Vietnam Ventures Limited reports on related-party trading activities involving the shares of Khang Dien House Trading and Investment Joint Stock Company (coded KDH on the Ho Chi Minh Stock Exchange, or HOSE)

Consequently, Vietnam Ventures Limited, an investment fund managed by VinaCapital, sold 1,037,900 shares out of the registered 2,433,600 KDH shares. The reason for not selling all the registered shares was due to unfavorable market conditions. The transaction was executed through order matching from September 27, 2024, to October 26, 2024.

Following this transaction, Vietnam Ventures Limited decreased its ownership from 9.18 million shares, equivalent to a 1.01% stake in Khang Dien House, to approximately 8.15 million KDH shares, representing a 0.90% ownership interest.

It is worth noting that Vietnam Ventures Limited has consecutively traded large volumes of KDH shares. Most recently, the fund sold 9.54 million shares out of the registered 11.98 million KDH shares during the period from August 22 to September 20, 2024. This transaction was also carried out through order matching.

As a result of this transaction, the fund’s ownership decreased from 18.73 million shares, or a 2.06% stake, to 9.18 million shares, representing a 1.01% holding.

Earlier, in late July 2024, during Khang Dien House’s offering of 110.09 million shares in a private placement to 19 professional investors at a price of VND 27,250 per share, Tien Loc Investment Joint Stock Company purchased the most shares, acquiring over 17.6 million shares, followed by Vietnam Investment Limited, which bought 11 million shares.

Recently, the company’s Board of Directors approved the dissolution of two subsidiary companies. Accordingly, the company decided to dissolve Long Phuoc Dien Housing and Infrastructure Development Co., Ltd. and Nam Phu Real Estate Development Co., Ltd., in which KDH owns 99.95% and 99% of the charter capital, respectively.

While the company has not yet published its financial statements for Q3 2024, VCSC has maintained its “buy” recommendation for KDH and adjusted its target price upward by 2% to VND 45,500 per share. The increase in the target price is mainly due to the rise in book value per share at projects that have not been included in KDH’s business plan, which VCSC values using the P/B method.

VCSC adjusted its profit-after-tax estimates for 2024 and 2025 upward by 8% and 4%, respectively. This adjustment is mainly due to contributions from undisclosed land sales in the first half of 2024 and an increase in the number of apartments expected to be handed over from The Privia project in 2025. VCSC’s forecast for 2026 remains unchanged.

Additionally, VCSC forecasts that the profit after tax for 2024 will increase by 26% YoY to VND 898 billion. This projection for the second half of 2024 is driven by the expected handover of sold apartments at The Privia project.

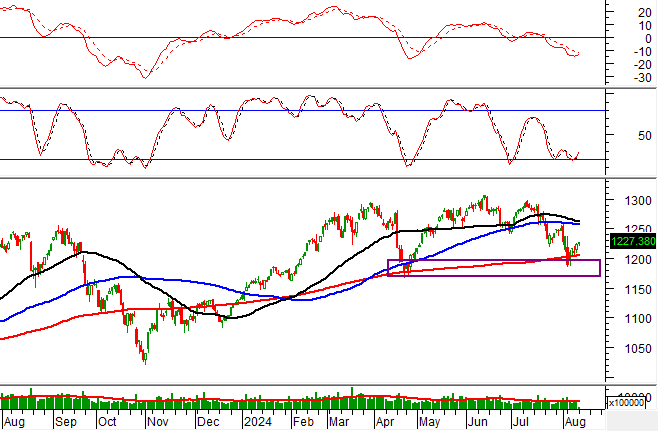

On October 29, KDH’s share price closed unchanged at VND 33,500 per share, representing a 15% decline from its one-year high of VND 39,350 per share reached on September 26, 2024.