The results of the State Securities Commission’s (SSC) 2024 audit quality inspection at DFK Vietnam Co., Ltd. (referred to as DFK) showed that the auditors did not fully perform the audit procedures and did not collect adequate appropriate audit evidence to express an opinion on the 2023 financial statements of QCG. Therefore, the SSC decided to suspend the auditors who signed the 2023 financial statements of QCG.

Following the announcement, QCG stated that its Board of Directors will work with the audit firm to ensure that the 2024 financial statements meet the audit standards and conditions and will be announced to shareholders as soon as possible.

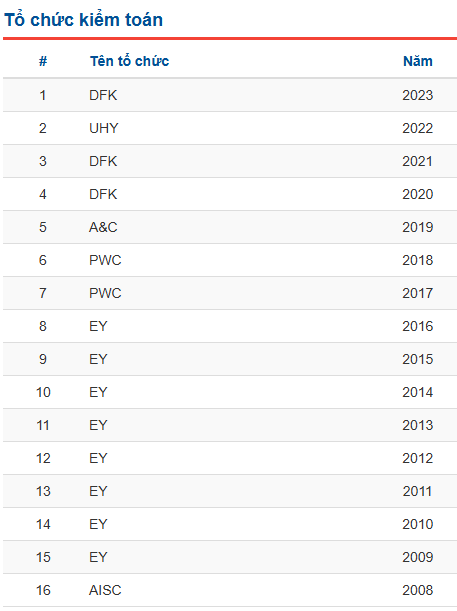

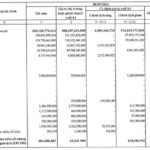

It is known that DFK has been the auditor for QCG’s financial statements for the years 2020, 2021, and 2023. For the 2023 financial statements mentioned above, this audit firm provided an unqualified opinion.

DFK was also the auditor for QCG’s 2024 semi-annual financial statements. The report received an unqualified opinion, along with another matter related to QCG having to refund the full amount of nearly VND 2,883 billion received from Sunny Island JSC to fulfill its obligation to Ms. Truong My Lan according to the first-instance judgment of the Ho Chi Minh City People’s Court dated April 11, 2024.

|

QCG’s financial statement audit firm through the years

Source: VietstockFinance

|

Quoc Cuong Gia Lai earned VND 67 billion related to Phuoc Kien project in Q3

Before sending the notification to QCG, the SSC had issued decisions to suspend the status of approved auditing firm and approved auditors for public interest entities in the securities sector for DFK Vietnam Co., Ltd. and its auditors, and Moore AISC Auditing and Informatics Services Co., Ltd. on November 12, 2024.

Specifically, the SSC suspended DFK’s status as an auditing firm until December 31, 2024, due to unsatisfactory audit quality, and also suspended the status of auditors Mr. Nguyen Anh Tuan and Mr. Nguyen Van Tan, both from DFK. For Moore AISC, the SSC suspended the status of auditor Mr. Phan Duc Danh until December 31, 2024.

What makes DFK Audit Special?

DFK Vietnam Co., Ltd. introduces itself as an independent member of DFK International since 2007. DFK International is an international network of audit and business consulting firms, comprising 219 member firms operating in 101 countries.

DFK Vietnam was established by “auditors with many years of experience working for Big4 auditing firms, currently has 100 employees, and is one of the top 20 auditing firms in Vietnam”.

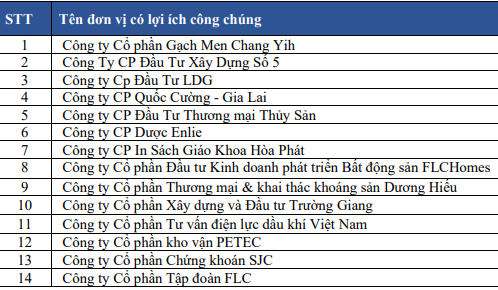

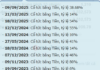

|

List of enterprises whose financial statements were audited by DFK in 2021

Source: DFK

|

According to its business registration certificate, DFK was established in 2003 and is currently headquartered on Bach Dang Street, Tan Binh District, Ho Chi Minh City. As of October 2020, its chartered capital was VND 10 billion, of which Mr. Nguyen Luong Nhan, General Director and legal representative, held 50%; Mr. Pham The Hung, Chairman of the Board of Members, held 18.5%; and the remaining three members, Mr. Nguyen Tien Dung, Mr. Nguyen Thanh Tuan, and Mr. Vu Van Sang, held 14%, 7.5%, and 10%, respectively.

The Chairman of the Board of Members, Mr. Pham The Hung, used to work for the international auditing firm KPMG and Arthur Andersen.

DFK also states that it is a member of the international auditing firm DFK International, an auditing network with offices in 92 countries.

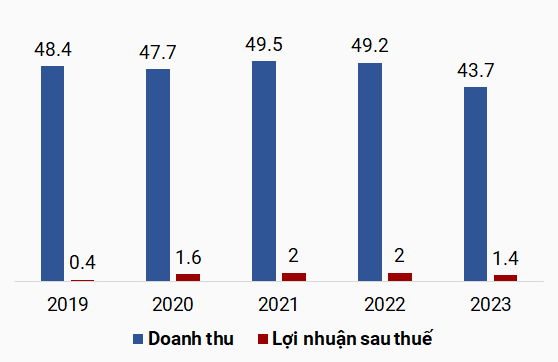

In 2023, DFK only recorded audits for two public companies. Its revenue reached nearly VND 44 billion, the lowest in the 2019-2023 period, and its after-tax profit was over VND 1.4 billion, a decrease of 11% and 28%, respectively, compared to the previous year.

|

DFK’s business results for the period 2019-2023 (Unit: Billion VND)

Source: DFK Vietnam. Compiled by the author

|

Recently, DFK was also mentioned in the investigation conclusion related to violations in the Dai Ninh project of Mr. Nguyen Cao Tri. Accordingly, the Investigation Police Agency of the Ministry of Public Security accused DFK of issuing an audit report on the capital contribution of shareholders, determining the owner’s equity capital to be VND 2,000 billion without sufficient evidence and without working with the Board of Directors, the Board of Management, or the legal representative of Saigon Dai Ninh Company, the project investor.

A Breach of Trading and Disclosure: A Tale of a Penalized Oil and Gas Enterprise

The Petrochemical DMC Corporation has been slapped with a hefty fine of VND 282.5 million by the SSC for violations related to trading and disclosure of information.

Top 10 Weekly Stock Movers: Surging Stocks “Ride the Wave” of Q3 Earnings, One Surges Post-Earnings Surprise

The market is highly polarized as the recovery momentum is largely concentrated on stocks with positive Q3 earnings.