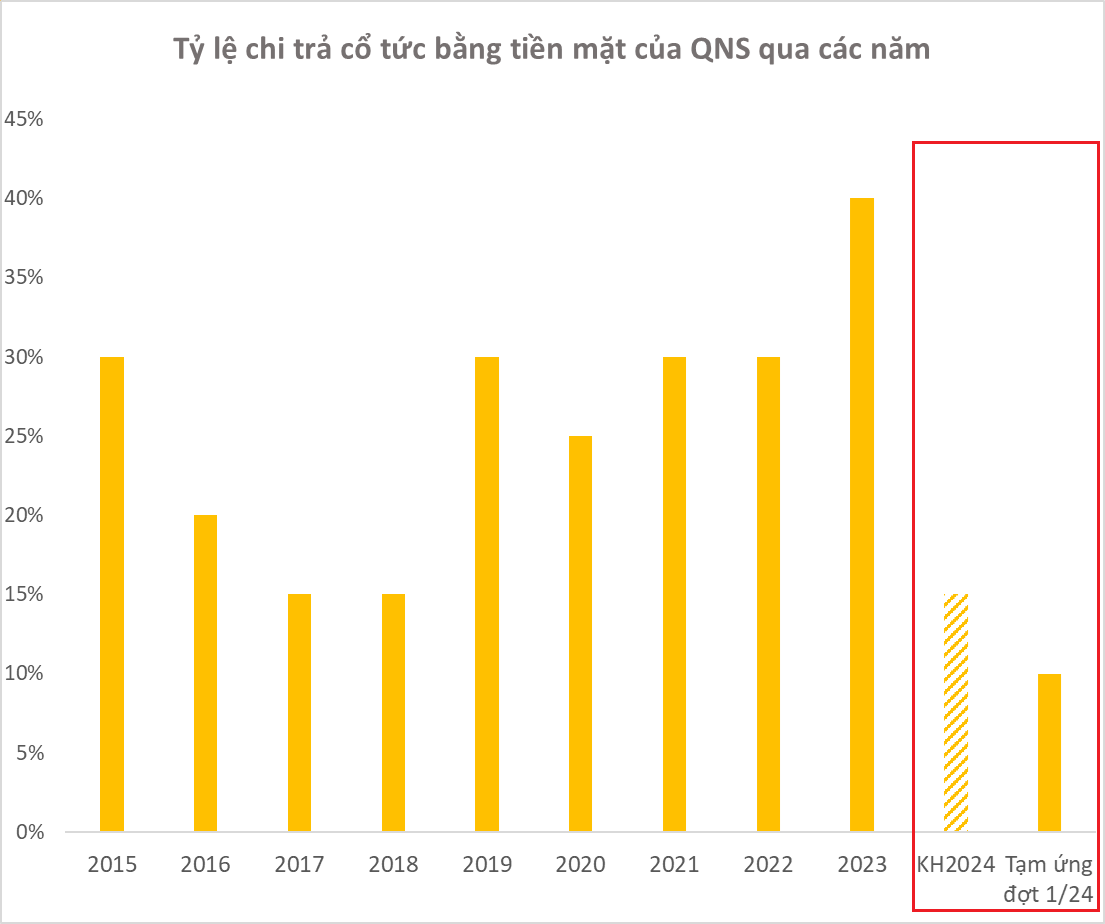

The Board of Directors of Vinh Hoan Joint Stock Company (code: VHC) has just approved an interim cash dividend for 2024, at a rate of 20% (1 share receives VND 2,000). The record date for listing shareholders to receive dividends is December 6, and the expected payment date is December 18, 2024. The payment will be made from undistributed retained earnings up to June 30, 2024.

With more than 224.45 million circulating shares, the company needs to spend about VND 449 billion on dividend payment. The annual general meeting of shareholders in early 2024 approved a dividend payout ratio of 20%. Notably, this “generous” dividend payout has been consistently maintained by Vinh Hoan since 2020.

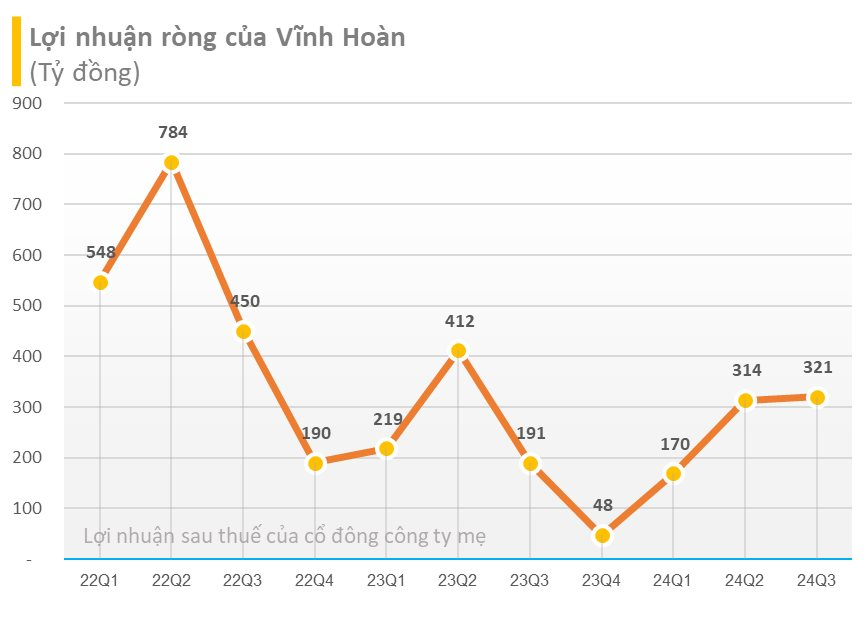

Vinh Hoan’s dividend payment comes after the seafood enterprise reported a brighter Q3/2024 business result compared to the same period last year.

According to the Q3/2024 financial report, VHC’s net revenue reached VND 3,278 billion, up nearly 22% over the same period in 2023. After deducting cost of goods sold, VHC’s gross profit was nearly VND 579 billion, double that of the same period last year.

After deducting expenses, VHC’s post-tax profit increased by 70% to VND 341 billion compared to the same period. Profit after tax attributable to the parent company increased by 68% to nearly VND 321 billion.

For the first nine months of the year, Vinh Hoan, known as the “queen of catfish,” recorded net revenue of VND 9,329 billion, up 22%, and profit after tax of VND 870 billion, down 1.5% over the same period last year. Profit after tax attributable to the parent company reached VND 808 billion.

In 2024, Vinh Hoan has set its business plan with two scenarios. In the high scenario, the company targets a revenue of VND 11,500 billion and profit after tax attributable to the parent company of VND 1,000 billion. In the base scenario, the company targets a revenue of VND 10,700 billion and profit after tax attributable to the parent company of VND 800 billion. Thus, after the first nine months of the year, Vinh Hoan has completed 101% of the base plan and 80.8% of the high plan.

A Luxury Condo Development on Prime Real Estate: Catalyzing a Company’s Transformation; 9M2024 Profits Soar 1,254 Times, EPS Nears 20,000 VND.

Introducing the visionary residential development, Hoang Thanh Pearl Apartment Project, located in the heart of Cau Dien Ward. This vibrant community rises from the grounds of what was once an old factory, bringing a new lease of life to the area.

Vinamilk: Overseas Market Revenue Surges 15.7%, Exports Remain the Key “Driver”

For the fifth consecutive quarter, Vinamilk’s overseas market revenue has maintained its stellar performance, with a notable boost from its export business. In the first nine months of the year, international markets contributed 8,349 billion VND to Vinamilk’s coffers, marking an impressive 15.7% increase.