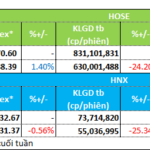

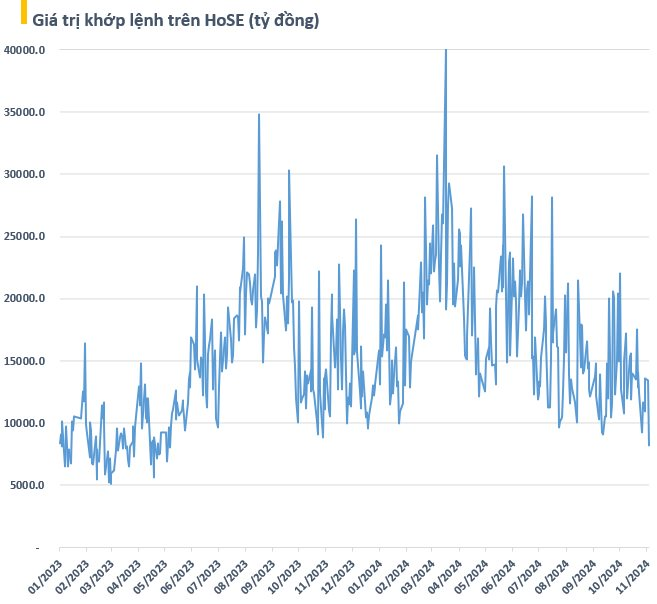

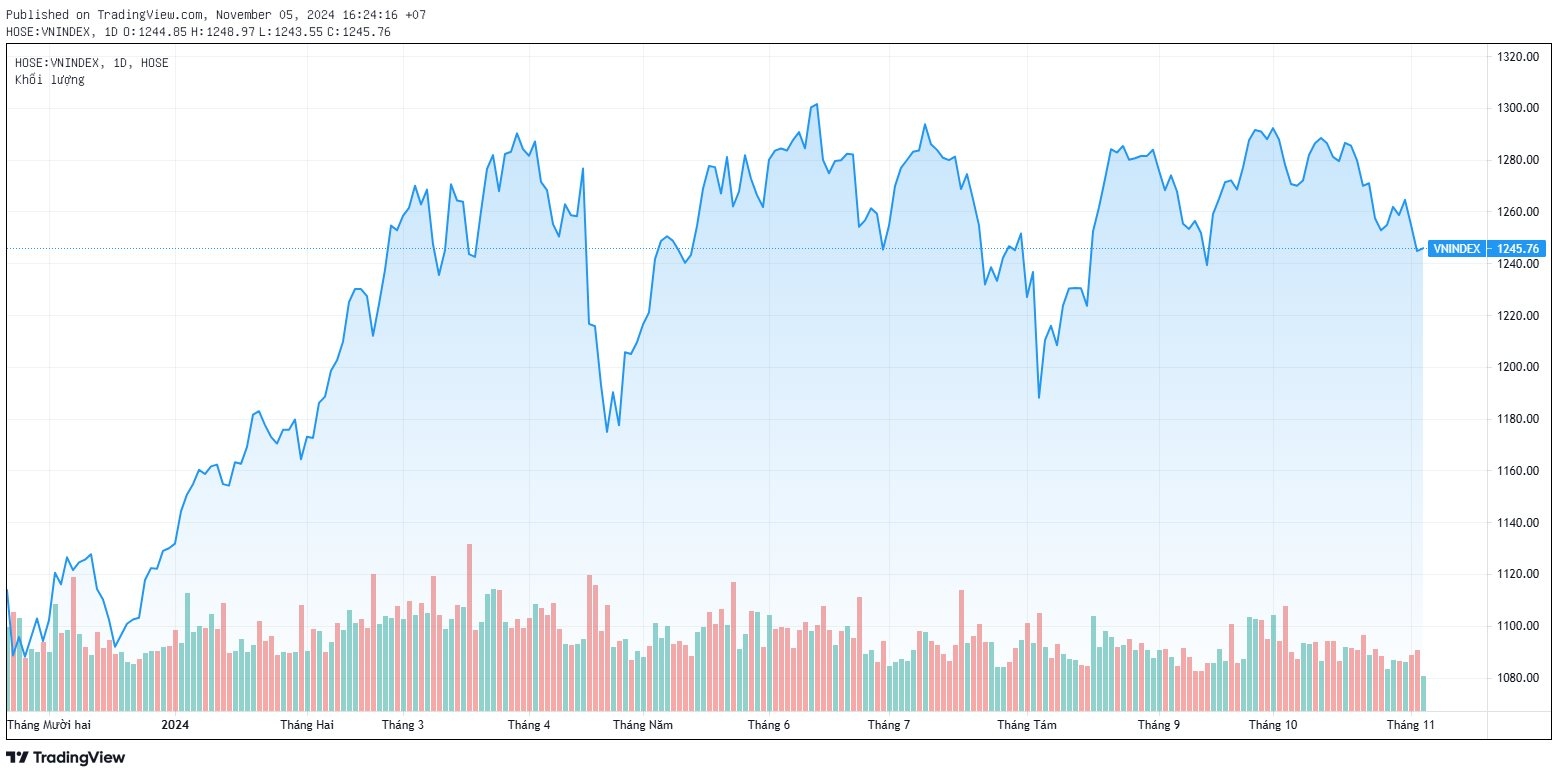

The stock market just experienced a volatile trading session on November 5th, with meager trading volume on the HoSE. The matching volume barely reached 384 million units, while the corresponding value was slightly above 8,100 billion VND, a 40% decrease from the previous session and the lowest in nearly a year and a half since the beginning of May 2023.

In fact, the matching liquidity has been on a downward trend for several months. The average trading value in the third quarter fell by 15% from the previous quarter to 14,500 billion VND per session.

This up-and-down liquidity movement follows a period of sideways trading within a narrow range. The index’s struggle to break through the 1,300-point threshold and its subsequent faltering have dampened investor sentiment. Additionally, the market’s “sawtooth” movement, with small recoveries followed by deeper declines, has left many investors with losses as their accounts are gradually eroded.

Investor caution is partly due to concerns about unpredictable global events, especially the upcoming US presidential election results and the Fed meeting on November 6-7. These developments could trigger new trends in global financial markets, leading investors to “freeze” their trading activities in anticipation of the latest updates.

Moreover, the prolonged polarization of stock groups and the lack of a leading industry have discouraged capital inflows, redirecting them toward investment channels with higher growth potential, such as gold, real estate, and bitcoin. Even safe investment options like savings deposits have seen remarkable increases. According to the State Bank of Vietnam, resident deposits in Vietnamese banks have reached an all-time high of nearly 6,840 trillion VND as of July 2024, an increase of 305,000 billion VND compared to the end of 2023.

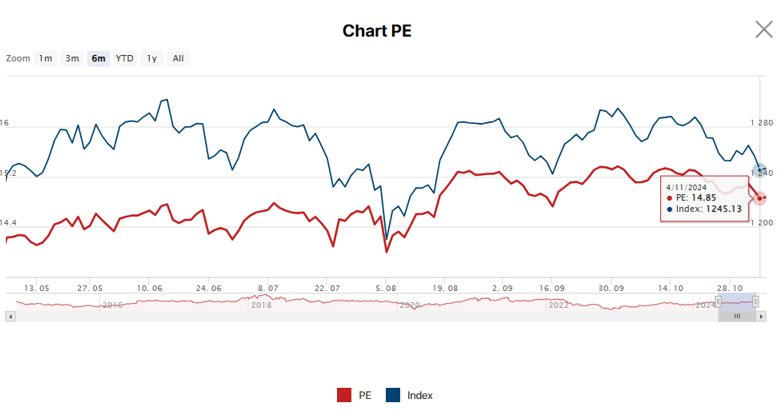

On the other hand, unattractive valuations have also dampened investor enthusiasm. Currently, the market’s P/E ratio hovers around 14 times, which is neither a bargain nor overly expensive, but rather in the middle of the VN-Index’s range for the past 10-15 years.

According to Mr. La Giang Trung, CEO of Passion Investment, while the market valuation is not low, it is also not excessively high. However, when looking at specific stock groups, there is a polarization in terms of valuation. Investing in stocks with very high valuations may not be rational, and investing in undervalued stocks may cause hesitation due to the perceived risk.

“I believe the market is in a very challenging phase for stock picking. However, from a conservative investment perspective, I still prioritize undervalued stocks,” said Mr. La Giang Trung.

In the context of a lackluster macro environment, Mr. Bui Van Huy, Executive Director of Ho Chi Minh City Branch, DSC Securities, believes that the market lacks support and is entering a quiet period with a lack of news flow. As a result, the upward trend cannot be confirmed, and the market is likely to trade sideways or experience further volatility.

On the global front, yields on US government bonds continue to rise sharply, and the US Dollar Index follows a similar path. The upcoming US election on November 5 and the Fed meeting on November 6-7, which may result in another rate cut, will likely trigger significant movements in global financial markets, both positive and negative.

Domestically, the November market is facing a dearth of supportive information after the third-quarter earnings season. Expectations for market upgrades are shifting to the next year, while foreign investors continue to offload Vietnamese stocks.

In this context, the large volume of bonds maturing in November and December may raise concerns. While there may not be a repeat of the 2022 chain reaction, the impact on market liquidity is undeniable. Circular 02, which will also mature at the end of 2024, will require banks to account for bad debts in 2025.

Experts from DSC acknowledge that the market currently lacks short-term opportunities and that trading sentiment is gloomy and challenging to predict. While the market may be prone to recovery in this state of despondency, there is still room for further declines.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

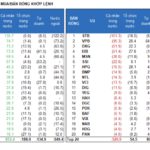

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pushed the market down to very low price levels. Except for the first few minutes when the VN-Index was slightly green, the market plummeted for the rest of the morning session, closing at its lowest point with four times as many losers as gainers.

The Savvy Investor: Pouring Money into the Market, a Smart Strategy?

Individual investors today bought a net amount of 353.8 billion VND, of which 603.9 billion VND was net bought in matched orders.

The Market Beat: VN-Index Hanging on at 1,280 Points

The market closed with the VN-Index down 1.6 points (-0.12%) to 1,279.48, while the HNX-Index fell 0.69 points (-0.3%) to 228.26. The market breadth tilted towards decliners with 381 losers and 287 gainers. The large-cap stocks in the VN30-Index basket witnessed a similar trend, with 18 stocks declining, 9 advancing, and 3 unchanged.