On October 30th’s session, numerous bank and real estate stocks witnessed a simultaneous surge.

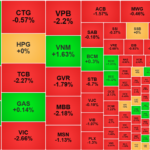

The market commenced the day on a positive note, donning a green hue during the first half of the morning session. Nonetheless, investor caution resulted in subdued trading, causing the overall indices to dip. Active selling was evident in large-cap stocks such as HPG, MSN, and MWG, exerting substantial pressure on the market.

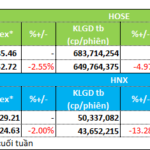

As the afternoon session unfolded, lackluster and subdued trading persisted across all three exchanges (HoSE, HNX, and UpCom), characterized by declining liquidity and a sea of red encompassing over 230 stock codes. Consequently, the retail and securities sectors endured the most significant adjustments, both plunging by nearly 0.9%.

At the closing bell, the VN-Index settled at 1258 points, marking a decline of 3 points or 0.25%.

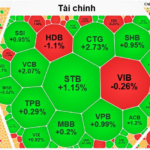

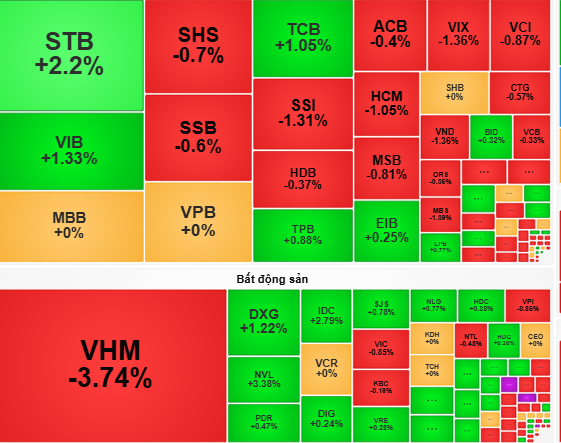

However, this session witnessed an impressive ascent in numerous bank and real estate stocks. Notably, STB climbed by 2.2%, TCB by 1%, TPB by 0.8%, NVL by 3.3%, PDR by 0.4%, DIG by 0.2%, and DIC by 2.7%… These advancements served to curb the market’s downward trajectory, prompting investors to anticipate a potential leading role for the bank and real estate sectors in the upcoming period.

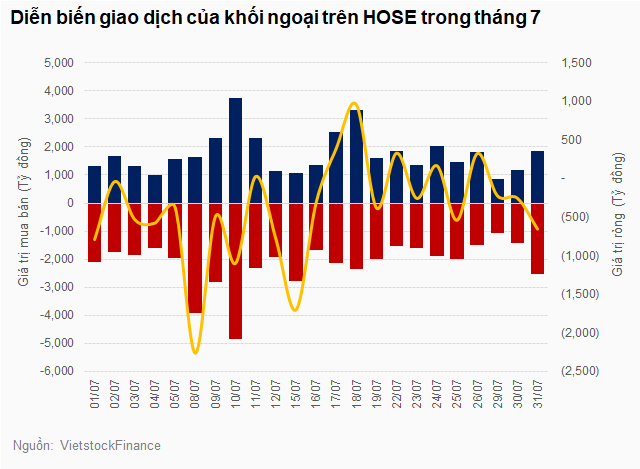

According to the Vietnam International Bank Securities Company (VCBS), despite the market downturn, liquidity on October 30th witnessed a significant decline. This indicates a pause in investors’ selling momentum, suggesting that the VN Index is gradually regaining equilibrium.

“Stock players can maintain their allocations in individual stocks that are accumulating points or those exhibiting rebound signals after corrections within the banking and real estate sectors…” VCBS recommended.

The King of Stocks: VN-Index Surges by Almost 6 Points

The VN-Index ended in the green on a busy day for the stock market king, with market-wide liquidity reaching over VND 19,000 billion, a significant surge compared to the previous session.

The Soaring Land Prices and the Struggling Real Estate Stocks: Unraveling the Mystery.

The real estate market has witnessed a scorching surge across almost all segments, including land, low-rise homes, luxury apartments, affordable condos, and even older apartment buildings. This surge in property values contrasts sharply with the prolonged slump in real estate stocks, which continue to languish at rock-bottom levels.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

Technical Analysis for the Session Ending October 31st: Indecision Plagues the Market

The VN-Index and HNX-Index exhibited contrasting performances, with one index rising while the other fell, and the emergence of a Doji candlestick pattern reflected the investors’ indecision and cautious sentiment.