Novaland JSC (Novaland, stock code NVL) has sent a document to the State Securities Commission of Vietnam (SSC), Ho Chi Minh City Stock Exchange (HoSE), and Hanoi Stock Exchange (HNX) regarding the explanation and periodic report on the progress of rectifying the warned securities status.

According to Novaland, for the reviewed semi-annual financial statement of 2024 and related explanations as regulated by law, the company completed the disclosure on September 26, 2024.

For the Q3 2024 financial statement, the company completed the disclosure on October 30, 2024, in compliance with the regulations on information disclosure in the securities market as stated in Clause 14.3.c, Circular No. 96/2020/TT-BTC.

“The company commits to continue complying with the regulations and regimes related to information disclosure to ensure the maximum benefits of investors and the transparency of the company,” the document from Novaland stated. The company also requested the management agency to facilitate the removal of the warning status of NVL stock in the next period.

Previously, NVL stock had been included in HoSE’s list of stocks not eligible for margin trading due to the company’s late disclosure of the reviewed semi-annual financial statement for 2024, exceeding the deadline by more than five working days.

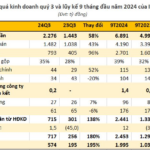

According to the newly published consolidated Q3 financial statement, Novaland recorded consolidated net revenue of VND 2,010 billion, nearly double that of the same period last year. Financial revenue also surged 2.4 times year-on-year to nearly VND 3,900 billion.

As a result, profit after tax soared to over VND 2,950 billion, 21.5 times higher than the same period last year. Of this, profit after tax attributed to the company’s owners was more than VND 3,100 billion, a record high since its listing.

However, the cumulative after-tax profit for the first nine months was still heavily negative at VND 4,377 billion, mainly due to the record loss in the previous quarter. The net loss attributable to the company’s owners was more than VND 4,100 billion, while the figure for the same period in 2023 was negative VND 841 billion.

In the market, NVL stock is experiencing a slight rebound from its all-time low and is currently trading at VND 10,700 per share. However, this price is still 37% lower than at the beginning of 2024. The corresponding market capitalization is less than VND 21,000 billion.

The Heir Apparent’s Accounts Receivable: A Novaland Saga – Unraveling the Financial Mysteries of the Elusive Bùi Cao Nhật Quân in Q3 2024

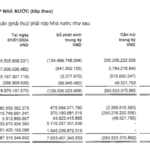

As per the Q3/2024 financial statements, Novaland reported a long-term receivable of VND 76 billion from Mr. Bui Cao Nhat Quan, son of Chairman Bui Thanh Nhon.