Hong River Machinery Joint Stock Company (MSH stock code) has just announced that it will finalize the list of shareholders for the 2024 interim cash dividend with a ratio of 35%, meaning that shareholders owning 1 share will receive VND 3,500, and the expected payment date is December 20th.

With more than 75 million shares currently in circulation, it is estimated that Hong River Machinery will pay a total of approximately VND 262.5 billion in this interim dividend.

Currently, the largest shareholder is Chairman Bui Duc Thinh, holding nearly 18 million shares (accounting for 23.91% of capital). Mr. Thinh’s daughter, Bui Thu Ha, is also a major shareholder with 5.8 million shares, and his son Bui Viet Quang holds 7.8 million shares. Accordingly, the Chairman’s family will receive more than VND 83 billion in dividends.

The second largest shareholder is an institutional investor, FPT Securities (FPTS) , holding 9.6 million shares, and they will also receive nearly VND 34 billion in dividends for this period.

The dividend payout comes as the Company is performing well. In the first nine months of the year, Hong River Machinery recorded net revenue of VND 3,852 billion, up 14% over the same period last year, and after-tax profit reached nearly VND 260 billion, up 57% over the same period last year.

In 2024, Hong River Machinery sets a target of VND 5,200 billion in revenue and VND 370 billion in profit, up 14.5% and 20.5%, respectively, compared to 2023.

Thus, at the end of the first nine months of 2024, Hong River Machinery has achieved 74% of its revenue plan and 70% of its profit target.

In terms of asset scale, as of September 30, the Company’s total assets increased by more than VND 900 billion compared to the beginning of the year, reaching VND 4,356 billion. The company’s cash and cash equivalents also increased by nearly 45% to over VND 659 billion. According to the explanation, the increase in the company’s assets is mainly due to the company’s cash holdings, including over VND 3,419 billion in cash on hand and more than VND 281 billion in bank deposits. In addition, the Company holds bonds worth nearly VND 374 billion.

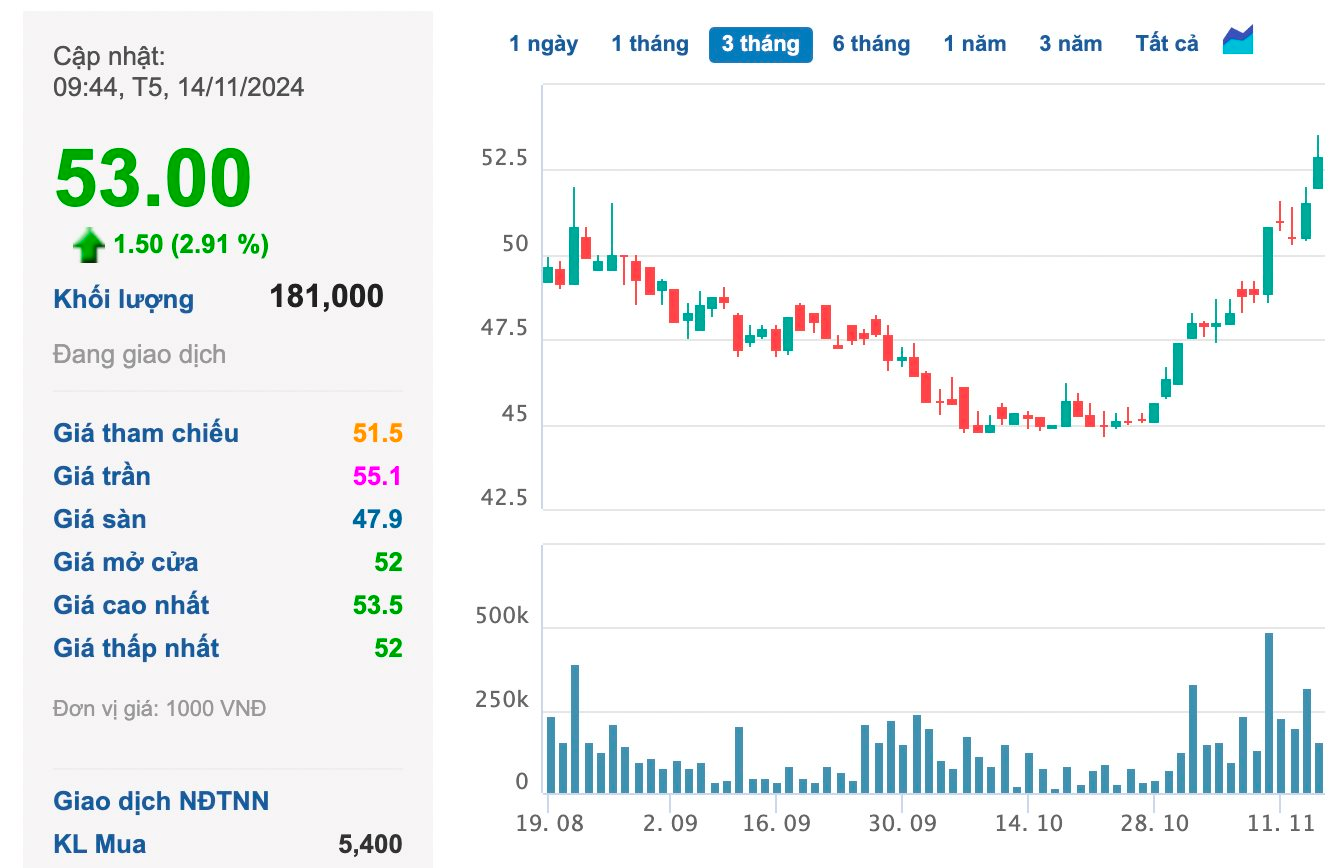

In the market, MSH shares are trading at VND 53,000/share, up 15% after less than 1 month of trading.

The Queen of Catfish Vinh Hoan Prepares for a High Cash Dividend After a Roaring Quarter

With over 224.45 million shares outstanding, the company will have to shell out approximately VND 449 billion to pay dividends.

A Luxury Condo Development on Prime Real Estate: Catalyzing a Company’s Transformation; 9M2024 Profits Soar 1,254 Times, EPS Nears 20,000 VND.

Introducing the visionary residential development, Hoang Thanh Pearl Apartment Project, located in the heart of Cau Dien Ward. This vibrant community rises from the grounds of what was once an old factory, bringing a new lease of life to the area.