In the international market, the DXY index advanced to near 105 points, a 0.63-point increase from the previous week. This is also the highest level the index has reached in over four months.

After a week of stagnant growth, USD prices continued to rise even as the Fed decided to loosen monetary policy, marking the second consecutive interest rate cut as inflation cooled and the labor market weakened.

Following the significant 0.5-percentage-point reduction in September, the Federal Open Market Committee (FOMC) lowered the target range for interest rates by 0.25 percentage points to 4.50-4.75%.

The reason for the US dollar’s renewed strength lies in the timing of the rate cut, which comes amid a shifting political landscape. Donald Trump emerged victorious over Vice President Kamala Harris in the November 5th election.

Trump’s win has raised questions about the Fed’s future pace and scale of interest rate cuts, as the president-elect’s tariff policies could potentially reignite inflationary pressures.

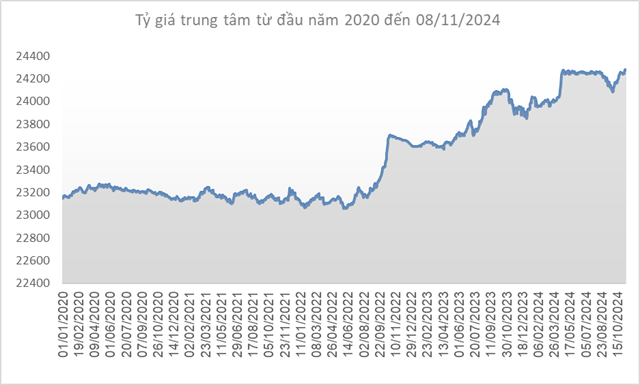

Source: SBV

|

In Vietnam, the central exchange rate of the Vietnamese dong to the USD also increased by 36 VND/USD compared to the previous week (November 1st), reaching 24,278 VND/USD on November 8, 2024.

With a 5% margin, the allowed trading range for USD at commercial banks is currently between 23,064 and 25,492 VND/USD.

At the State Bank of Vietnam (SBV), the immediate buying price remains unchanged at 23,400 VND/USD. The immediate selling price is also fixed at 25,450 VND/USD from October 25th, serving as the intervention price to “rein in” the exchange rate (equivalent to the intervention rate in Q2/2024). Commercial banks can purchase USD from SBV provided they have a negative foreign currency status.

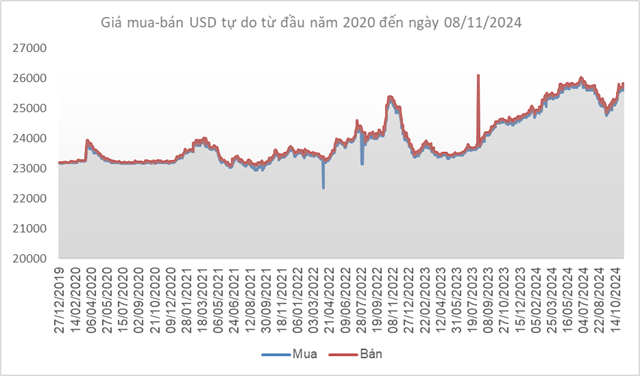

Source: VCB

|

Following the same trend, Vietcombank’s exchange rate stood at 25,100-25,470 VND/USD (buy-sell), a 16 VND/USD increase in both directions.

Source: VietstockFinance

|

Similarly, the USD/VND exchange rate in the free market rose by 120 VND/USD in both directions, reaching 25,720-25,820 VND/USD (buy-sell).

The Rising Exchange Rate: A Boon for Banks

The volatile exchange rates in the first half of the year have resulted in a windfall for many banks’ foreign exchange business.