Vietnam Airlines (code: HVN on HOSE) has released its Q3 2024 financial report, detailing its profit improvement and plans to address its controlled entity status.

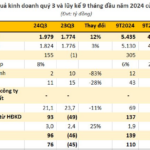

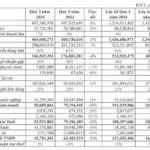

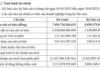

According to the consolidated financial statements, Vietnam Airlines’ revenue reached VND 26,830 billion, a nearly 13% increase from the previous year’s VND 23,569 billion. The consolidated after-tax profit was VND 862 billion, a significant improvement from the loss of over VND 2,100 billion in the same period last year.

Vietnam Airlines attributed the improvement to a 19.12% increase in revenue and other income for the parent company in Q3 2024 compared to Q3 2023, amounting to over VND 3,470 billion. This growth was primarily driven by a 17.34% surge in service revenue, equivalent to an increase of more than VND 3,055.7 billion year-over-year. The increase in domestic and international revenue, by 22.2% and 11.3% respectively, can be attributed to the full restoration of domestic flight networks and the resumption and expansion of international routes.

The parent company’s total expenses in Q3 2024 rose by 5.53%, or VND 1,101 billion, compared to the same period last year, mainly due to higher cost of goods sold, in line with increased production, and lower financial expenses due to favorable exchange rates at the reporting period-end. The parent company’s gross profit from service provision exceeded VND 2,021 billion, a remarkable 351.6% increase compared to the previous year, resulting in an after-tax profit surge of over VND 2,368.8 billion compared to the loss in Q3 2023.

The consolidated after-tax profit for Q3 2024 stood at VND 862 billion, a turnaround from the loss in Q3 2023, as both the parent company and subsidiaries reported profits compared to losses in the previous year.

The positive performance was a result of the recovering transportation market and the proactive implementation of short- and long-term solutions by the Group, including flexible management of transportation supply, stringent cost-cutting measures, and successful negotiations for reduced service costs. These factors contributed to the profitable Q3 2024 financial results.

According to the financial statements, the Group’s consolidated and parent company’s after-tax profit for the first nine months of 2024 reached VND 6,263.7 billion and VND 1,870.9 billion, respectively. Vietnam Airlines acknowledged that these positive results were achieved despite ongoing financial risks and rising oil prices, presenting a challenging business environment.

Measures and Roadmap to Address Controlled Entity Status:

Vietnam Airlines has finalized a comprehensive proposal outlining solutions to overcome difficulties arising from the COVID-19 pandemic, aiming for the Group’s swift recovery and sustainable development from 2021 to 2035. This proposal has been submitted to the relevant authorities.

As per the proposal, Vietnam Airlines will implement a range of synchronized solutions in 2024-2025 to address the negative equity situation. These include measures to enhance adaptability and profitability, as well as asset restructuring and financial portfolio reconfiguration to boost income and cash flow.

For 2024, Vietnam Airlines forecasts a revenue of over VND 105,900 billion, with a consolidated after-tax profit of VND 4,233 billion and an after-tax profit for the parent company of VND 105 billion.

The Industrial Real Estate Titan: A Stellar Third Quarter with a Near 200% Surge in Profits, Achieving Yearly Targets in Just Nine Months

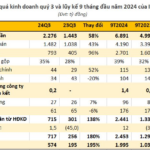

For the first nine months of the year, Idico recorded a remarkable performance with net revenue reaching VND 6,891 billion and pre-tax profit of VND 2,453 billion, reflecting a significant increase of 38% and 89%, respectively, compared to the same period in 2023.