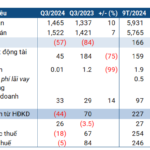

Mobile World Investment Corporation (coded as MWG) has just announced its Q3/2024 financial report, with net revenue reaching VND 34,147 billion, a 13% increase compared to the same period last year. After deducting the cost of capital, gross profit increased by 21%, earning VND 6,892 billion. The gross profit margin reached 20%, a slight improvement from the 19% of the previous year.

In this period, financial revenue decreased by 7% to VND 575 billion, while financial expenses decreased by 26% to VND 330 billion. On the other hand, management expenses surged by 183% to nearly VND 968 billion.

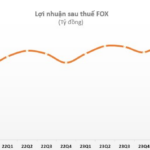

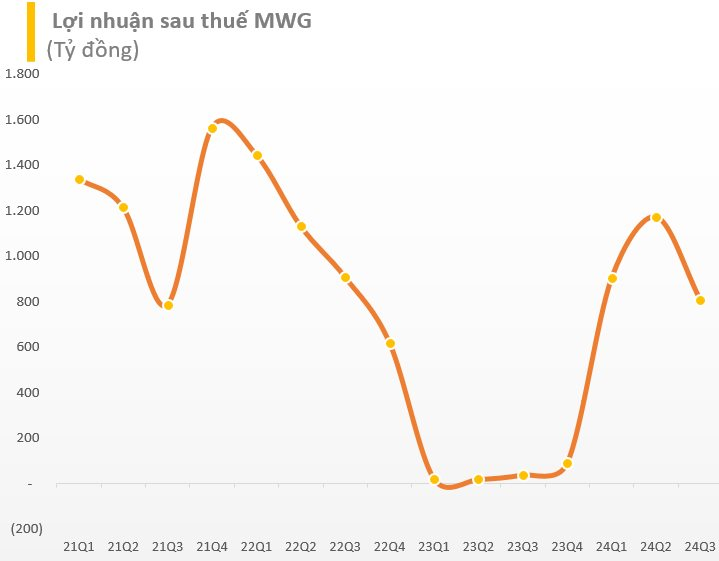

After deducting various expenses, MWG’s net profit was nearly VND 806 billion, almost 21 times higher than the low base of the same period in 2023. However, the Q3/2024 after-tax profit decreased by more than 32% compared to the previous quarter, breaking the previous four consecutive quarters of growth.

The after-tax profit for the parent company’s shareholders in Q3/2024 exceeded VND 800 billion, corresponding to nearly 21 times that of the same period last year.

For the first nine months of the year, MWG recorded net revenue of VND 99,767 billion, a 15% increase compared to the same period last year. After-tax profit reached VND 2,881 billion, more than 37 times higher than the low base of 2023.

With these results, the company has achieved nearly 80% of its revenue plan and exceeded its after-tax profit target by 20% for the full year.

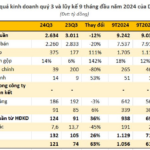

In the first nine months of the year, the two chains of The Gioi Di Dong (including Topzone) and Dien May Xanh achieved a total revenue of VND 66,700 billion, a 7% increase compared to the same period last year. In September alone, MWG generated approximately VND 7,800 billion from the sale of phones, computers, and appliances, an increase of 8% compared to the same period last year and nearly 4% higher than the previous month.

According to MWG, the positive sales performance in September, which is usually a low season (except for air conditioners and the Tet season), was partly due to the iPhone, with iPhone sales in September increasing by more than 50% compared to August after a few days of product launch. Additionally, laptop sales maintained stable monthly growth during the back-to-school season, along with double-digit growth in washing machines compared to the previous month due to the rainy season.

As of the end of September, MWG operated 1,023 The Gioi Di Dong stores (including Topzone) – unchanged from the end of August. Meanwhile, the Dien May Xanh chain reduced its store count by one, totaling 2,030 stores.

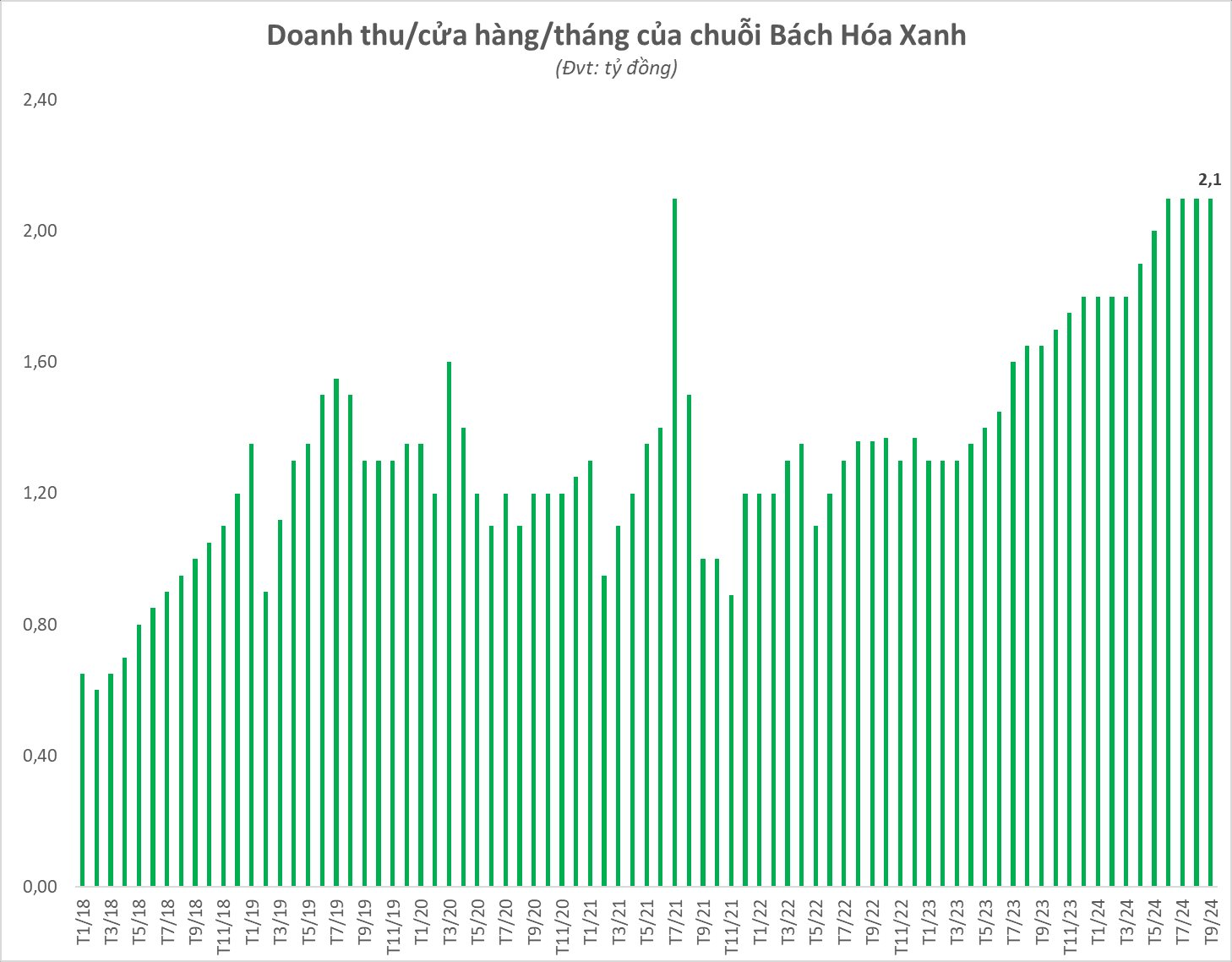

For the Bach Hoa Xanh supermarket chain, cumulative revenue for the first nine months of the year reached VND 30,300 billion, an increase of nearly 36% compared to the same period last year. In September, revenue was nearly VND 3,600 billion, unchanged from the previous month. Both fresh and FMCG categories showed stable growth. The average revenue in September remained at VND 2.1 billion/store.

This is the fourth consecutive month that the average revenue/store has reached this level, even as the chain continues to expand. As of the end of September, there were 1,726 stores, an increase of 5 from the previous month.

Additionally, the Ankang pharmacy chain maintained its store count at 326 as of the end of September. The Erablue electronics chain in the Indonesian market continued to expand, reaching 76 stores, an increase of 5 stores compared to the end of August.

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

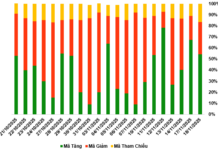

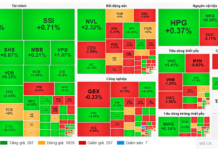

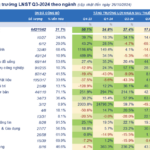

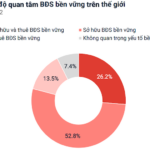

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.