Profits surge despite the off-peak season

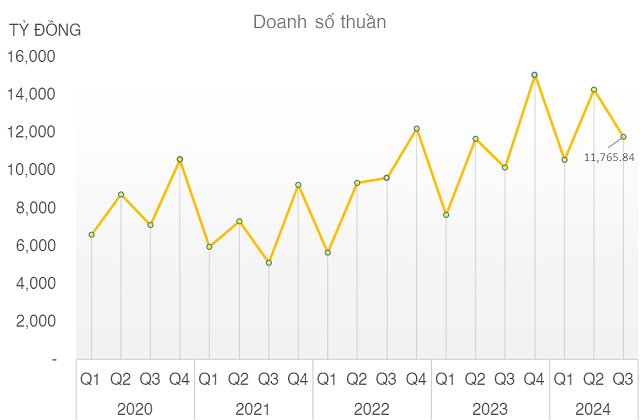

According to statistics from the Q3/2024 financial statements of eight construction-investment enterprises (including C4G, CTD, DPG, FCN, HHV, LCG, VCG, and LGC), total revenue for the period reached VND 11,765 billion, a 14% increase compared to the same period last year.

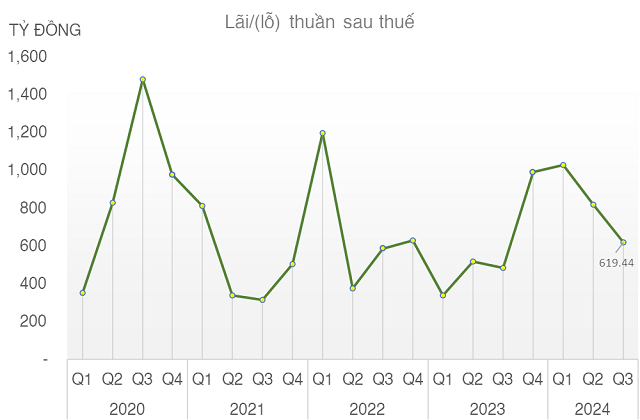

Notably, the after-tax profit of these eight enterprises surged by 28% year-on-year to VND 619.44 billion. While there was a divergence in performance, with some enterprises reporting decreases compared to the previous year, including DPG (-28%), FCN (-86%), and LGC (-25%), several others posted significant profit increases, such as C4G (+81%), CTD (+40%), HHV (+5.5%), LCG (+51%), and VCG (+436%).

The most remarkable performance was by VCG, with a net revenue of VND 8,139 billion, of which nearly 68% came from construction activities. Its after-tax profit for the quarter soared to VND 147.5 billion, a five-fold increase compared to the same period last year.

Looking at the nine-month performance, the enterprises under review collectively earned nearly VND 2,500 billion in profits, surpassing the results achieved in the entire year of 2023. Notably, VCG‘s profit for this period stood at VND 765 billion, reflecting a remarkable 3.75-fold increase compared to the previous year.

Admittedly, the surge in VCG‘s after-tax profit was largely attributed to its real estate business. However, it is worth mentioning that the gross profit from its construction segment also doubled year-on-year, reaching VND 240 billion in the first nine months of the year.

Meanwhile, enterprises that focus more on public investment, such as C4G, HHV, and LCG, have also witnessed robust growth in their after-tax profits during the first three quarters. Furthermore, FCN has returned to profitability after incurring losses in the previous year.

The business landscape is gradually brightening as we approach the peak season for revenue recognition. Typically, the fourth quarter is a crucial period for the disbursement of public investment, so the enterprises’ performance may further improve.

Currently, some enterprises are getting closer to achieving their profit targets, such as VCG (80%) and HHV (91%). In contrast, LCG (72.2%), LGC (68.7%), and C4G (62%) will be relying on their Q4 results to fulfill their commitments to shareholders.

Bright prospects for the industry, but capital remains dormant for a year.

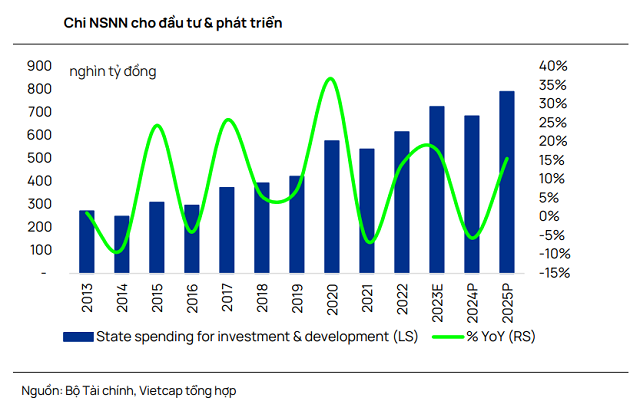

Not only has the industry witnessed promising financial results, but there is also further potential in public investment, given the government’s orientation to increase development spending.

Although public investment disbursement has shown signs of slowing down in recent months, reaching only 47% of the annual plan (lower than the 50% achieved in the first nine months of 2023), the Ministry of Finance estimates that development spending could reach approximately VND 684.4 trillion, representing a 5.6% decrease compared to the previous year. This amount is expected to fulfill 101% of the National Assembly’s annual plan and about 95% of the plan assigned by the Prime Minister.

For the 2025 fiscal year, the development spending budget is projected to reach VND 790.7 trillion, indicating a 16.7% increase compared to the 2024 estimate. Notably, this projected budget is 30% higher than the previous estimate presented by the Government in the Financial and State Budget Plan for the 2024-2026 period, submitted to the National Assembly in October 2023.

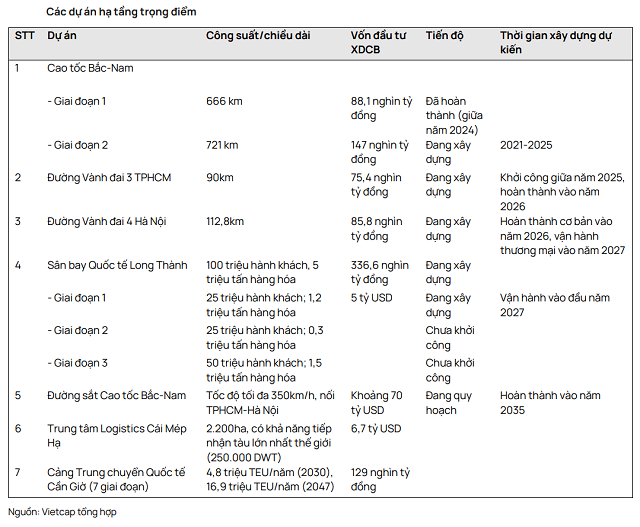

Several key projects are in the pipeline, including the North-South High-Speed Railway, the Cai Mep Ha Logistics Center, and the Can Gio Transit Port.

However, investors have not shown signs of capitalizing on the expectations surrounding public investment enterprises in the past year. A wave of investment in these stocks has yet to emerge since November 2023, despite market rallies in sectors such as banking, technology, and securities.

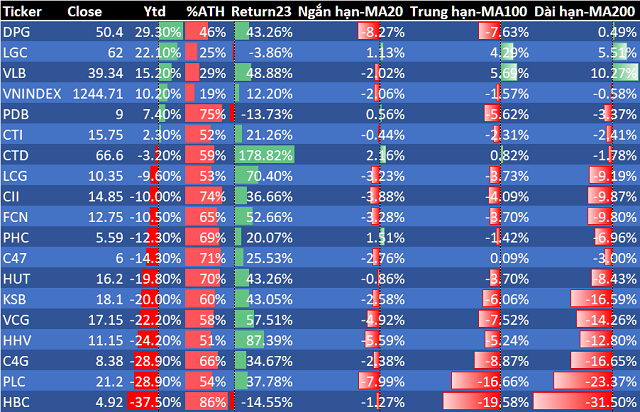

Performance of construction and building materials stocks (as of the trading session on November 4).

|

As of the trading session on November 4, only two out of the eight aforementioned stocks have outperformed the VN-Index: DPG (+29%) and LGC (+22%). However, LGC has minimal liquidity, and DPG‘s trend appears uncertain as it hovers near its 200-day moving average.

The remaining stocks have not only lost their long-term upward trends but have also posted negative returns since the beginning of 2024: FCN (-10.5%), VCG (-22%), HHV (-24%), C4G (-29%), LCG (-10%), and CTD (-3%).

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.