The Vietnamese stock market witnessed a modest recovery during the latest trading session, but the gains were modest amid low liquidity. After a period of consolidation, the market staged a stronger rebound in the afternoon but quickly lost steam.

At the close of the November 5 session, the VN-Index climbed 1.05 points (+0.08%) to settle at 1,245.76. Combined trading volume on the three exchanges reached approximately VND 12,000 billion, marking a nearly 30% decline compared to the previous session.

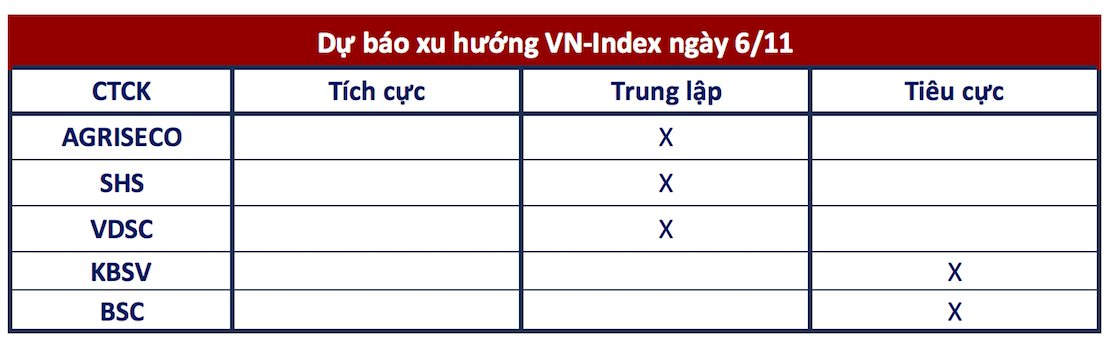

Looking ahead, most securities companies anticipate a neutral scenario for the VN-Index. Failing to hold the support level of 1,240 points may trigger further downside pressure, potentially retesting the 1,220-1,230 range.

VN-Index Yet to Revert to an Uptrend

Agriseco Securities

From a technical perspective, the VN-Index halted its downward trajectory and established a new equilibrium around the 1,245 (+-5) mark. While selling pressure appeared relatively weak, proactive buying power remained lackluster. In the view of Agriseco Research, the index’s sustained closure below the MA200-day average indicates that it has not reverted to an upward trajectory.

The 1,240 level, and more significantly, the 1,200 (+-10) zone, are anticipated to serve as reliable support levels during volatile periods. Given the influence of various macro factors, both domestically and internationally, on investor sentiment, Agriseco recommends maintaining a high cash balance. Investors are advised to await clearer signals of a short-term bottom before considering allocating funds to the market.

Nearest Support at 1,240 Points

SHS Securities

In the short term, the VN-Index exhibits weakness as it trades below the psychological resistance zone of 1,250 points, which corresponds to the highest price level of 2023 and the 200-session average. A meaningful improvement can only be expected if the index surpasses this resistance zone. The nearest support is located at 1,240 points, representing the lowest price level of September 2024. Failing to maintain this support level may result in renewed downside pressure, potentially retesting the 1,220-1,230 range, which aligns with the 200-week average.

VDSC Securities

The market is expected to find support near the 1,240 level in the upcoming session and may experience a technical rebound towards the 1,252 resistance zone. However, it’s important to note that the recent decline below the MA(200) could exert further downward pressure in the near future.

Selling Pressure Likely to Resurface

KBSV Securities

The VN-Index formed a Doji candle with a narrow range, indicating a slowdown in overall market activity ahead of significant events. Despite a positive market breadth, the sharp decline in index liquidity suggests that the upward movement lacked conviction. It is likely that selling pressure will resurface.

Investors are advised to refrain from chasing rallies during early recovery phases. Instead, consider placing staggered buy orders as the index/stocks retreat towards distant support levels.

Potential Retreat

BSC Securities

In the upcoming sessions, there remains a possibility that the VN-Index could retreat further towards the 1,240 threshold.

The Stock Market Soars to Record Highs as Trump Claims Victory

The S&P 500 futures hit record highs after Republican nominee Donald Trump claimed victory in the US presidential election.

The Stock Market Week of October 28 – November 1, 2024: A Fragile Recovery

The VN-Index experienced a volatile week with alternating sessions of gains and losses. The cautious sentiment among investors is evident as trading volume remains below the 20-day average. Moreover, the continuous net selling by foreign investors will likely impact the growth trajectory of the VN-Index in the coming period.