The VN-Index remained range-bound, trading within a tight range around the 1,261-1,257 point region. With 163 advancing stocks and 212 declining stocks, investor sentiment appeared cautious.

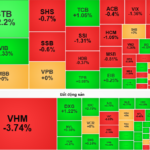

Specifically, large-cap stocks such as VCB, CTG, and VHM had the most negative impact, dragging the index down by nearly 2.4 points. These stocks are considered pillars within the VN30 basket. On the flip side, TCB, STB, BID, and HVN were the most positive influencers, contributing over 1.1 points to the index.

Meanwhile, the HNX-Index posted a slight gain, indicating that some small-cap stocks remained active. Market liquidity was subdued, with trading volume reaching approximately 61 million shares, corresponding to a value of over VND 969 billion.

VN-Index declines.

The real estate sector witnessed the sharpest decline, dropping by -0.73%. This was followed by the materials sector and the non-essential consumer goods sector, which fell by 0.46% and 0.42%, respectively.

On the recovery front, the industrial sector led the way with a gain of 0.44%, while the information technology sector rose by 0.33%.

Market-wide liquidity continued to dwindle, falling short of the levels seen in previous months, reflecting the cautious stance adopted by both domestic and foreign investors.

Foreign investors displayed a mixed bag of activity in October, engaging in net buying for certain stocks while also executing large divestments, particularly from strategic shareholders in banks. A notable example was CBA’s sale of over 300 million VIB shares, resulting in proceeds of approximately VND 5,300 billion.

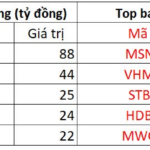

In terms of foreign trading activities, they continued to be net sellers on the HOSE, offloading over VND 214 billion worth of stocks, primarily in STB, MSN, VHM, and SSI. On the HNX, foreign investors sold a net of over VND 11 billion, focusing on IDC, PVS, and CEO.

Despite the VN-Index testing support levels and facing pressure from blue-chip stocks, some experts anticipate a potential short-term recovery for the market.

The Beat of the Market on 10/28: Indecision Looms, Telecom Services Shine Brightly

At the end of the trading session, the VN-Index rose 2.05 points (+0.16%) to 1,254.77, while the HNX-Index dipped 0.03 points (-0.01%) to 224.59. The market breadth tilted towards gainers with 389 advancers and 283 decliners. The large-cap stocks also witnessed a sea of green, as reflected in the VN30-Index, with 15 gainers, 9 losers, and 6 stocks holding steady.

Tomorrow’s Stock Market Outlook: Anticipating Real Estate and Banking Stocks to Lead the Charge

Although the VN-Index fell during the October 30th session, it was a positive day for many bank and real estate stocks, which saw their share prices rise.