Global gold prices plunged during Thursday’s trading session (Oct. 31) after setting a new all-time high. However, the precious metal concluded its fourth consecutive month of gains, buoyed by heightened risk aversion ahead of the US presidential election.

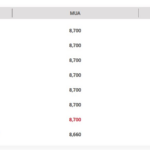

Spot gold dropped by $41.50/oz, or nearly 1.5%, to close at $2,744.40/oz on the New York market, according to Kitco exchange data. This was a sharp decline from the record high of over $2,790/oz reached earlier in the session.

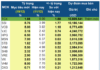

As of Friday morning (Nov. 1) in Vietnam, the price of spot gold in the Asian market had rebounded, trading at $2,749.90/oz, which translates to approximately VND 84.3 million per tael according to Vietcombank’s selling exchange rate. This represents a slight decrease of VND 1.2 million compared to Thursday’s opening price.

October marked the fourth straight month of gains for gold, with prices climbing about 4% since July. The precious metal has been accumulating some gains, and with pivotal events on the horizon, traders are bracing for potential volatility.

“The market is awaiting next week’s news, including the US election on Tuesday and the Fed meeting on Wednesday,” remarked David Meger, director of metal trading at High Ridge Futures. “So, some profit-taking ahead of these events is not surprising.”

With just days to go until the Nov. 5 election, polls indicate a tight race between former President Donald Trump and Vice President Kamala Harris, setting the stage for a potentially contentious and unpredictable outcome.

Adding to the mix, the Fed’s two-day meeting concluding on Nov. 7 has market participants anticipating a rate cut. Federal funds futures are pricing in a 100% chance of a 0.25-percentage-point reduction in interest rates.

This expectation was bolstered by the latest Personal Consumption Expenditures (PCE) price index data from the US Labor Department, which showed a 2.1% year-over-year increase in September, matching forecasts. PCE is the Fed’s preferred gauge of inflation, and this reading signaled that inflation is hovering very close to the Fed’s 2% target.

Rhona O’Connell, an analyst at StoneX, commented that the underlying factors stimulating gold demand, including geopolitical tensions and uncertainties surrounding the US election, remain in play. As a result, investors tend to buy on dips, underpinned by gold’s safe-haven appeal.

“Both gold and the US dollar are currently serving as safe havens, which is a rare occurrence during times of heightened tension,” O’Connell noted.

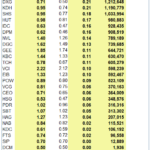

The US Dollar Index, which measures the greenback’s strength against a basket of six major currencies, ended Thursday’s session at 103.98, slightly down from the previous day’s close of 103.99. However, the index has climbed about 1.4% in October, reflecting a stronger dollar.

On Friday, the market will receive the closely watched US non-farm payrolls report from the Labor Department, which, along with the latest inflation data, is expected to influence the Fed’s interest rate decision.

Ricardo Evangelista, senior analyst at ActivTrades, shared his insights with Kitco News: “If the upcoming US jobs data comes in better than expected, it could increase the likelihood of a slower pace of rate cuts by the Fed. This scenario would further pressure Treasury bonds, pushing yields higher and creating headwinds for gold.”

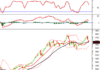

Evangelista’s remarks come as the yield on the 10-year US Treasury note hovers above 4.28%, the highest level in three months. Nonetheless, gold has managed to sustain its upward trajectory despite the rising yields since the Fed’s rate cut in September.

Gold Prices Stuck as US Treasury Yields Keep Rising

This week, gold prices could be volatile due to a slew of upcoming U.S. economic data, which is likely to reshape expectations for the Federal Reserve’s interest rate path. With markets closely watching for any insights into the Fed’s future moves, the precious metal’s performance hinges on these critical releases.

Gold Prices Slip in Early Monday Trade, Experts Point to “Anomalies”

“It’s an anomaly that gold prices have continued to break records recently, despite rises in the USD and US Treasury bond yields.