## No Recovery Yet?

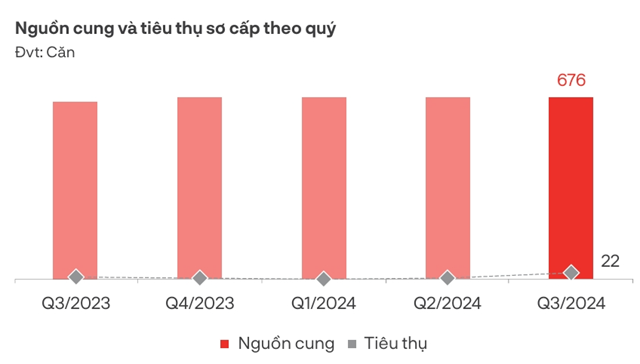

The third quarter of 2024 saw 22 new condotel units enter the market, a 2.1-fold increase from the same period last year, but still only accounting for 3% of the 676 primary units (up 2%) launched.

Primary supply in Da Nang and surrounding areas has remained unchanged over the past five quarters, but consumption is showing positive signs. Source: DKRA

|

According to DKRA, market demand has increased slightly. While consumption has doubled, it is concentrated in a single project in Quang Nam. Other primary projects have remained stagnant, with no new transactions recorded.

Quang Nam and Da Nang continue to lead the market, accounting for 93% of total supply in the quarter, mainly from existing inventory of older projects, although still lower than the 2019 levels.

“New supply in this area has been almost non-existent for the past two years due to the cautious approach of many investors given the current market challenges,” DKRA stated in its report. However, the absorption rate indicates that the market is gradually improving.

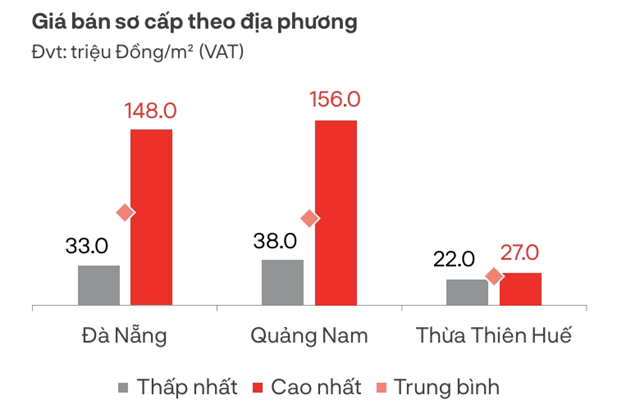

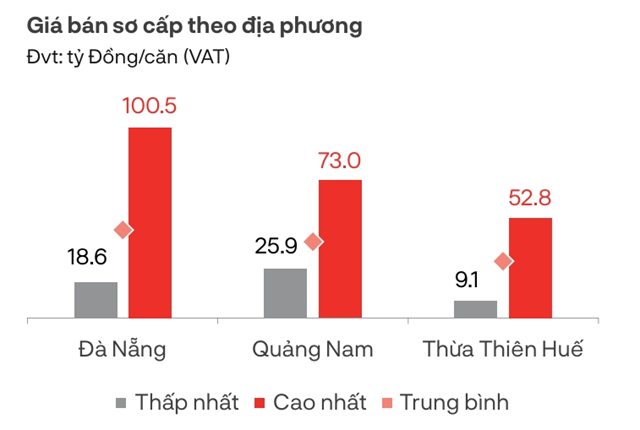

The stagnant primary sales prices further reflect the current market situation. While profit/revenue-sharing and interest rate support policies are still in place, they have not yielded the desired results.

From a research perspective, DKRA believes that despite the recovery in tourism in Da Nang and surrounding areas, the market for condotels in the region remains subdued and shows no signs of short-term recovery due to ongoing issues with project legalities, construction delays caused by funding shortages, and liquidity challenges.

Condotel selling prices in Da Nang and surrounding areas. Source: DKRA

|

Zero Liquidity?

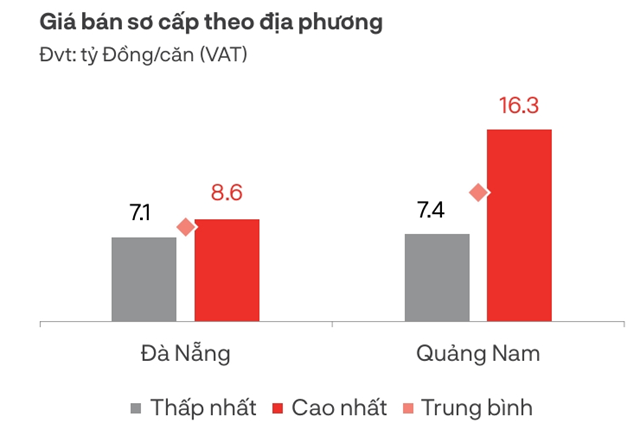

Similar to condotels, the primary supply of other types of resort real estate, such as villas and townhouses/shophouses, remained unchanged from the previous year, with 232 and 36 units recorded, respectively. These, too, are mainly from older projects that were launched in previous years. As a result, selling prices have also remained stable.

The key difference lies in the absence of transactions for villas and townhouses/shophouses during the quarter.

In the case of villas, DKRA attributes this to legal issues preventing new launches, sustained high prices, and a predominance of high-end, high-value inventory, all of which contribute to challenging market liquidity and a lack of transactions.

Meanwhile, a series of townhouse/shophouse projects that have not yet been put into operation have impacted investor confidence. Adding to this, legal violations have negatively affected the market, further hindering liquidity.

“Customer confidence has not returned, and many investors have turned away from the market due to concerns about legality and the effectiveness of profit recovery when tourism business operations face challenges,” the research firm assessed, noting that profit/revenue-sharing, debt grace periods, and interest rate support policies continue to be widely applied to boost liquidity.

For the fourth quarter, DKRA forecasts that liquidity will remain subdued, at least in the short term, as legal issues persist and investor confidence remains low.

In the immediate future, the market will continue to see a lack of supply for various types of resort real estate as developers adopt a cautious approach to sales amid the current subdued market conditions.

Selling prices of vacation townhouses/shophouses in Da Nang and surrounding areas. Source: DKRA

|

Selling prices of vacation villas in Da Nang and surrounding areas. Source: DKRA

|

Unleashing Quang Nam’s Economic Engine: The 2700 Billion VND Project Commencement

“The Chairman of the People’s Committee of Quang Nam Province led a crucial meeting to discuss land clearance procedures for a significant project with an investment of over VND 2,700 billion. The chairman’s expertise and leadership were pivotal in navigating the complex process of land acquisition, ensuring a smooth path toward the project’s success.”

The Golden Mountain’s Exploration: County Reverses Decision to Allow Mining in Nature Reserve

Despite initial disagreements over granting permission for gold exploration to Phuoc Son Gold Company due to concerns about the potential impact on natural forests, the People’s Committee of the province received a change of heart from Phuoc Son district.