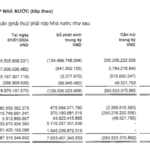

More than a decade ago, SID required 800 billion VND to finance three projects: the Saigon Co.op Commercial, Service, and Residential Center (An Phu project); the Co.opmart project in Cat Bi, Hai Phong; and the Co.opmart Shopping Center in Vinh City, Nghe An province. SID successfully raised 255 billion VND from existing shareholders, with the expectation of disbursing the funds in 2012 and 2013.

However, reality brought many changes in the past decade, prompting the Company to propose to the 2024 Annual General Meeting of Shareholders to adjust the capital usage plan. Currently, the Company is only investing in one project, An Phu.

SID’s Initial Capital Allocation Plan. Source: SID

|

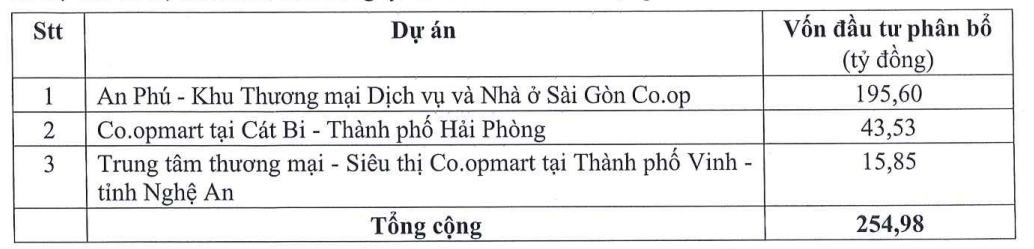

Fifteen years ago, SID became the investor and started accounting for the An Phu project in its books after it was transferred by Saigon Co.op. The “basic construction cost in progress” at the end of 2011 was approximately 440 billion VND.

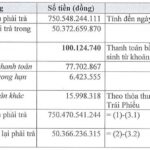

The An Phu project covers an area of about 6.9 hectares, estimated to require up to 448 million USD (11.2 trillion VND at an exchange rate of 25,000 VND/USD), and was planned to be implemented from 2011 to 2016. SID intended to allocate 198 billion VND from the issuance for this project but has only disbursed 29 billion VND so far. As of the end of the third quarter, the cumulative investment in the An Phu project exceeded 476 billion VND.

In 2019, it was announced that the project had exceeded the time limit according to the decision on the investment policy of the HCMC People’s Committee. According to the minutes of this year’s annual general meeting, SID has submitted the dossier for the land handover procedure and also requested an adjustment to the investment policy in 2022.

SID is continuing to coordinate with Thu Thiem Real Estate Joint Stock Company to fulfill its obligations for technical infrastructure contributions, as well as matters related to the cooperation contract with Novaland. Currently, the Company still holds more than 102 billion VND in long-term deposits received from Nova An Phu Company Limited – a subsidiary of Novaland Group (Novaland, HOSE: NVL).

SID wants to terminate cooperation with NVL in the Saigon Co.op An Phu project

.jpg) An Phu Saigon Co.op Commercial, Service, and Residential Center Project Perspective.

|

Project location via Google Maps, which currently shows an empty plot of land.

|

The trio of SID, Nova An Phu, and NVL decided to collaborate on developing this project through a contract signed in late 2016. However, when it came to implementation, they could not agree on a cooperation plan due to, according to SID, “many objective reasons.” The relationship further deteriorated as the parties had to resort to the Vietnam International Arbitration Center to resolve their disputes, but a final ruling is yet to be made.

“Regarding the cooperation with Novaland, the Company is discussing to terminate the cooperation as it is finalizing the legal procedures as the project’s investor,” said SID‘s leader at the 2023 annual meeting.

Investment amount in the An Phu project as of Q3/2024. Source: SID

|

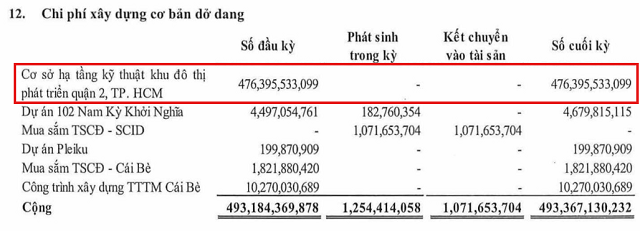

At the May annual general meeting, SID proposed and obtained shareholder approval to remove the 16 billion VND investment in the Co.opmart Shopping Center project in Vinh City, Nghe An province, from the next capital usage progress reports.

The partner in the Vinh project, BMC Construction and Commercial Installation Joint Stock Company, encountered issues related to land legal procedures and could not hand over the site as committed. SID has filed a lawsuit against this partner and made full provisions for difficult-to-recover debts in 2023, deciding not to continue investing in this project in the future. Shareholders agreed to transfer the money to working capital to serve business activities once the Company recovers it from BMC.

As for the Co.opmart project in Cat Bi, Hai Phong, it has not been reported on since the 2016 annual general meeting, as it has been transferred back to the parent company, Saigon Co.op.

The Heir Apparent’s Accounts Receivable: A Novaland Saga – Unraveling the Financial Mysteries of the Elusive Bùi Cao Nhật Quân in Q3 2024

As per the Q3/2024 financial statements, Novaland reported a long-term receivable of VND 76 billion from Mr. Bui Cao Nhat Quan, son of Chairman Bui Thanh Nhon.