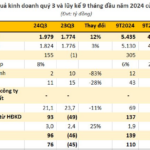

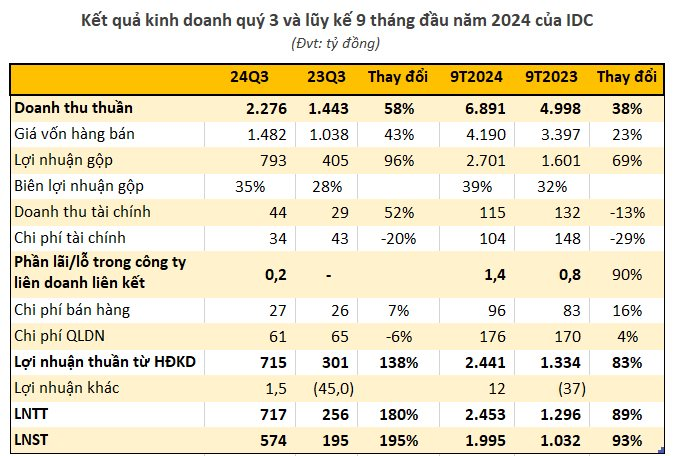

IDICO JSC (IDC) has released its Q3 2024 financial report, showing a 58% year-on-year surge in net revenue to VND 2,276 billion. With cost of goods sold increasing at a slower pace than revenue, the gross profit margin improved from 28% to 35% this quarter. Gross profit spiked by 96%, reaching VND 793 billion.

Additionally, financial income brought in VND 44 billion, a 50% increase compared to the same period last year, while financial expenses decreased by 20% to VND 34 billion.

Source: CafeF

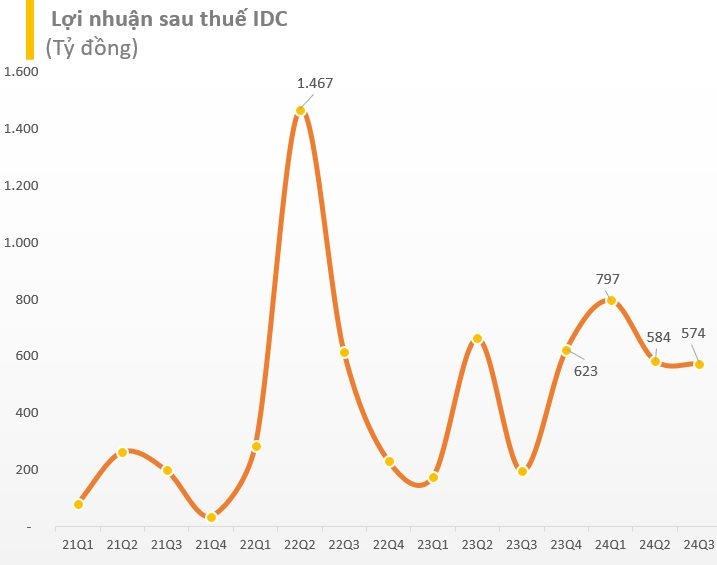

After accounting for other expenses, Idico reported a 195% surge in net profit to VND 574 billion for Q3 2024. Net profit attributable to the parent company’s shareholders stood at over VND 511 billion, triple that of the previous year.

According to the explanatory note, the company attributed the surge in net profit to revenue from infrastructure leasing contracts in industrial parks, which met the conditions for one-time revenue recognition as stipulated in Circular No. 200/2014/TT-BTC dated December 22, 2014, of the Ministry of Finance.

Source: CafeF

For the first nine months of 2024, Idico recorded VND 6,891 billion in net revenue and VND 2,453 billion in pre-tax profit, representing increases of 38% and 89%, respectively, compared to the same period in 2023. In terms of revenue structure, the main contributor was still the land and infrastructure leasing segment in industrial parks, which generated nearly VND 2,765 billion, a 63% increase year-on-year, followed by the electricity business segment with almost VND 2,361 billion, a 14% increase over the same period.

For the full year 2024, the company has set a record-high business plan with a projected revenue of VND 8,466 billion and a pre-tax profit of VND 2,502 billion, representing increases of 13% and 22%, respectively, compared to the previous year’s results. Thus, after nine months, Idico has achieved 81% of its revenue target and is close to fulfilling its pre-tax profit goal.

IDC is one of the largest industrial park developers in Vietnam, with 554 hectares of land for lease in the provinces of Long An, Ba Ria Vung Tau, and Thai Binh. With a focus on expanding its industrial real estate portfolio, IDC plans to add 2,430 to 2,820 hectares of industrial land in the coming years.

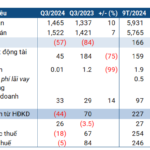

As of September 30, 2024, Idico’s total assets stood at VND 18,135 billion, a slight increase of 2.3%. Notably, cash, cash equivalents, and deposits witnessed a significant surge to VND 2,921 billion, a 30% increase from the beginning of the year. Inventories amounted to over VND 1,461 billion, a 12% increase compared to the start of the year, while construction in progress decreased by 2% to VND 4,993 billion, mainly attributed to the Hựu Thạnh Industrial Park, valued at VND 3,203 billion as of Q3 2024.

On the capital side, total liabilities remained relatively unchanged from the beginning of the year at VND 11,444 billion. Total borrowings (with long-term debt accounting for a large proportion) increased to VND 2,651 billion. Meanwhile, owners’ equity rose sharply by nearly VND 500 billion to VND 6,691 billion, and undistributed post-tax profits reached approximately VND 1,131 billion.

“Dropping Dividends: Pha Lai Thermal Power Reports First Loss in Three Years”

High production costs coupled with a significant decline in dividend income from subsidiaries resulted in a net loss for Pha Lai Thermal Power Joint Stock Company (HOSE: PPC) in Q3/2024, marking the first quarter of losses after twelve consecutive profitable quarters.