE with a value of nearly VND 129 billion and net sold nearly VND 12 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market could not continue its recovery momentum during the trading session on October 30. The initial green color was quickly pushed back by sellers, dragging the index into the red until the end of the session. Selling pressure focused on pillar stocks, putting significant pressure on the index as capital inflows showed no signs of improving. At the sharpest decline, the VN-Index lost more than 6 points, although a recovery effort at the end of the session helped narrow the loss, but it may not have been enough to boost investor confidence. At the close, the VN-Index fell 3.15 points to 1,258.63.

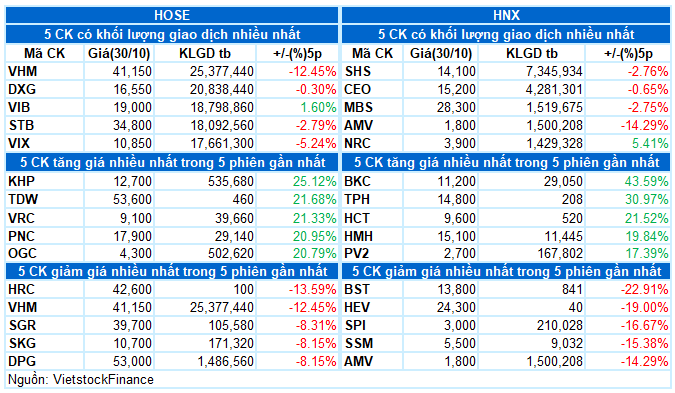

– In terms of impact, the 10 stocks with the most negative influence took away nearly 4 points from the index. Of which, VHM alone accounted for 1.6 points, followed by VCB, VNM, and VIC, which also caused the VN-Index to fall by more than 1 point. On the other hand, TCB, STB, and BID made the most notable efforts to narrow the decline, contributing more than 1 point to the overall gain.

– VN30-Index closed down 0.14%, at 1,333.85 points. The breadth was negative with 17 declining stocks, 8 advancing stocks, and 5 stocks closing unchanged. Among them, VHM faced heavy selling pressure, ranking last with a decrease of 3.7%. In addition, SSI, PLX, and VNM fell by more than 1%. In contrast, the “king” stocks exclusively occupied the top 4 positions, namely STB, VIB, TCB, and TPB, with gains ranging from 0.9% to 2.2%.

Sectors were mixed. The real estate group ranked at the bottom with pressure from large-cap stocks such as VHM (-3.74%), VIC (-0.85%), and BCN (-0.6%). However, many stocks in this industry still attracted good demand, notably NVL (+3.38%), SIP (+4.51%), IDC (+2.79%), DXG (+1.22%), and SZC (+1.03%).

The financial sector index ended the session just below the reference level. Positive performance was seen in stocks such as TCB (+1.05%), STB (+2.2%), VIB (+1.33%), TPB (+0.88%), NAB (+1.58%), etc. Notably, VPB and TCB attracted strong buying interest from foreign investors in this session, especially VPB, which was net bought by more than 8 million shares out of a total trading volume of nearly 10 million. Meanwhile, VCB (-0.33%), CTG (-0.57%), ACB (-0.4%), SSI (-1.31%), VND (-1.36%), HCM (-1.05%), etc., remained in negative territory.

On the upside, the industrial group led the market with a gain of 0.44%. Notable performers included VEA (+3.18%), HVN (+1.59%), MVN (+4.36%), PHP (+2.46%), BCG (+1.45%), STG (+5.71%), and C4G (+2.35%).

VN-Index returned to negative territory despite the positive effect from the previous two recovery sessions, indicating that the tug-of-war trend is not over yet. Additionally, trading volume remained below the 20-day average, suggesting a lack of capital inflows into the market. Currently, the MACD and Stochastic Oscillator indicators continue to decline after giving sell signals, reflecting a still cautious short-term outlook.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume remains below the 20-day average

VN-Index returned to negative territory despite the positive effect from the previous two recovery sessions, indicating that the tug-of-war trend is not over yet. Additionally, trading volume remained below the 20-day average, suggesting a lack of capital inflows into the market.

Currently, the MACD and Stochastic Oscillator indicators continue to decline after giving sell signals, reflecting a still cautious short-term outlook.

HNX-Index – Stochastic Oscillator indicator gives a buy signal again

HNX-Index continued to rise after a prolonged period of consecutive declines. However, trading volume needs to surpass the 20-day average to sustain the upward momentum.

At present, the Stochastic Oscillator indicator has given a buy signal again in the oversold region. If, in the coming sessions, the MACD indicator also gives a similar signal, the short-term outlook will be more optimistic.

Money Flow Analysis

Movement of smart money: The Negative Volume Index indicator of the VN-Index fell below the EMA 20-day moving average. If this condition persists in the next session, the risk of a sudden drop (thrust down) will increase.

Foreign capital flow: Foreign investors continued to net sell during the trading session on October 30, 2024. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

III. MARKET STATISTICS ON 10/30/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

The Dollar’s Turbulent Ride: A Year-End Review of the Volatile Currency Market

Sharing at the Khớp Lệnh program on October 28, 2024, Mr. Nguyễn Việt Đức, Digital Sales Director of VPBank Securities Joint Stock Company (VPBankS), stated that the exchange rate is currently under significant pressure and has been the main factor hindering the stock market’s performance in recent times. He also highlighted the presence of numerous variables that could come into play towards the end of the year.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.

The Stock Market Optimist: Can We Expect a Revival in Liquidity?

The VN-Index rallied and retested the 100-day SMA. A decisive move above this level, coupled with trading volume surpassing the 20-day average, would reinforce the bullish momentum. Notably, the Stochastic Oscillator has provided a buy signal within the oversold region. If this buy signal persists and the index climbs out of this oversold territory in upcoming sessions, the outlook will turn even more positive.

“Technical Analysis for the Afternoon Session on October 29th: A Glimmer of Hope Emerges”

The VN-Index and HNX-Index both climbed, with a slight uptick in trading volume in the morning session, indicating an improvement in investor sentiment.

The Cautious Sentiment Persists

The VN-Index showed promising gains despite trading volume remaining below the 20-day average. This indicates a persistent cautious sentiment among investors. For the upward momentum to be sustained, an improvement in trading volume is necessary in the coming days. The Stochastic Oscillator is currently dipping into oversold territory, and a buy signal from this indicator, coupled with a volume boost, would reinforce a more positive short-term outlook.