Quốc Cường Gia Lai JSC (QCG) has posted impressive results for the third quarter of 2024, with a remarkable 166% year-on-year surge in revenue to over VND 178 billion. Despite cost of sales increasing at a higher rate than revenue, the company still managed to improve its gross profit by 29% to VND 28 billion, with a gross margin of nearly 16%.

After accounting for expenses, QCG reported a significant improvement in pre-tax profit, reaching over VND 28 billion, a 4.5-fold increase compared to the same period last year. Net profit also witnessed a substantial rise, climbing to VND 25 billion, up 147% year-on-year.

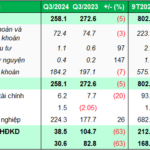

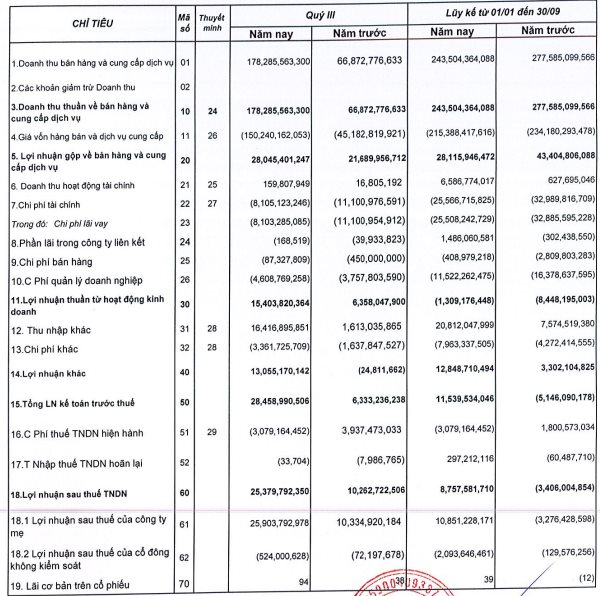

QCG’s nine-month financial statement (Source: CafeF)

For the first nine months of the year, QCG’s revenue stood at nearly VND 244 billion, a 12% decline year-on-year, while its pre-tax profit reached close to VND 12 billion, a notable improvement from the VND 5 billion loss recorded in the previous year.

With these results, the company has achieved 19% and 12% of its full-year revenue and profit targets, respectively.

As of September 30, 2024, QCG’s total assets were recorded at VND 9,337 billion, a slight decrease of 2% from the beginning of the year. Cash holdings witnessed a significant increase of 85% to nearly VND 53 billion. Inventory accounted for nearly VND 6,923 billion, constituting 74% of the company’s total assets, primarily consisting of real estate under construction valued at over VND 6,400 billion.

Turning to the capital structure, shareholders’ equity stood at VND 4,515 billion, reflecting a VND 173 billion increase since the year’s start. Financial borrowings amounted to VND 421 billion, while undistributed profit after tax was nearly VND 520 billion.

In a related development, Quốc Cường Gia Lai has faced a significant challenge recently. On July 18, the Investigation Agency of the Ministry of Public Security decided to prosecute, arrest, and search the residence of Nguyễn Thị Như Loan, General Director of Quốc Cường Gia Lai JSC, for “Violation of regulations on the management and use of State assets, causing loss and waste” as stipulated in Article 219, Clause 3 of the Criminal Code.

This incident unfolded as the authorities expanded their investigation into violations at the Vietnam Rubber Industry Group (GVR), Dong Nai Rubber Company, Ba Ria Rubber Company, the Ministry of Natural Resources and Environment, and related units. These violations included those pertaining to the 39-39B Ben Van Don project, which covers an area of over 6,000m2 of land with state ownership origins.

Consequently, Nguyễn Quốc Cường, the son of Nguyễn Thị Như Loan, has taken on the role of General Director of Quốc Cường Gia Lai JSC.

In the stock market, QCG has displayed a positive performance, surging in the last two sessions, with a particularly strong gain on October 30, reaching the maximum daily limit. The QCG share price closed at VND 11,900 per share, reflecting a remarkable 78% increase compared to the beginning of October 2024.

QCG share price movement (Source: BVA)

“Soaring Provisioning Costs, Yet BVBank’s 9-Month Pretax Profit Triples Year-on-Year”

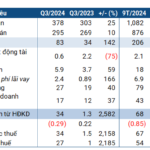

The consolidated financial statements show that despite increasing provisions for risk, BVBank (BVB on UPCoM) reported a remarkable pre-tax profit of nearly VND 182 billion for the first nine months, almost triple that of the same period last year. This impressive performance is attributed to a significant increase in core income from lending activities, showcasing the bank’s resilience and strong positioning in the market.

“Declining Core Revenue and Soaring Expenses: Unveiling Dragon Capital’s Manager’s Earnings in Q3”

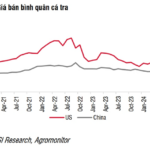

In Q3 of 2024, the financial results of Dragon Capital Vietnam Asset Management JSC (DCVFM) were significantly impacted by a decline in revenue from its two core business segments: advisory and fund management. While revenue from these key areas decreased, management expenses rose sharply, creating a challenging environment for the company.

Why Did TIP’s Net Profit Decrease by Over 70% in Q3?

The absence of joint venture profit recognition in Q3 2024 caused a 72% decline in net profits for the Industrial Park Development and Investment Joint Stock Company (HOSE: TIP) compared to the same period last year.