At the recent questioning session at the National Assembly, the Governor of the State Bank of Vietnam (SBV) affirmed that the SBV has not licensed any gold or foreign exchange (forex) trading floors. However, in reality, underground gold and foreign currency trading floors are still operating clandestinely, day and night, while official investment channels such as securities and real estate are quite gloomy, and gold liquidity is very low.

Transfer money from securities and virtual gold

On November 15, the domestic stock market plunged for the second consecutive session. The VN-Index fell more than 13 points to just above the 1,200-point mark, with many stock codes falling by 5-10% within a few short days. Meanwhile, the price of gold dropped from nearly VND 90 million/tael to VND 80 million/tael, causing dismay among investors.

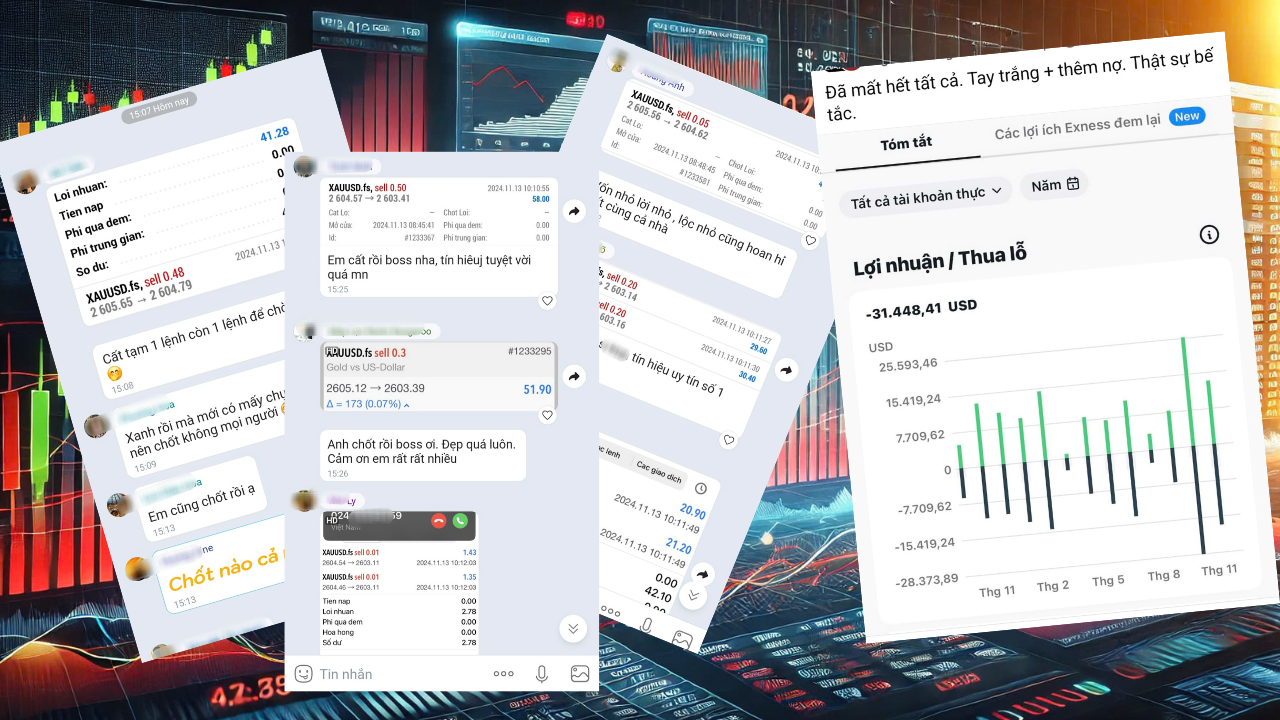

On the contrary, in the gold and forex investment groups on social media platforms such as Zalo and Telegram, the atmosphere was quite bustling as the international gold and USD prices fluctuated strongly. Some investors, disheartened by the stock market, started depositing money into underground forex floors to “play” gold and foreign currencies. “I’ve just deposited some money, please help me make some profits, Thanh (a broker from Fexsi floor who is guiding a group of over 100 investors). The stock market is so dull, it’s frustrating,” said a person named Ngoc in the “Gold and Forex Investment” group on Zalo, receiving many heart reactions from other members.

Screenshot of buy and sell orders on forex investment groups. Photo: LAM GIANG

According to the investigation by the Laborer Newspaper, Ms. Ngoc (from Ho Chi Minh City) is one of about 20 new members of this investment consulting group, led by a person named Thanh. This person will guide new investors on how to register an account on the Fexsi floor, exchange VND to USD, and provide instructions on placing orders. According to Thanh, Fexi is a reputable forex floor from the United Kingdom that has been operating for many years, and all transactions comply with international regulations. Thanh also asserted that in Vietnam, forex floors have not been licensed, so there will be risks, but they are very low (!?). “For those with small capital, I will guide them to increase their capital, and then charge a 10% fee on the profit,” Thanh said.

A characteristic of international forex floors is that they operate 24/7, so investors can trade at any time. According to brokers, the attraction of forex investment is that whether the gold price rises or falls, investors can profit from Buy (buy) or Sell (sell) orders at any time.

Ms. Nga (from Ho Chi Minh City), a gold account investor for about a month, said that although she had lost a few times, her overall trading result was positive, so she was “very confident” and “very happy.” Ms. Nga also switched from stock investment to forex. Notably, in discussions, many investors are aware that forex floors are not licensed in Vietnam, and international floors are far away and their addresses are unknown, but no one seems worried about the risk of collapse, fraud, or loss of money because “they are international floors, so how can they collapse?”

According to observations, in addition to investment consulting groups on Zalo and Telegram, there are also many gold and forex investment forums on the web with tens of thousands of members, with dozens of daily posts discussing the ups and downs of gold and foreign exchange rates… Many people post complaints and accusations of losing billions of dong due to losses on forex floors, but almost no one seems concerned. When the world gold price peaked at $2,790 per ounce in late October, many predicted that the price could reach $3,000 per ounce, causing many investors to place Buy orders for gold. However, the actual gold price has continuously plummeted and is now around $2,567 per ounce, resulting in losses for many investors. “I lost quite a lot because I placed Buy orders when I thought the price would go up further in the $2,700 per ounce region, but now I’m ruined. First 70 million VND, then 190 million VND; the more money I deposited, the more I lost,” said a regretful investor named Giang.

Nevertheless, on these forums and groups, there are still many invitations to invest to recoup losses, such as “those who are stuck with orders or have deeply negative accounts, join our group to recover your accounts.” However, the effectiveness of these groups is not verified. The Laborer Newspaper has also received some complaints from investors who poured billions of dong into domestic forex floors, only to find themselves unable to claim their rights when the floor collapsed.

High Risks

Talking to the Laborer Newspaper, economist Dr. Dinh The Hien said that when it comes to forex, people often think of the foreign exchange market with various currencies and the gold market. However, forex does not fall under typical investment segments as it is more akin to gambling. “When an investment channel has a gambling nature, it is usually only suitable for a small number of knowledgeable investors and involves more winning or losing. Many people are aware of the risks of derivative gold and foreign currency markets and the lack of legal protection, but they still close their eyes and participate due to the allure of high profits. Gold and foreign currency prices in these markets fluctuate by the minute and hour, so investors can win or lose their entire account in an instant. Especially when there is an incident with these international trading floors, investors will not be protected,” Dr. Hien analyzed.

Meanwhile, financial expert Phan Dung Khanh said that not only international forex floors attract Vietnamese investors, but there are also fake floors or those that borrow the names of foreign floors to lure investors. When there is an incident, or the floor collapses, or the investor loses, it will be very difficult to claim their rights because the floor is not registered for business, has no specific address, and mainly operates online… “The nature of the forex market already has risks that are many times higher than the stock market due to the high leverage ratio of up to 1:100. The ratio of winning investors on official international forex floors is already low, and the risk is even higher on fake and fraudulent floors in Vietnam. When there is an incident, investors lose money, and it is not easy for management agencies to handle it because they don’t know where the server is located or how the transaction flow works,” said Mr. Phan Dung Khanh.

Some financial experts warn that, with fraudulent forex floors, the operators often manipulate the buy and sell orders, even colluding to manipulate the market, to let investors win a small amount of money at first. Once the investors deposit a much larger amount, they will “trap” them and cause them to lose everything.

SBV Governor Nguyen Thi Hong affirmed that according to Vietnam’s current foreign exchange management regulations, only credit institutions licensed to operate foreign exchange business, especially foreign exchange business in the international market, are allowed to do so.

When enterprises and individuals have foreign currency needs, they should only transact with credit institutions. No organization or individual has been licensed by the SBV to operate foreign exchange business. Especially, the SBV has not licensed any forex trading floor to operate in Vietnam. If people transact on such floors, the risk of fraud will be very high. To control risks for people, relevant agencies must strengthen the detection of organizations and individuals establishing underground floors.

“LG Invests an Additional $1 Billion in Hai Phong”

The LG Group, a South Korean conglomerate, is expanding its investment in Vietnam with a new project for LG Display Vietnam Hai Phong Ltd. Co. in Trang Due Industrial Park. This significant investment of an additional USD 1 billion brings the total investment to USD 5.65 billion, a substantial increase from the initial USD 4.65 billion.

“Investing in Vietnam: Access to 65 of the World’s Top Markets”

On the morning of November 8th, Prime Minister Pham Minh Chinh attended a Vietnam-China business forum in Chongqing city. The forum was organized by the Ministry of Planning and Investment, the Committee for Management of State Capital at Enterprises, and the Vietnamese Embassy in China, in collaboration with the Chongqing municipal government.

The Foreign Sell-Off: VN-Index Takes a Tumble

On November 6, the 47th US Presidential Election saw a victory for billionaire Donald Trump, sparking a surge in the Dow Jones Industrial Average of over 1,500 points. The S&P 500 and Nasdaq Composite also reached new record highs. The VN-Index witnessed a significant boost, climbing 15 points, while gold prices took a downturn. However, in subsequent trading sessions, the VN-Index extended its decline as foreign investors continued their selling spree, and gold prices unexpectedly rebounded.

![[Infographic] A Comprehensive Overview of Bank Performance in H1 2024](https://xe.today/wp-content/uploads/2024/09/info-kqkd-ngan-hang-6T-100x70.jpg)