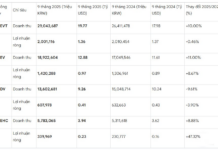

As of October 31st, the SJC gold bar price surged to 88-90 million VND per tael (buy-sell). Meanwhile, the gold ring price also hit an all-time high of 88.63-89.63 million VND per tael (buy-sell). This is the highest price for gold rings in Vietnam’s history. Despite the continuous surge in gold prices, many people still flocked to purchase gold at major gold shops in Hanoi, as observed by our reporters. However, most large gold shops announced that they had run out of SJC gold bars and rings, only accepting purchases and not sales.

On the other hand, in the trading session on October 31st, world gold prices also witnessed a sharp increase, reaching a record high of 2,790.15 USD/ounce. This marks a 6% increase in October alone.

According to experts, the surge in world gold prices is influenced by the upcoming US election, which is entering its final stage. Opinion polls indicate a tight race between former US President Donald Trump and Vice President Kamala Harris, heightening the tension.

An Unprecedented Gold Record

Experts attribute the gold price hike to the US election and geopolitical instability. Image source: Haberler

Mr. Kyle Rodda, a financial market analyst at Capital.com, commented: “Gold prices are rising due to the impact of the US election. Traders are turning to gold as a safe haven.”

In reality, gold bullion is considered a safe investment, especially during periods of economic and geopolitical instability like the present.

Additionally, investors’ keen interest in weekly unemployment benefit claims and the payroll report at the end of the week also influences gold prices.

According to the World Gold Council’s (WGC) latest report on gold demand trends for Q3, released on October 31st, global gold demand reached 1,313 tons, a 5% increase compared to the same period in 2023. This marks a record high for Q3.

As per WGC, for the first time in history, global gold demand surpassed 100 billion USD by the end of Q3/2024, fueled by robust investments amidst soaring gold prices.

In Q3, global gold investment demand reached 364 tons, more than doubling compared to the same period in 2023. This surge is attributed to changing demands for gold exchange-traded funds (ETFs), primarily from Western investors. Currently, gold ETFs hold an additional 95 tons of gold. This is also the first quarter to witness significant growth in gold ETFs since Q1/2022.

What’s Next for Gold Prices?

Experts predict that gold prices may continue to rise in the coming months. Image source: CNBC

Mr. Shaokai Fan, Regional Director for Asia Pacific (excluding China) and Central Bank Director at the World Gold Council, stated: “Gold prices continue to surge as investment demand increases. Geopolitical risks, economic recession fears, and soaring gold prices have significantly contributed to these figures, even as record-high prices may make some buyers hesitant.”

Mr. Fan further informed that global geopolitical tensions, concerns about political and economic instability, and expectations of rising gold prices maintained ASEAN investors’ interest in gold during Q3.

However, according to the WGC report, Vietnam is an exception compared to other regional countries like Thailand, Indonesia, and Malaysia, which all recorded double-digit annual growth. In contrast, Vietnam experienced a 33% quarterly decline and a 10% yearly drop in gold bar and coin demand. WGC attributed this decrease in Vietnam’s gold demand to the soaring gold prices, which might have deterred new purchases.

Nevertheless, the Central Bank Director at the World Gold Council cautioned that the persistently high gold prices could further dampen demand for gold jewelry. Thus, price stability is necessary to reverse this trend. Notably, Vietnam’s gold jewelry demand in Q3 also dropped by 15% compared to the previous quarter and by 13% from the same period in 2023.

Similarly, Ms. Louise Street, Senior Market Analyst at the World Gold Council, attributed the “fear of missing out” among investors as the primary driver of increased gold demand in Q3/2024. Specifically, many investors still want to buy gold even as prices climb. Furthermore, with expectations of future interest rate cuts, investors are considering gold’s role as a safe haven amid political instability in the US and escalating conflicts in the Middle East.

“In the coming months, the surge in gold investments is predicted to persist, potentially leading to sustained high levels of gold prices and demand,” emphasized Ms. Louise Street.

However, according to the expert, the economic growth outlook could be a factor that alters this scenario.

References: WGC, Kitco, Capital

Gold Rings Surge 25 Million VND per Tael since the Start of the Year

The price of plain gold rings has been on a remarkable upward trajectory, with a consecutive 10-day increase. Compared to the beginning of the year, gold ring prices have soared by 25 million VND per tael, representing an impressive 40% performance.