Illustration

Chinese car sales in Russia – a country spanning both Asia and Europe – have hit a new record high so far this year. This comes as sanctions have caused Western auto brands to sever ties with Moscow, and Beijing faces higher tariffs on electric vehicle exports from Washington and Brussels.

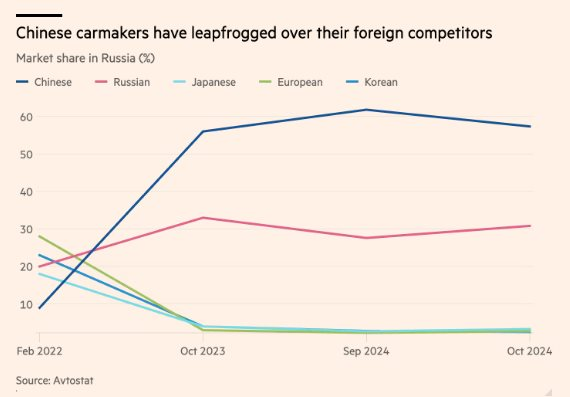

The conflict between Russia and Ukraine has seen a sharp decline in sales for European, South Korean, and Japanese auto brands, which previously dominated this market. According to analytics firm Avtostat, while these brands held a 69% market share as of February 2022, they now account for just 8.5%. In contrast, Chinese manufacturers’ market share during the same period has surged from 9% to 57%.

Data from the China Passenger Car Association reveals that in the first nine months of 2024, Russia was the top destination for Chinese-made cars, with a volume of 849,951 units. The second-largest market, Mexico, imported half as many cars from China as Russia.

Chinese cars are witnessing overwhelming sales in Russia.

Around 90% of Chinese cars sold in Russia have internal combustion engines. The expansion of China’s presence is so significant that not only customers but also industry experts are flocking to work for these new companies. Vadim Gorzhankin, PR director of Krasnoe Slovo, a company working with the automotive industry, stated, “Almost everyone who used to work for Western companies now works for Chinese ones.”

Chinese customs data shows that their automakers exported $1.8 billion worth of cars to Russia in September, compared to just $96 million in September 2021.

However, not all Russian consumers are happy with Chinese electric vehicles. In October, a taxi drivers’ union in Russia complained to the Kommersant newspaper about the issues the industry has faced since switching to cheaper Chinese models. Taxi drivers claim that Chinese cars often encounter breakdowns after 150,000 km, while European and Korean cars used to last up to 300,000 km. The union also noted that obtaining spare parts for repairs could be time-consuming.

The growing Chinese dominance has also angered some domestic manufacturers. Avtovaz, a shareholder in the Lada car manufacturer, stated in September that its market share could drop to 25% following the surge in Chinese car sales. Russian automakers have been hard hit by sanctions, limiting their access to Western parts and technology. To compensate, they have turned to Chinese products.

Car prices have also fluctuated wildly since the conflict. In Germany, a BMW X5 30d costs around $95,000, while the same model in Russia ranges from $152,000 to $203,000. In contrast, a comparable Chinese-made Chery Exeed VX costs about $56,000.

Some Chinese automakers have been tight-lipped about their involvement in Russia, attributing their increased presence to a black market operated by independent traders.

The trading relationship between Russia and China is becoming imbalanced. According to Trade Data Monitor, China, which was the Kremlin’s top trading partner before 2022, now accounts for over half of Russia’s total official exports. In September, only 5% of China’s total imports came from Russia.

John Kennedy, a Russia expert at Rand Europe, stated, “The direction of travel is towards greater Russian dependence on China.” Analysts believe that the growing trade volume between Russia and China could make it more difficult to detect sanctioned imports into Moscow.

According to FT

What Does the International Press Say About VinFast’s Achievement as Vietnam’s No.1 Brand?

“The Green Revolution’s Trailblazer”, “A Pioneer”, and “A Testament to Vietnamese Determination” – these are just a few ways international media has described VinFast’s remarkable journey to becoming Vietnam’s number one automotive brand. In a short span of time, VinFast has not only captured the hearts of Vietnamese drivers but has also left its fossil fuel-dependent competitors in the dust.

Electrifying Sustainability: Revving Up the Electric Vehicle Production Line

Supplying cutting-edge technology, production lines, and innovative solutions, Bühler Group is at the forefront of sustainable electric vehicle manufacturing in Vietnam and beyond. By reducing resource wastage, minimizing emissions, and optimizing production processes and costs, the company is paving the way for a greener future.

The Evolution of Trade Figures Between Vietnam and Russia

Vietnam’s trade with the Russian Federation has reached 3.52 billion USD in the first three quarters of this year, a significant 41% increase compared to the same period last year. This has sparked a growing interest from Vietnamese enterprises, with many delegations traveling to Russia to explore market opportunities.