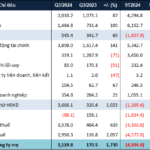

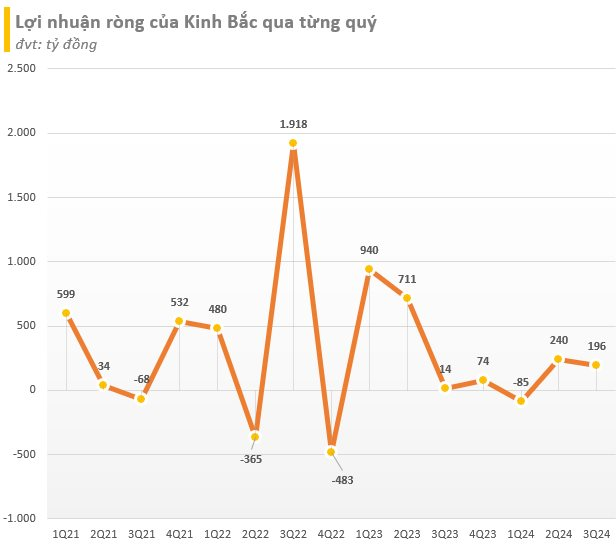

Kinh Bắc Urban Development Corporation (code: KBC) has announced its Q3/2024 financial statement, with a remarkable performance. The company’s revenue reached VND 950 billion, a 3.8x increase compared to the same period last year. After deducting expenses, gross profit stood at over VND 359 billion, 3.6 times higher than the previous year.

Financial income doubled year-on-year to VND 116 billion, attributed to increased interest income. However, financial expenses, selling expenses, and administrative expenses also rose during this period.

As a result, Kinh Bac Urban Development Corporation reported a pre-tax profit of VND 250 billion, 5.3 times higher than the previous year. Net profit attributable to parent company shareholders was VND 196 billion, a 39-fold increase year-on-year. EPS surged from VND 8 to VND 256.

For the first nine months of the year, the company’s revenue and net profit were VND 1,994 billion and VND 351 billion, respectively, down 58% and 82% year-on-year.

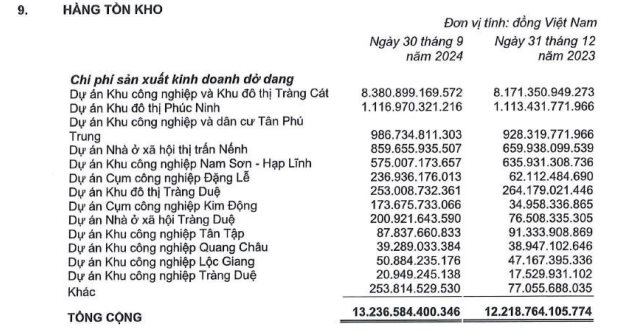

As of September 30, total assets amounted to VND 42,345 billion, a 26.6% increase year-on-year. Inventories accounted for the largest proportion of assets (31%), totaling VND 13,236 billion. These are the company’s production and business costs for ongoing projects.

Short-term and long-term receivables stood at over VND 12,000 billion. The company also holds over VND 9,500 billion in cash and deposits, an increase of nearly VND 7,000 billion since the beginning of the year. This substantial cash position earns Kinh Bac Urban Development Corporation over VND 1 billion in interest income per day.

Equity reached VND 20,618 billion, including nearly VND 5,300 billion in undistributed post-tax profits. Financial borrowings were nearly VND 6,000 billion, with over 90% being long-term debt.

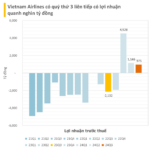

Vietnam Airlines Posts Near-Thousand Billion Profit for Third Consecutive Quarter, Yet Remains in a 35,000 Billion Cumulative Loss, With Stock Rising for Four Straight Sessions

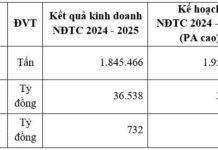

For the nine-month period ending September 2024, Vietnam Airlines reported a revenue of VND 79,161 billion, a remarkable 17% increase compared to the same period last year. The airline also achieved a impressive net profit of nearly VND 6,000 billion during this time frame.

Vinamilk: Overseas Market Revenue Surges 15.7%, Exports Remain the Key “Driver”

For the fifth consecutive quarter, Vinamilk’s overseas market revenue has maintained its stellar performance, with a notable boost from its export business. In the first nine months of the year, international markets contributed 8,349 billion VND to Vinamilk’s coffers, marking an impressive 15.7% increase.

“A Stunning Turnaround: Novaland’s Q3 Profits Soar to Over 3,000 Billion VND”

Despite an exceptional surge in profits during the third quarter of 2024, Novaland Group (Novaland), listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘NVL’, faces the grim prospect of historical annual losses. With a staggering cumulative loss of over VND 4,000 billion in the first nine months of the year, the real estate giant is struggling to stay afloat.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.