The VN-Index experienced a relatively range-bound trading session, with investor sentiment turning cautious following the recently concluded Q3 earnings season. At the close of the November 5 session, the VN-Index edged up 1.05 points to 1,245.76. Liquidity on HoSE dried up, with the matching value falling to its lowest level in 18 months at a mere VND8,184 billion.

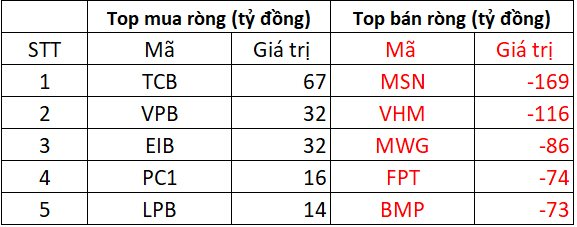

Foreign investors continued their net selling streak, offloading over VND868 billion across the market:

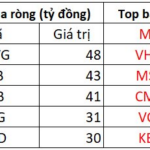

On HoSE, foreign investors net sold a substantial VND854 billion. MSN witnessed the strongest net selling pressure from foreign investors, with a net sell value of VND169 billion. VHM and MWG also faced net outflows of VND116 billion and VND86 billion, respectively, while FPT and BMP were net sold above VND70 billion each.

Conversely, VPB, TCB, and CTG were the top three bank stocks favored by foreign investors on HOSE, with a total net buy value of VND423 billion. Foreign investors also net bought over VND100 billion of MWG, and BMP witnessed strong net inflows of VND41 billion.

On the HNX, foreign investors net sold approximately VND17 billion:

In terms of net buying, VGS led the pack with a net buy value of VND3 billion, followed by VFS and PVI, which were net bought for VND1 billion each.

On the other side, PVS, TNG, MBS, IDC, and SHS faced net selling, although the net sell values were relatively modest, amounting to a few billion VND for each stock.

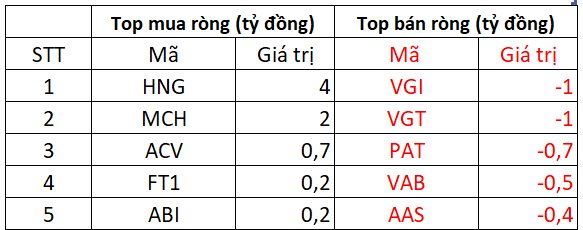

On UPCOM, foreign investors net bought around VND3 billion:

HNG and MCH were the top net bought stocks, with net buy values of VND4 billion and VND2 billion, respectively. ACV and FT1 also witnessed net inflows of a few hundred million VND each.

Conversely, VGI and VGT faced net selling pressure from foreign investors, with net sell values of VND1 billion each. PAT, VAB, and AAS also witnessed minor net outflows.

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.

The Stock Market Week of October 28 – November 1, 2024: A Fragile Recovery

The VN-Index experienced a volatile week with alternating sessions of gains and losses. The cautious sentiment among investors is evident as trading volume remains below the 20-day average. Moreover, the continuous net selling by foreign investors will likely impact the growth trajectory of the VN-Index in the coming period.