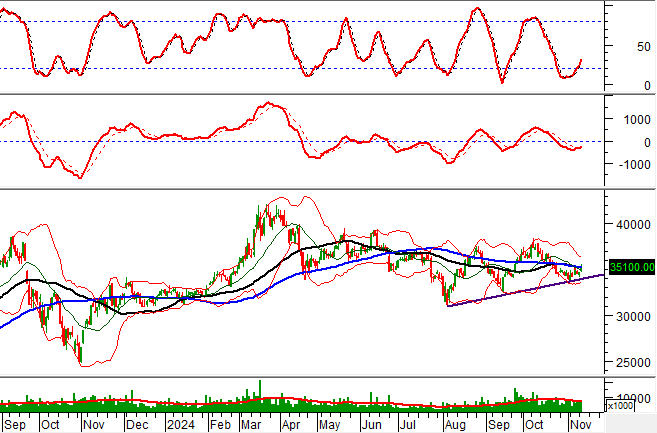

Technical Signals of VN-Index

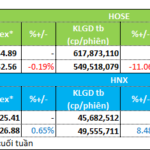

During the trading session on the morning of November 12, 2024, the VN-Index witnessed a slight dip, forming a Doji candlestick pattern, while liquidity significantly declined, indicating investors’ cautious approach.

At present, the VN-Index is testing the SMA 200-day moving average, with the ADX indicator remaining at a low level, suggesting a sideways trend with interspersed rises and falls that may persist in upcoming sessions.

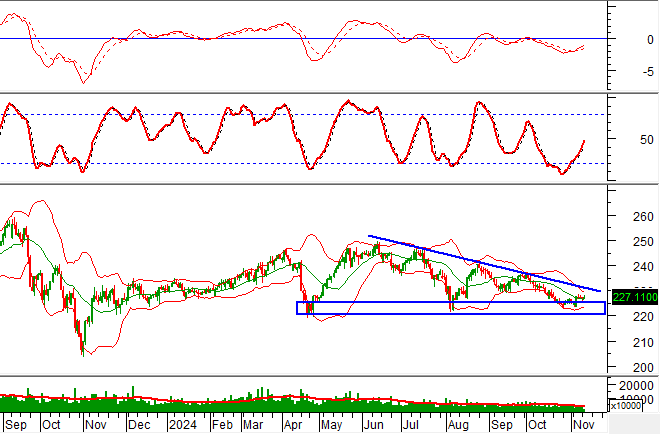

Technical Signals of HNX-Index

On November 12, 2024, the HNX-Index experienced a mild increase, while trading volume dropped during the morning session, reflecting investors’ indecisiveness.

Additionally, the HNX-Index is trending upwards, testing the upper edge of the Descending Triangle pattern. If the short-term uptrend continues and breaks through this upper boundary, the next potential price target zone is expected to be the 245-250 point range.

VCI – Vietcap Securities Joint Stock Company

On the morning of November 12, 2024, VCI witnessed a price surge, forming a Rising Window candlestick pattern, while liquidity surpassed the 20-session average, indicating active trading by investors.

Currently, the stock price is rebounding after testing the short-term upward trendline and crossing above the Middle line of the Bollinger Bands. The MACD indicator suggests a buy signal, implying that the short-term uptrend may persist in the upcoming sessions.

Furthermore, the stock price is testing the SMA 50-day and SMA 100-day moving averages. If the upward momentum is sustained, and the stock price crosses above these averages, the mid-term optimistic outlook will likely return.

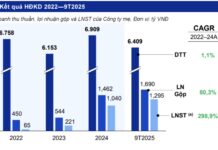

SAB – Saigon Beer, Alcohol and Beverage Joint Stock Company

On the morning of November 12, 2024, SAB witnessed a substantial price increase, accompanied by a significant surge in trading volume during the morning session, surpassing the 20-session average and indicating investors’ optimism.

Additionally, a Golden Cross formation between the SMA 50-day and SMA 100-day moving averages underscores the presence of a mid-term optimistic outlook.

Moreover, the stock price broke out of its medium-term downward trendline, and the Stochastic Oscillator indicator generated a buy signal in the oversold region, suggesting that the recovery scenario may extend into the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

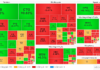

Industrial Real Estate Stocks: A Week of Capital Attraction

Liquidity remained lackluster during the week of November 4–8, with no significant improvements observed. However, certain sectors stood out as money magnets, attracting investors’ attention with their unique narratives.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”

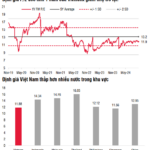

The Looming Threat of a Market Downturn: Navigating the Risks Ahead

The VN-Index witnessed its fourth consecutive session of losses, dipping below the 200-day SMA. This downward trend indicates a negative shift in market sentiment. Accompanying this decline is a drop in trading volume below the 20-day average, reflecting heightened investor caution. The MACD indicator continues to plummet, reinforcing the sell signal and suggesting that the short-term outlook remains pessimistic.

The Vietnam Stock Market’s Performance Post US Presidential Elections: VN-Index Rises 5 out of 6 Times, Painting the Town Green.

The historical data of the Vietnamese stock market indicates an average increase of 11.92% post-election, and analysts are optimistic about a positive reaction from the VN-Index as the event concludes.