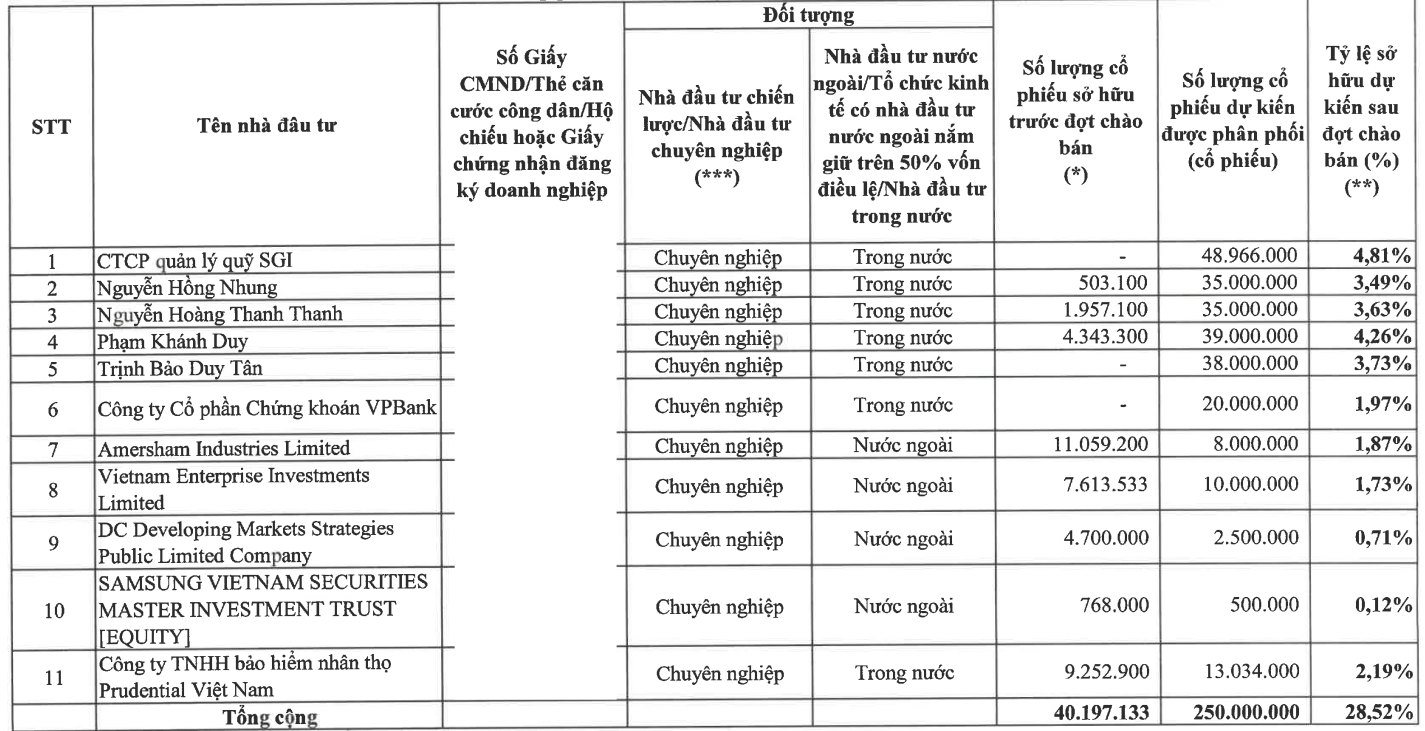

Specifically, KBC plans to offer 250 million shares, equivalent to 32.57% of the circulating shares, to 11 professional domestic and foreign securities investors. These shares will be subject to a one-year lock-up period. The expected timeline for the offering is between Q1 and Q3 of 2025.

Source: KBC

|

According to KBC’s proposal, the offering price will be set at 80% of the average closing price of the 30 trading sessions prior to the date on which the State Securities Commission (SSC) issues a written approval for the receipt of the complete file registration for the private placement. The lowest offering price is set at VND 16,200 per share, which is 45% lower than the closing price on November 15th, 2024, of VND 29,350 per share. If all the registered shares are sold, KBC will receive a minimum of VND 4,050 billion.

However, KBC stated that to restructure its debts, enhance the company’s financial capacity, and supplement capital for production and business activities, while also taking into account the stock price fluctuations, the total amount of money KBC intends to utilize is approximately VND 6,250 billion, corresponding to an offering price of VND 25,000 per share.

With the expected proceeds, KBC plans to allocate VND 6,090 billion for debt restructuring, mainly for repaying principal and interest to two subsidiary companies: Saigon Bac Giang Industrial Park JSC, with more than VND 4,428 billion, and Saigon Hai Phong Industrial Park JSC, with over VND 1,462 billion.

Benefiting from Trump’s re-election as US President, as the leading industrial park developer in Northern Vietnam signed an agreement with Trump Organization for a $1.5 billion project to build a golf course complex in Hung Yen province, the project’s timeline may be accelerated. KBC’s stock price has increased by 9% since Trump’s re-election on November 6th.

Thanh Tú

“Chairman Van Thanh Liem and Family Liquidate Their Sabibeco Holdings”

Following Sabeco’s public buyout announcement, a string of executives and relatives from Sabibeco, or the Saigon-Binh Tay Beer Joint Stock Company, have registered to offload their entire stock holdings. From November 1st to December 10th, over 22.3 million shares, constituting 25.6% of the company, were slated for sale by insiders.

Unlocking the Secrets Behind the 275 Nguyen Trai Project: A TCH Exclusive

TCH assures that its business operations remain uninterrupted and that it continues to fulfill its financial obligations. The company refutes the narratives circulating on social media, stating that they are not an accurate representation of the truth.