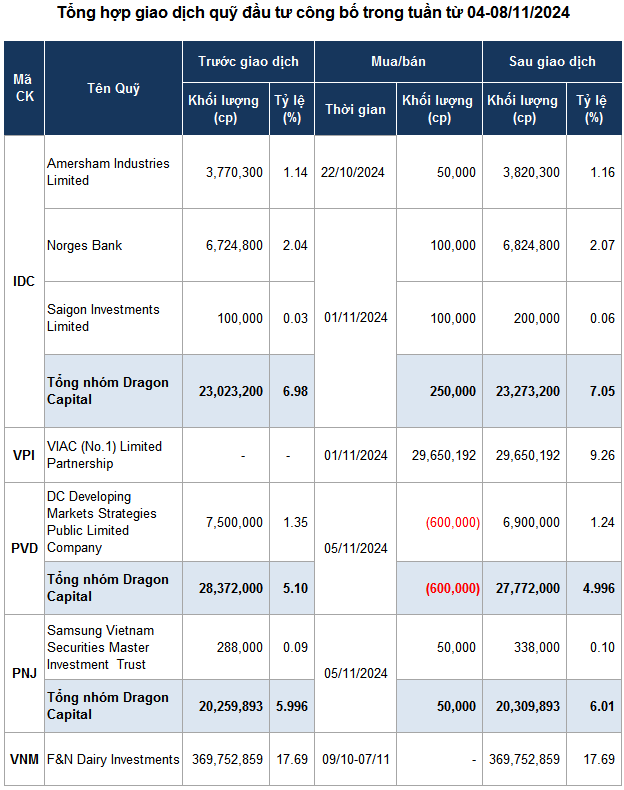

Dragon Capital has returned to increase its ownership stake in PNJ, a leading jewelry company in Vietnam, surpassing the 6% threshold once again. On November 5th, 2024, Dragon Capital invested approximately VND 5 billion to purchase an additional 50,000 PNJ shares, bringing their total holdings to over 20 million shares, equivalent to a 6.01% stake.

This move comes as the retail and wholesale jewelry market is expected to improve in the fourth quarter of 2024, with the peak wedding season driving up demand for jewelry and wholesale customers preparing for the upcoming Lunar New Year.

| PNJ Share Price Performance from the Beginning of 2024 to November 8th, 2024 |

On the same day, Dragon Capital sold 600,000 shares of PVD, a leading oil and gas drilling company in Vietnam. Following this transaction, the group is no longer a major shareholder in PVD, with their ownership stake falling below 5%, equivalent to nearly 28 million shares.

| PVD Share Price Performance from the Beginning of 2024 to November 8th, 2024 |

As of the close of the trading session on November 5th, PVD’s share price stood at VND 25,200 per share, reflecting a 28% decrease from its peak of VND 34,900 reached earlier in April. This also represents a 10% decline since the beginning of the year. Based on this share price, Dragon Capital is estimated to have generated over VND 15 billion from their divestment.

The reason for Dragon Capital’s departure as a major shareholder in PVD may be attributed to the misalignment between the share price performance and the company’s financial results.

| PVD’s Financial Performance for the First Nine Months of the Year |

For the first nine months of 2024, PVD recorded nearly VND 6.5 trillion in revenue and over VND 478 billion in net profit, representing increases of 61% and 25%, respectively, compared to the same period last year. The company attributed the profit increase to higher rig day rates and improved utilization of jack-up rigs.

For the full year 2024, PVD has set revenue and net profit targets of VND 6,200 billion and VND 380 billion, respectively. With the results of the first nine months, the company has already surpassed these targets, achieving 105% of the revenue target and 121% of the profit target.

Source: VietstockFinance

|

“Investing in Vietnam: Access to 65 of the World’s Top Markets”

On the morning of November 8th, Prime Minister Pham Minh Chinh attended a Vietnam-China business forum in Chongqing city. The forum was organized by the Ministry of Planning and Investment, the Committee for Management of State Capital at Enterprises, and the Vietnamese Embassy in China, in collaboration with the Chongqing municipal government.

The Deadline Has Passed, Yet Ninh Thuan Has Only Implemented 13 Out of 17 Special Policies

Over the past five years, the province has implemented only 13 out of 17 policies outlined in the Government’s Resolution No. 115, dated August 31, 2018, on the implementation of special mechanisms and policies to support the socio-economic development and stabilize production and people’s lives in Ninh Thuan Province for the 2018-2023 period.

High-Speed Rail Tickets for the North-South Route as Low as 1,000 VND per km?

The Parliamentary Economic Committee has proposed an interesting suggestion to increase the feasibility and effectiveness of the high-speed North-South railway. They suggest that by reducing the ticket prices to 60-70% of airline prices, the railway could become a more attractive and viable option for travelers. This proposal warrants further exploration as it could significantly impact the transportation industry and passenger preferences.

The $67.3 Billion Super-Project: Europe Watches Vietnam’s 1,541km Mega-Project with Keen Interest

The European nation’s ambassador to Vietnam expressed keen interest in and close attention to the key project under consideration by the National Assembly.