The increase in DIG‘s ownership in DIC Hospitality came not long after this subsidiary changed its business model from an LLC to a JSC on July 1, 2024. Following the transition, DIC Hospitality’s charter capital remained at over VND 1,000 billion but decreased by VND 5,728 billion compared to before the change.

DIC Hospitality was established in January 2020, headquartered in Vung Tau city, Ba Ria – Vung Tau province. At that time, its charter capital was VND 230.5 billion, of which DIG held 99.957%, and Mr. Nguyen Hung Cuong – the current Chairman of DIG‘s Board of Directors – held 0.043%.

In 2020 and 2021, DIC Hospitality continuously increased its charter capital. By December 2021, the company’s charter capital had risen to over VND 1,000 billion, with DIG holding 78.302%, Mr. Cuong holding 0.01%, and the remaining 21.688% owned by Mr. Cao Van Vu.

Mr. Vu Thanh Binh, the brother-in-law of former DIG Chairman Nguyen Thien Tuan, has served as the General Director and legal representative of DIC Hospitality since its inception.

In its 2023 annual report, DIG introduced DIC Hospitality as the operator of various projects, including the DIC Star Landmark Hotel, Cap Saint Jacques (CSJ) building, Thuy Tien apartment building, and DIC Star Vinh Phuc Hotel.

|

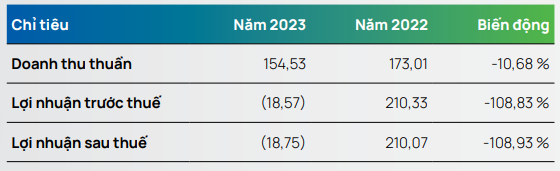

Financial Performance of DIC Hospitality for 2022-2023

Source: DIG

|

The change in DIC Hospitality’s business model and DIG‘s increased ownership were approved by DIG‘s Board of Directors in a resolution dated June 24, 2024, regarding the company’s financial investment plans for 2024.

According to this resolution, in addition to DIC Hospitality, DIG will also divest part of its capital from DIC Anh Em, a joint-stock company, and completely divest from Kratie Rubber Phu Rieng Joint Stock Company to investors with a demand for transfer. The transfer was to be completed by September 30, 2024, with payment made via bank transfer.

In early October 2024, DIG announced that it had completed the partial divestment of capital from DIC Anh Em as per the June 2024 resolution. However, the company has not provided any updates regarding the transfer of capital from Kratie Rubber Phu Rieng.

In terms of business performance, DIG reported a net profit of just over VND 16 billion in the first nine months of 2024, an 85% decrease compared to the same period last year, despite a 46% increase in revenue to VND 869 billion. This increase in revenue was attributed to its real estate business, including the transfer of apartments in the Cap Saint Jacques complex (CSJ), the transfer of raw houses in the Dai Phuoc and Hau Giang projects (DIC Victory Hau Giang), and the transfer of land use rights in the Nam Vinh Yen project.

The significant drop in net income was due to a 75% decrease in financial revenue, amounting to nearly VND 52 billion, resulting from reduced income from investments.

“DIG Increases Ownership in Cap Saint Jacques Building Operator to 99.9%”

In a recent disclosure, the Construction Development Investment Corporation (HOSE: DIG) announced that it has increased its ownership stake in its subsidiary, DIC Hospitality, from 78.3% to 99.9%.

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.

“A Stunning Turnaround: Novaland’s Q3 Profits Soar to Over 3,000 Billion VND”

Despite an exceptional surge in profits during the third quarter of 2024, Novaland Group (Novaland), listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘NVL’, faces the grim prospect of historical annual losses. With a staggering cumulative loss of over VND 4,000 billion in the first nine months of the year, the real estate giant is struggling to stay afloat.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.