I. VIETNAMESE STOCK MARKET WEEK 28/10-01/11/2024

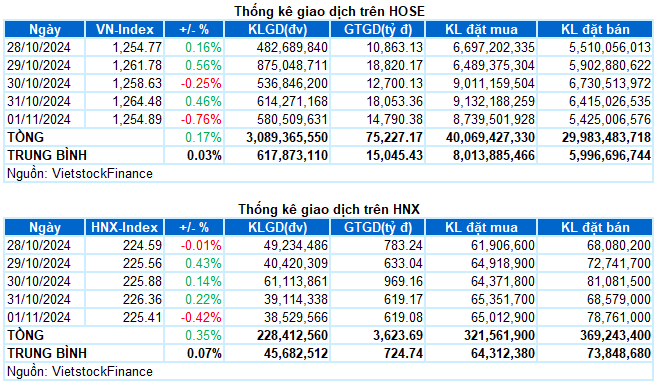

Trading: The main indices fell sharply in the last trading session of the week. By the end of the day on 01/11, VN-Index lost 0.76%, falling to 1,254.89 points; HNX-Index decreased by 0.42%, settling at 225.41 points. For the whole week, VN-Index slightly rose by 2.17 points (+0.17%) and HNX-Index increased by 0.78 points (+0.35%).

The sharp fall in the last session of the week wiped out most of the index’s recovery efforts throughout the week. The lack of liquidity even in the recovery sessions indicated that money was not ready to return to the market, as the index lacked a clear breakthrough momentum. Moreover, the continuous net selling pressure from foreign investors also exerted significant pressure. The VN-Index closed the last session of the week at 1,254.89 points, down 0.76% from the previous session.

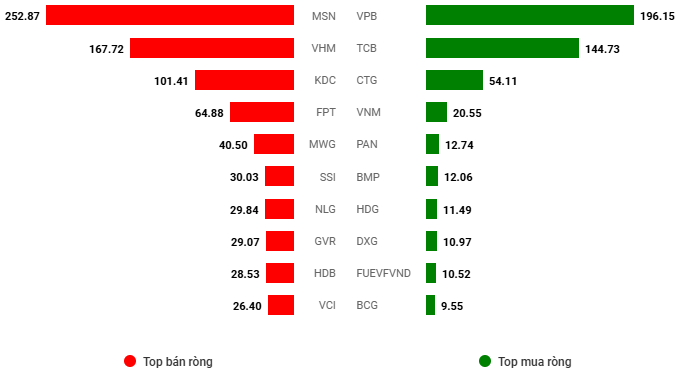

In terms of contribution, the 10 stocks with the most negative impact took away more than 5 points from the VN-Index, led by MSN, GVR, VPB, and MBB, causing the index to fall by about 2.5 points. On the other hand, the 10 stocks with the most positive impact only helped the VN-Index to increase by less than 1 point, showing the dominance of the selling side.

Red dominated all industry groups in the last session of the week. Among them, the telecommunications group was the most heavily sold, plunging 3.79%. Large-cap stocks in the industry all fell sharply, including VGI (-4.68%), FOX (-2.09%), and CTR (-2.05%).

Following were the materials and information technology groups, which declined by about 1%. This was mainly influenced by stocks such as HPG (-1.3%), GVR (-1.82%), DCM (-1.86%), DPM (-1.88%), NTP (-2.03%), PHR (-2.81%); FPT (-0.96%), and CMG (-2.5%).

Financial stocks, which were mixed in the morning session, were also mostly painted red in the afternoon session. Notably, many stocks fell by more than 1%, putting significant pressure on the overall market, such as MBB, ACB, VPB, HDB, TPB, MSB, OCB, SSI, VND, HCM, etc. A few bright spots were SSB (+2.42%), BVH (+1.4%), and EVF (+1.38%).

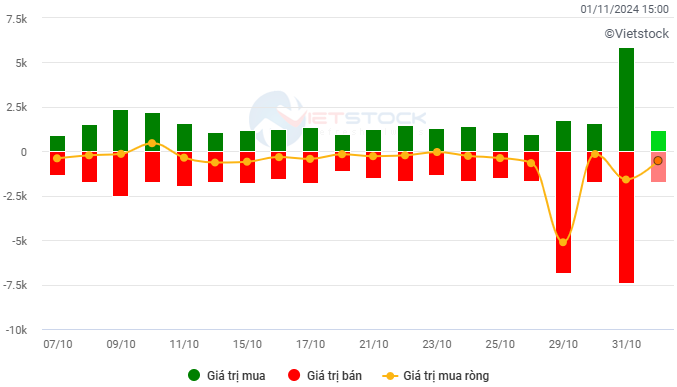

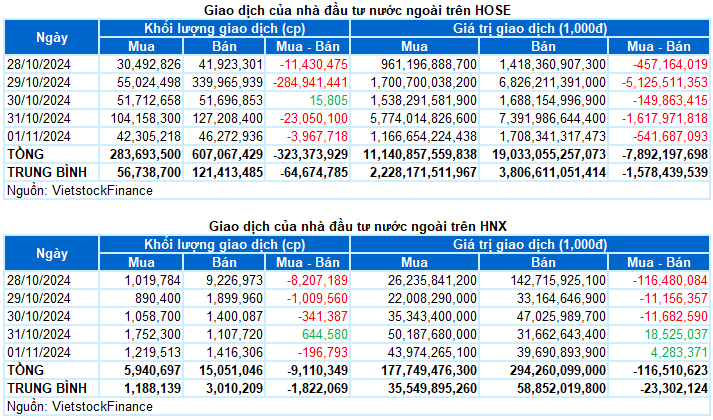

Foreign investors continued to net sell with a value of more than 8 trillion VND on both exchanges this week. Specifically, they net sold nearly 7.9 trillion VND on the HOSE and more than 116 billion VND on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

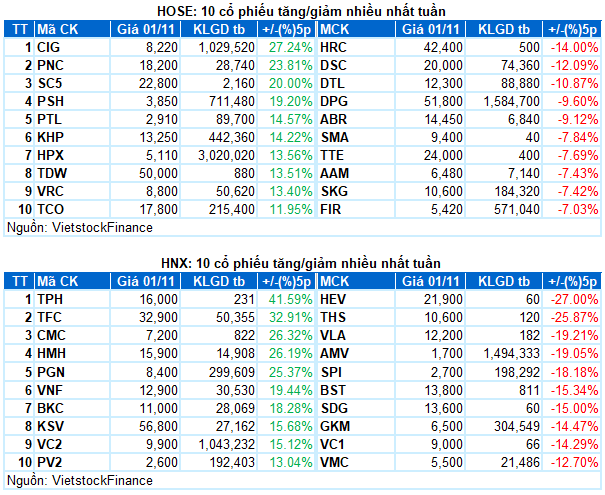

Stocks that increased significantly last week were CIG

CIG rose by 27.24%: CIG had a brilliant trading week with a gain of 27.24%. The stock continuously surged strongly since breaking above the SMA 200-day mark, along with the appearance of the White Marubozu and Rising Window candlestick patterns. At the same time, trading volume surged strongly and exceeded the 20-day average, indicating that money started to participate more vigorously.

However, the Stochastic Oscillator indicator has entered the overbought zone. Investors should be cautious in the coming period if sell signals reappear.

Stocks that decreased significantly last week were DSC

DSC fell by 12.09%: DSC experienced a rather negative trading week as money showed signs of withdrawing from the market. This caused liquidity to decrease further, along with five consecutive losing sessions since falling below the SMA 50-day mark.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the risk of short-term adjustments remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic Analysis & Market Strategy Department, Vietstock Consulting

The Short-Term Absorption Effort Continues: Bank Stocks Keep the Beat

Another flash sale appeared this morning, even overwhelming the VN-Index in the red for most of the trading session. HoSE trading volume rose nearly 11% from yesterday’s morning session, and many stocks are rebounding, indicating that bottom-fishing efforts have been somewhat effective.

The Real Estate Stock Rout: A Market Crash or Correction?

Today’s trading session (October 30) saw a mixed performance in the stock market. The VN-Index paused at 1,257, a 4.15-point dip from the previous session due to selling pressure from large-cap stocks. The real estate sector experienced the sharpest decline in the market, dropping by -0.73%.