On October 24, 2024, the State Securities Commission (SSC) held a conference at its headquarters to deploy Circular No. 68/2024/TT-BTC dated September 18, 2024, of the Ministry of Finance amending and supplementing a number of articles of the Circulars prescribingsectionscovering securities trading on the securities trading system; securities settlement and payment; activities of securities companies; and information disclosure in the securities market.

Vice Chairman of the SSC Bui Hoang Hai presided over the conference. The event was also attended by representatives from relevant departments of the SSC, the Vietnam Stock Exchange, the Ho Chi Minh City Stock Exchange, the Hanoi Stock Exchange, the Vietnam Securities Depository and Clearing Corporation (VSDC), the Vietnam Securities Business Association, and nearly 200 delegates from securities companies, custodian banks, and payment banks.

Conference Overview. Photo: TT&QHCC

In his opening remarks, Vice Chairman Bui Hoang Hai shared that despite its relatively young age of 24 years, the Vietnamese stock market has achieved remarkable milestones. The market’s scale, including both the stock and bond markets, has reached nearly 100% of GDP, with an average trading value of over $1 billion per session. There are more than eight million securities trading accounts, accounting for approximately 10% of Vietnam’s current population.

According to Vice Chairman Bui Hoang Hai, Circular No. 68/2024/TT-BTC is a result of a very urgent and transparent regulatory process, demonstrating the close and proactive coordination between regulatory and operating agencies and market members in pursuing the goal of market upgrade and development of a safe, comprehensive, healthy, integrated, and sustainably developing securities market. To continue striving for the upgrade goal and maintain the upgraded status, as well as achieve long-term objectives in market development, the regulatory agency and market members need to join hands to implement Circular No. 68/2024/TT-BTC.

“This conference aims to introduce the new contents of Circular No. 68/2024/TT-BTC and, more importantly, provide a platform for regulatory and operating agencies to exchange and discuss with market members about preparation and implementation plans to enhance the effectiveness and enforcement of the Circular in practice,” emphasized Vice Chairman Bui Hoang Hai.

Vice Chairman of the SSC Bui Hoang Hai speaks at the conference. Photo: TT&QHCC

At the conference, a representative from the SSC’s Market Development Department introduced the contents of Circular No. 68/2024/TT-BTC. Following this, a representative from VSDC shared the contents to be amended and supplemented in the draft VSDC regulations, including the Regulation on Securities Settlement and Payment Activities at VSDC, the Regulation on Securities Registration and Transfer of Ownership at VSDC, and the Regulation on Custodian Members at VSDC.

The conference also heard the opinions of several custodian banks and securities companies on their preparations for implementing the Circular. Representatives from custodian banks and securities companies considered Circular No. 68/2024/TT-BTC as an important legal basis for further opening the door to foreign investors in the Vietnamese stock market. They shared positive feedback from investors and clients regarding the new regulations. With these provisions, foreign investors can easily access information on equal terms as domestic investors. Foreign institutional investors can invest in the Vietnamese stock market with more favorable, open conditions, lower costs, and reduced risks related to exchange rates and portfolio swaps. Securities companies also affirmed that they have been actively preparing in terms of business processes, human resources, systems, risk management mechanisms, and capital sources to implement the Circular.

The conference dedicated significant time for discussions between regulatory and operating agencies and market members regarding the readiness of custodian banks, securities companies, and clients, as well as the necessary tasks to be carried out to implement the new provisions of the Circular.

In his closing remarks, Vice Chairman Bui Hoang Hai highly appreciated the support, efforts, and dedication of market members during the past time and their serious and unified working spirit at the conference. He requested that market members continue to maintain serious and close coordination with the market regulatory agency to safely and effectively implement Circular No. 68/2024/TT-BTC, jointly striving for the market upgrade goal and long-term development objectives.

Circular 68/2024/TT-BTC includes some notable points: (1) Foreign institutional investors can trade stocks without the requirement of pre-funding (Non Pre-funding solution – NPS), and (2) A roadmap for information disclosure in English. These moves are considered by experts as steps toward meeting the requirements for upgrading Vietnam’s stock market to emerging market status.

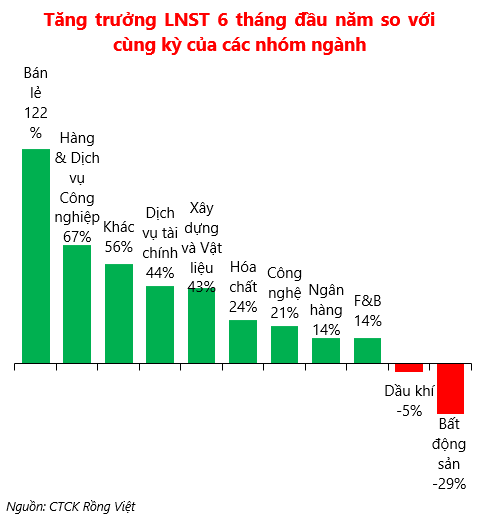

The Profit Plunge: Unraveling the Sequential Decline in Vietnam’s Securities Industry

In Q3, the combined pre-tax profits of securities firms reached an impressive VND 6,900 billion, matching the same period in 2023 but falling just shy of the preceding quarter by nearly 7%.

Stock Market Ascension: Elevating the Vietnamese Investor

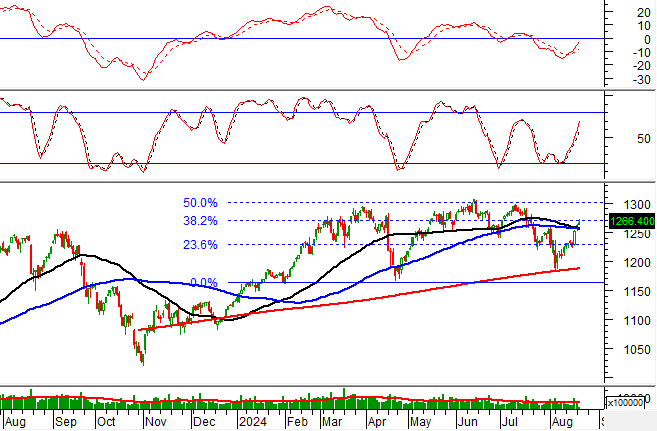

In the recent FTSE Russell review in September 2024, Vietnam remained on the watchlist for a potential upgrade to Secondary Emerging Market status. The country’s prospects for an upgrade are still open, with organizations keeping a close eye on its progress. The next review by FTSE is expected in March 2025, followed by MSCI in 2026, which could potentially elevate Vietnam’s standing in the global financial landscape.

The Record-High Margins vs. the Vanishing Liquidity: Are Stock Market Funds Overly Leveraged?

The market-wide margin surge, unaccompanied by a proportional uptick in liquidity, indicates a heightened level of risk in the stock market.