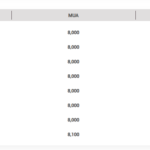

In the international market, the DXY index gained 1.72 points over the week, reaching 106.67. This marks the second consecutive week of increases, hitting its highest level since November 14, 2022.

|

DXY index performance from 2022 to November 15, 2024

Source: marketwatch

|

According to the recently released report by the US Bureau of Labor Statistics (BLS) on November 13, the consumer price index (CPI) rose by 0.2% from the previous month. Year-over-year, CPI increased by 2.6%, a 0.2 percentage point rise compared to September.

This report heightens concerns for the Federal Reserve as inflation rebounds and moves further away from its 2% target. Adding to the complexity is the election of Donald Trump as President. His plans for increased tariffs and higher government spending could stimulate growth but also exert additional inflationary pressure.

As a result, traders have tempered their expectations regarding the Fed’s rate cuts in the near future. They now anticipate a reduction of 0.75 percentage points by the end of 2025, about 0.5 points lower than pre-election forecasts.

Following the release of the inflation report, Fed Chairman Jerome Powell sent a clear message during an event in Dallas on November 14 that there is no rush to lower interest rates. He stated that the US economy’s solid performance would give the Fed more time to carefully consider the extent and pace of monetary policy easing.

The Fed’s gradual approach to reducing interest rates will keep US rates relatively higher compared to other countries. This, in turn, increases the demand for USD-denominated assets, leading to a stronger US dollar.

Source: SBV

|

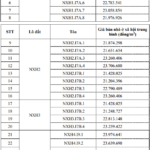

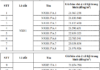

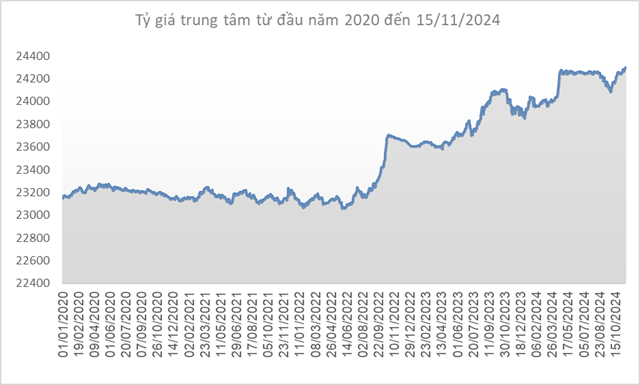

In Vietnam, the central exchange rate of the Vietnamese dong to the US dollar also increased by VND 20 per USD compared to the previous week (November 8), reaching VND 24,298 per USD on November 15, 2024.

With a 5% margin, the allowable trading range for commercial banks is between VND 23,083 and VND 25,513 per USD.

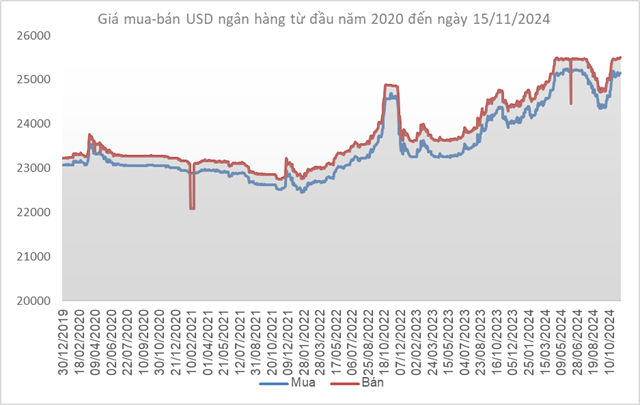

At the State Bank of Vietnam (SBV), the immediate buying rate remained unchanged at VND 23,400 per USD. The immediate selling rate was also kept constant at VND 25,450 per USD from October 25, reflecting the intervention rate set by the SBV to curb exchange rate fluctuations (similar to the intervention rate in the second quarter of 2024). Commercial banks can purchase USD from SBV provided they meet the negative foreign currency status requirement.

Source: VCB

|

Following the same trend, Vietcombank’s exchange rate stood at VND 25,160-25,512 per USD (buying-selling), representing a VND 60 increase in the buying rate and a VND 42 rise in the selling rate. The selling rate of VND 25,512 per USD is the highest in Vietcombank’s history since 2000. It also surpasses the immediate selling rate of VND 25,450 per USD set by SBV on the same day.

Source: VietstockFinance

|

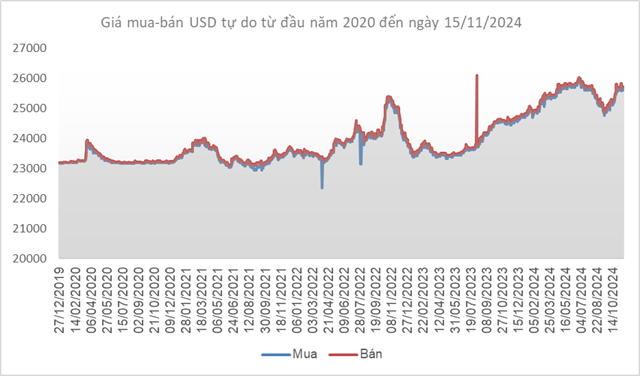

In contrast, the USD/VND exchange rate in the free market decreased by VND 100 in both buying and selling rates, settling at VND 25,620-25,720 per USD.

Khang Di

Building a New Phong Chau Bridge: Securing Safe and Efficient Transportation with an Additional 800 Billion VND Investment by 2025

On November 15th, Deputy Prime Minister Nguyen Hoa Binh signed a decision to allocate additional capital from the central budget reserve for 2024 to the Ministry of Transport. The funds are intended for the construction of the new Phong Chau Bridge on National Highway 32C in Phu Tho Province.

The Master Dealer’s New “Game”: Taking the MG Car-Selling Subsidiary Public

PTM is currently the distributor of MG motor vehicles for Haxaco, with a nationwide network of 7 dealerships.

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.