Binance CEO Richard Teng told the Financial Times that Trump’s victory was a “big boost for crypto,” and the new US administration may be more open-minded about digital assets. Executives optimistically anticipated a fundamental shift in policy in Washington, welcoming the end of the Democratic regime, which was perceived as more “hostile” towards cryptocurrencies.

Binance was fined $4.3 billion last year for anti-money laundering and sanctions violations, while its former CEO was imprisoned.

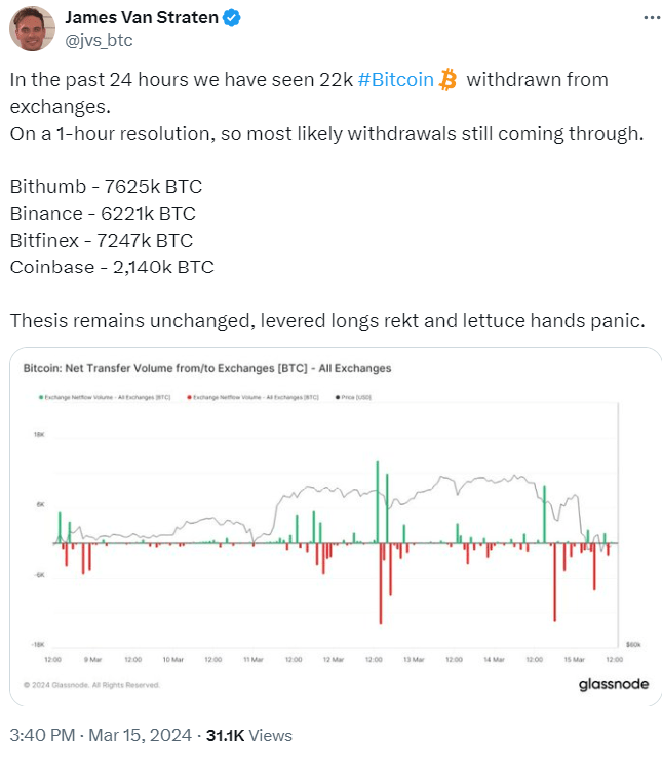

A year ago, the crypto industry eyed the election as a pivotal moment to change attitudes in Washington, which they believed was stifling innovation and driving businesses out of the US. This week, their faith and strategies, including raising $170 million for political campaigns this year, paid off. Bitcoin surged to a new all-time high of $81,000. Billions of dollars poured into US Bitcoin ETFs, according to Bloomberg data.

“America will embrace economic freedom,” said Brian Armstrong, CEO of Coinbase, a cryptocurrency exchange. Investors hope that the White House, under Trump, will initiate a program that sparks interest from major US institutions in cryptocurrencies.

Shervin Pishevar, a venture capitalist close to Trump and Elon Musk – one of the President-elect’s biggest supporters – said the US is “on the cusp of sensible crypto policy.” Trump has strongly touted the benefits of Bitcoin for the US economy during his campaign, endorsing the creation of a strategic Bitcoin reserve and even promoting a new crypto project backed by his sons.

Many in his inner circle are also pro-crypto. Vice President-elect JD Vance is a cryptocurrency owner.

“This is an extremely important day for the crypto industry,” said Mike Novogratz, the billionaire founder of Galaxy Digital, a crypto investment firm, despite his support for Kamala Harris’ campaign. “We’re in the early innings of a favorable year… with good news every week,” he added.

However, the crypto industry had also planned for the other outcome. Efforts to build consensus in Washington around clear crypto laws failed under the Democrats, while the EU, Singapore, and other nations have passed initial regulations on digital assets.

To gain more favorable support in Washington, the industry heavily invested in influencing political races—and it seems to have paid off.

However, the biggest challenge lies with the SEC, where Chairman Gary Gensler is pursuing an aggressive regulatory campaign. Major players like Binance, Coinbase, and Ripple have faced lawsuits in the recent past. While Trump has vowed to fire Gensler on day one, this may face legal hurdles as Gensler’s term extends until July 2026.

Experts predict a significant shift in the regulatory approach. Amy Lynch, a former SEC inspector, suggests that the Trump administration might transfer primary regulatory authority from the SEC to the CFTC, creating a more “risk-accepting” environment with less oversight. This could spur rapid growth but also carries the risk of large-scale fraud.

One of the industry’s top priorities is reforming regulations around how banks handle customers’ digital assets. The SEC’s 2022 accounting rule requires institutions to treat customer-held digital assets as liabilities on their balance sheets, rather than off-balance-sheet items. With the Congress likely tilting towards the Republicans, hopes are high for a repeal of this regulation.

Unraveling Trump’s Triumph, Elon Musk’s Billion-Dollar Turnaround, and the Silent Majority: Insights from Professor Ha Ton Vinh

“In a stunning victory, Donald Trump clinched the presidency in the 2024 US elections, winning in 4 out of 7 battleground states. This triumph propelled him to become the 47th President of the United States, marking an unprecedented milestone in the world’s largest economy after 132 years. From the US, Professor Ha Ton Vinh shared with us his insights on the ‘interesting yet simple’ reasons behind Donald Trump’s win.”

The Great SCB Cash Withdrawal Incident: What Impact Did Trump’s US Presidential Win Have?

The election of Donald Trump as the President of the United States sent shockwaves around the world, and naturally, the question on everyone’s mind is: What does this mean for the Vietnamese economy? In a week filled with notable events, we saw the impact of Trump’s victory on gold and currency rates, a viral video of the Military Bank CEO dancing to ‘Above the Penthouse’, and the Governor of the State Bank of Vietnam addressing the pressure of mass withdrawals from SCB. To top it off, a proposal for a two-part electricity price structure has sparked discussions. Stay tuned as we delve into these fascinating developments and explore their implications.