Illustration

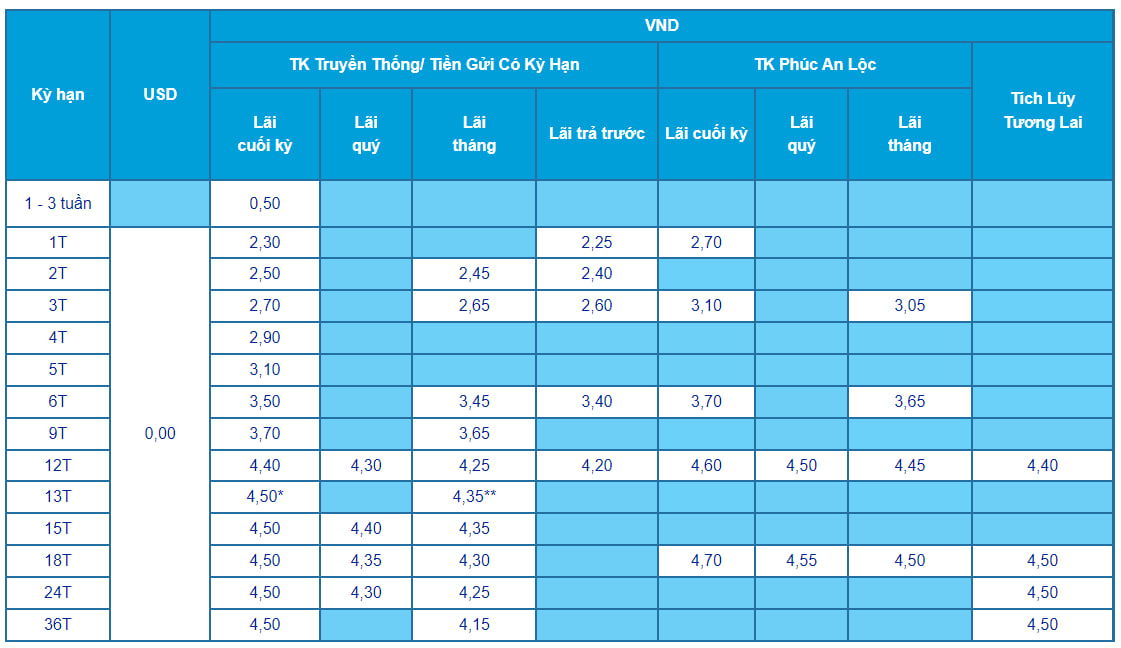

ACB’s Deposit Interest Rates for November 2024

During November, Asia Commercial Joint Stock Bank (ACB) offers its regular customers deposit interest rates ranging from 0.5% to 4.5% per annum for over-the-counter deposits with interest payable at maturity.

Specifically, the 0.5% per annum interest rate applies to tenors of 1-3 weeks; the 1-month tenor has an interest rate of 2.3% per annum; the 2-month tenor is 2.5% per annum; the 3-month tenor is 2.7% per annum; the 4-month tenor is 2.9% per annum; the 5-month tenor is 3.1% per annum; the 6-month tenor is 3.5% per annum; the 9-month tenor is 3.7% per annum; and the 12-month tenor stands at 4.4% per annum.

ACB offers a 4.5% per annum interest rate for long-term tenors ranging from 13 to 36 months. For the 13-month tenor, customers who deposit 200 billion VND or more will enjoy a preferential interest rate of 6.0% per annum.

For non-term deposits, the interest rate is set at 0.01% per annum.

ACB’s Over-the-Counter Deposit Interest Rate Table for November 2024

Source: ACB

In November, ACB also continues to offer flexible interest payment options: Quarterly interest: Interest rates range from 4.30% to 4.4% per annum; Monthly interest: Interest rates range from 2.45% to 4.35% per annum (For the 13-month tenor, a minimum deposit of 200 billion VND earns an interest rate of 5.9% per annum); Interest payable in advance: Interest rates range from 2.25% to 4.2% per annum.

Additionally, ACB introduces the Phúc An Lộc and Tích Lũy Tương Lai savings packages for customers to choose from, with the highest interest rate reaching 4.7% per annum.

ACB’s Online Deposit Interest Rates for November 2024

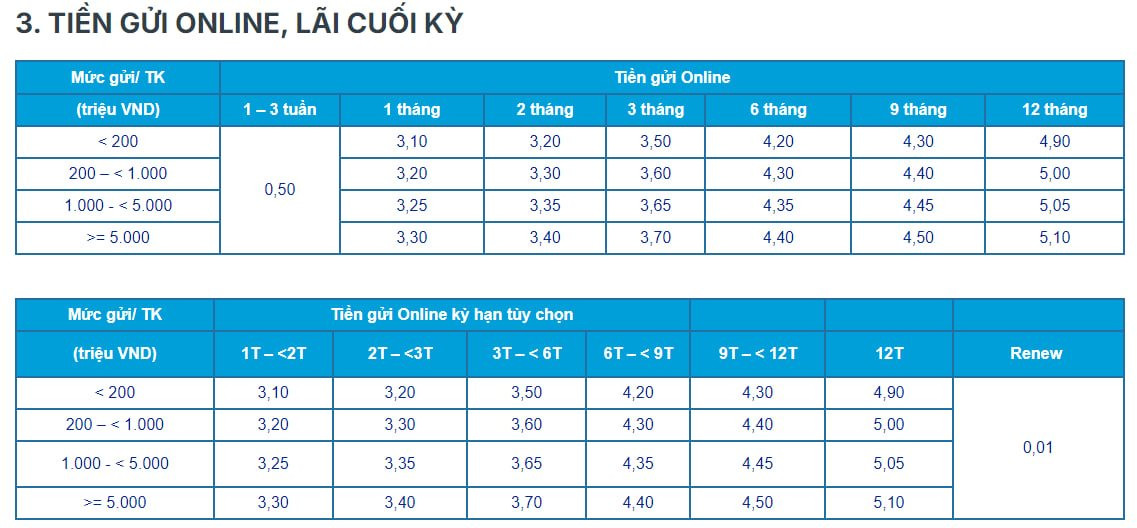

For online deposits, ACB offers interest rates ranging from 0.5% to 5.1% per annum for customers who choose to receive interest at maturity.

Specifically, ACB sets the interest rate for tenors of 1-3 weeks at 0.5% per annum.

For other tenors, ACB offers the following interest rates based on different deposit amounts:

For deposits below 200 million VND: The interest rate for a 1-month tenor is 3.1% per annum, 2 months is 3.2% per annum, 3 months is 3.5% per annum, 6 months is 4.2% per annum, 9 months is 4.3% per annum, and 12 months is 4.9% per annum.

For deposits from 200 million VND to less than 1 billion VND: The interest rate for a 1-month tenor is 3.2% per annum, 2 months is 3.3% per annum, 3 months is 3.6% per annum, 6 months is 4.3% per annum, 9 months is 4.4% per annum, and 12 months is 5.0% per annum.

For deposits from 1 billion VND to less than 5 billion VND: The interest rate for a 1-month tenor is 3.25% per annum, 2 months is 3.35% per annum, 3 months is 3.65% per annum, 6 months is 4.35% per annum, 9 months is 4.45% per annum, and 12 months is 5.05% per annum.

For deposits of 5 billion VND and above: The interest rate for a 1-month tenor is 3.3% per annum, 2 months is 3.4% per annum, 3 months is 3.7% per annum, 6 months is 4.4% per annum, 9 months is 4.5% per annum, and 12 months is 5.1% per annum.

Thus, for online deposits, the highest interest rate offered by ACB is for the 12-month tenor, ranging from 4.9% to 5.1% per annum.

ACB’s Online Deposit Interest Rate Table for November 2024

Source: ACB

ACB’s Lending Interest Rates

Recently, ACB announced the average lending interest rate for new loans disbursed in October 2024. Specifically, the average lending interest rate was 6.67% per annum, and the average interest rate spread between deposits and loans was 2.56% per annum.

ACB notes that this is the bank’s average lending interest rate and may not be applicable to specific loan cases. Customers can contact their nearest ACB Branch or Transaction Office for consultation and detailed information about ACB’s credit programs and promotions.

The New Deposit Record: People Are Now Banking Almost VND 2,900 Billion Every Day

As of the end of August, the total amount of savings deposits held by Vietnamese citizens in banks stood at an impressive 6.92 million billion Vietnamese Dong. This figure highlights a significant trend; on average, during August, citizens deposited nearly VND 2,900 billion in banks every single day.

The Cash Flows Strongly into the Banks

According to the latest data released by the State Bank of Vietnam, resident deposits reached over VND 6,920 trillion by the end of August 2024, a 6% increase compared to the end of 2023. This significant growth showcases the thriving economy and the confidence of residents in the country’s financial system.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

The Power of Compounding: Maximizing Your BIDV Savings Account Interest in November 2024

In November, BIDV offered an impressive 4.9% annual interest rate on online deposits for personal customers with a tenure of 24 to 36 months. This highly competitive rate showcases BIDV’s commitment to rewarding its customers with attractive returns on their savings. With this offer, customers can rest assured that their money is not only secure but also growing at a remarkable rate during this period.