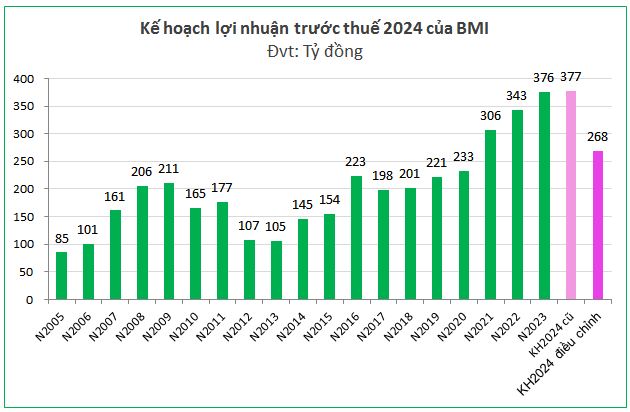

On December 27, 2024, BMI will hold an Extraordinary General Meeting to adjust its 2024 business plan targets.

Source: VietstockFinance

|

The BMI Board of Directors proposes a 29% reduction in the 2024 pre-tax profit plan, from VND 377 billion to VND 268 billion. Accordingly, the minimum ROE and dividend payout ratio will also decrease to 7% from the initial 10% plan.

BMI’s management decision to adjust the annual profit target came after a 52% year-over-year decline in net profit for the third quarter to just over VND 51 billion.

BMI explained that many of its customers suffered losses due to Typhoon Yagi, resulting in a surge in compensation provisions for the period, negatively impacting third-quarter profit.

| BMI’s nine-month net profit over the years |

For the first nine months of 2024, BMI recorded a net profit of nearly VND 195 billion, down 23% from the same period last year. Compared to the initial plan, BMI has achieved only 58% of its profit target after nine months. However, compared to the adjusted plan, BMI has accomplished 82%.

Khang Di

The Race to Surpass: HSC Aims High with a Proposed Capital Increase to Over VND 10 Trillion

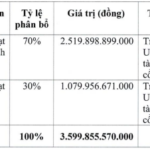

The Ho Chi Minh City Securities Corporation (HSC) is planning to offer its existing shareholders a treat. According to the company’s recent extraordinary general meeting documents, the board of directors is seeking approval for a share sale proposal. The offer price? A tempting 10,000 VND per share, equivalent to the par value. And the timing? Well, HSC is eyeing 2025 for this enticing opportunity.

“DIG Increases Ownership in Cap Saint Jacques Building Operator to 99.9%”

In a disclosure dated November 7, Construction Development Investment Corporation (HOSE: DIG) announced that it had increased its ownership stake in its subsidiary, DIC Tourism Joint Stock Company (DIC Hospitality), from 78.3% to 99.9%.

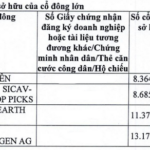

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.