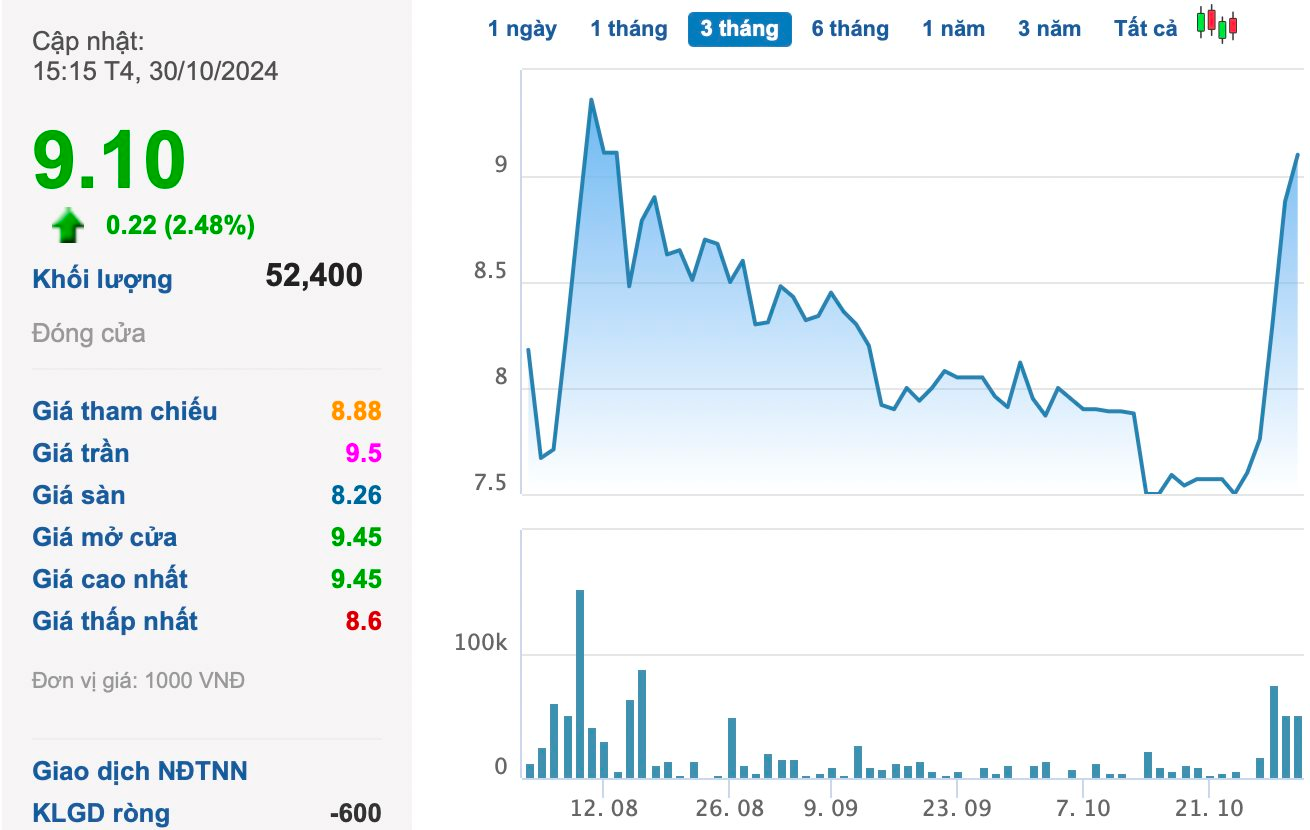

Closing the October 30 session, shares of VRC of Real Estate and Investment Joint Stock Company VRC continued to break out, extending the 5-day winning streak. The share price also accelerated by more than 20% in just one week to climb to VND 9,100/cp – the highest region in more than 2 months. Notably, VRC shares rebounded after falling to the lowest bottom since late October 2023.

Series of leaders divest clean capital

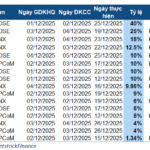

The surge in VRC shares was surprising as the company is witnessing a strong divestment wave from its key leaders. Most recently, Mr. Phan Van Tuong, Member of the Board of Directors of Real Estate and Investment Joint Stock Company VRC, announced that he had sold all of his more than 7.32 million VRC shares, or 14.65%, from October 14 to 28 by order matching. After the transaction, Mr. Tuong no longer holds any shares in VRC.

Mr. Tu Nhu Quynh – Chairman of the Board of Directors of VRC also recently announced that he had sold all 6.27 million VRC shares he owned in the enterprise to meet personal financial needs from October 16-18. The successful transaction means that Mr. Quynh no longer holds any shares in VRC.

At the same time, another major shareholder of VRC, Mr. Hoang Toan Quan, also sold all 2.9 million VRC shares to reduce ownership to 0%. It is estimated that Mr. Quan collected nearly VND 22 billion from the above divestment.

Another major shareholder, Nguyen Minh Hanh, also divested all 2.78 million VRC shares (5.56% capital) on August 19, earning an estimated VND 23 billion.

Inversely, major shareholder Tran Thi Van continued to buy 1.6 million VRC shares, increasing her holding to 12 million units (24.17%) on October 18. Prior to this, Ms. Van had continuously bought shares to become a major shareholder and increased her ownership in VRC. After the leaders’ massive divestment wave, Ms. Van is also the largest shareholder in this enterprise.

Along with the leaders’ divestment moves, VRC also recorded important personnel changes. Specifically, the company dismissed Ms. Nguyen Thi Minh Khiem from the position of General Director from October 3, 2024, and appointed Ms. Nguyen Ngoc Quynh Nhu to this position, who also became the new legal representative of the company.

Also on October 3, VRC received a resignation letter from Mr. Nguyen Quoc Phong from the position of Member of the Board of Directors and Chairman of the Audit Committee of the Company for personal reasons.

Hold a series of real estate projects in prime locations

According to our findings, Real Estate and Investment VRC was formerly known as Construction Installation Enterprise of Vung Tau – Con Dao Special Zone – one of the earliest construction companies in Ba Ria – Vung Tau Province. The enterprise was listed in July 2010 and underwent a comprehensive restructuring in 2017, thereby officially changing its name to Real Estate and Investment Joint Stock Company VRC and increasing its charter capital to VND 500 billion as at present. By June 2018, the company’s head office had been moved to Ho Chi Minh City.

Currently, VRC is implementing many real estate projects in prime locations in HCMC, Ba Ria – Vung Tau, and Long An, such as the Phu Thuan Residential Area project (District 7, HCMC), Babylon Garden project (District 7, HCMC), and the hotel-apartment complex project (Vung Tau City). VRC’s land fund for project implementation mainly comes from the acquisition of Construction Joint Stock Company ADEC – a company with a state-owned enterprise origin. VRC invested in this enterprise in 2017 and owns 60.06% capital with an investment value of nearly VND 320 billion.

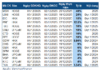

In terms of business results for the first nine months of 2024, this real estate enterprise recorded consolidated net revenue of over VND 14 billion, five times higher than the same period last year, while consolidated after-tax profit reached over VND 1 billion, an improvement compared to a profit of VND 355 million in the same period.

As of September 30, 2024, VRC’s asset scale was VND 1,730 billion, mainly inventory of VND 1,181 billion (equivalent to 68%). The enterprise allocates to the Nhon Duc Residential Area Project, Phuoc Loc – Nha Be (VND 785 billion), ADC Phu My Residential Area Project (VND 366 billion), and Long An Residential Area Project (VND 30 billion).