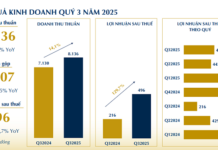

The large-cap stocks’ plunge today erased the gains from yesterday’s bottom-fishing session. The VN-Index fell by nearly 12 points to 1205.15 as foreign investors sold a net VND 1.658 trillion. Moreover, the HoSE’s liquidity dropped to a two-week low.

The slight recovery efforts in the morning session failed to provide any momentum in the afternoon. The entire afternoon session was a continuous downward trend. The VN-Index closed at its intraday low, down 0.98% with 287 gainers and 83 losers. The number of stocks falling by more than 1% surged to 154, compared to 78 in the morning.

The pressure in the afternoon was quite intense, with HoSE’s liquidity in the afternoon session surging by 74% compared to the morning, reaching VND 7,206 trillion. With a very narrow breadth and a significant increase in the number of stocks declining sharply, it is clear that sellers dominated the market and continuously pushed prices lower.

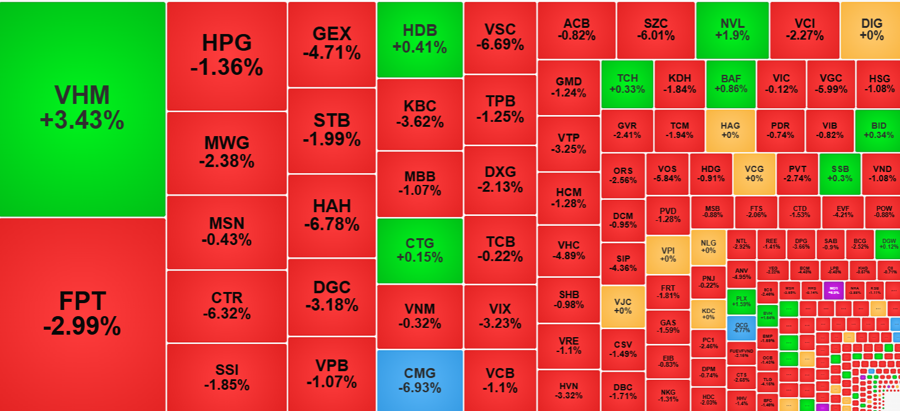

Of course, the blue-chip stocks were the main culprits, dragging down the VN-Index and further exacerbating the pessimistic sentiment. FPT fell by 2.99%, VCB by 1.1%, HPG by 1.36%, GAS by 1.59%, and VPB by 1.07%. These are all among the largest-cap stocks in the market. As these stocks did not decline much in the morning, they gave a certain sense of “safety.” When the VN-Index plunged deeply, fear spread, and selling pressure emerged broadly.

In the VN30 basket, more than half of the stocks (18) closed at their intraday lows. This reflects the continuous pressure until the end of the trading session. The VN30-Index fell by 0.88% with 6 gainers and 23 losers, including 13 stocks falling by more than 1%. The basket’s liquidity in the afternoon session also increased by 23% compared to the morning, confirming increased selling pressure.

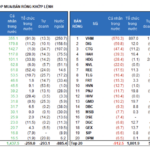

FPT, a key stock, experienced its deepest decline in nearly four months, falling by 2.99%. Its liquidity surpassed VND 1,000 billion, the highest in 28 sessions and leading the market today. Foreign investors were net sellers of 3.93 million shares, including matched transactions, with a net value of VND 312 billion. In contrast, VHM rose by 3.43% with a liquidity of VND 1,105 billion. VHM was also net sold by foreign investors for VND 342.3 billion, but domestic investors were strong buyers, accounting for 95% of the total liquidity. VHM’s market capitalization is slightly higher than that of FPT, and thanks to its more substantial increase, it offset the points lost by the VN-Index due to FPT. However, the significant decline in many other stocks rendered this balance meaningless.

With significant selling pressure in the afternoon, many stocks widened their decline and witnessed increased liquidity. Among the 154 stocks falling by more than 1% at the VN-Index’s close, 24 had a turnover of over VND 100 billion, including 9 from the VN30 basket. The remaining stocks were mainly from the midcap segment.

The sharp decline in the index also severely impacted the mid and small-cap stocks. The midcap index closed 1.6% lower, while the small-cap index fell by 1.7%. CTR, GEX, HAH, DGC, KBC, CMG, and VSC plunged sharply with high liquidity.

Today’s contrarian stocks were mostly illiquid. Apart from VHM, notable stocks included NVL, up 1.9% with a matching value of VND 131.4 billion; PLX, rising 1.59% with VND 24.5 billion; NO1, climbing 6.9% with VND 12.7 billion; BWE, advancing 1.83% with VND 10.3 billion; and TRC, up 4.06% with VND 9.6 billion.

Foreign investors continued to sell a net VND 547.6 billion in the afternoon session, following a net sell-off of VND 1,110.4 billion in the morning. In terms of scale, the selling in the afternoon eased slightly by about 13% compared to the morning but still amounted to VND 1,295.2 billion. Buying increased to VND 747.6 billion but remained small compared to the selling side. Overall, foreign investors sold a net of more than VND 1,658 billion on the HoSE. The most sold stocks were VHM (-VND 342.3 billion), FPT (-VND 312 billion), HDB (-VND 208.2 billion), HPG (-VND 131.2 billion), and SSI (-VND 108.6 billion). On the UpCOM, MCH was net bought for VND 239.6 billion through matched transactions in the morning.

Today’s sharp decline indicates that the reversal seen yesterday is not yet reliable. It is evident that the money flow is no longer pushing prices higher, and the significant drop in liquidity suggests that buyers are still waiting for lower prices.

The Market’s “Rebound Rally”: Foreign Selling “Accepted”, Bottom Fishers “Strike” from 1200-Point Region, Liquidity Nearly Doubles

Yesterday’s pessimistic performance led to a negative opening for the market this morning, with the VN-Index dipping as low as 1,197.99 points and the number of declining stocks outpacing advancers fivefold. However, an unexpected turnaround occurred as strong buying power once again demonstrated its strength, driving a series of upward reversals. Turnover on the two exchanges is up nearly 90% from yesterday’s morning session, even as foreign investors continue to offload significant net sell positions.

The Market Dip: Exploring Stocks with Potential for Profitable Gains

The banking sector stocks form a significant part of the portfolio, thanks to their ability to generate stable profits. Alongside this, the real estate, transportation, and retail sectors present potential for mid- to long-term growth.

The Art of Strategic Trading: Navigating the Freeze on Liquidity for Derivatives Maturity

The trading market was sluggish this morning as investors awaited the derivatives expiration in the afternoon. The total matched order value on HoSE and HNX fell by 58% compared to yesterday’s morning session, reaching just over VND 3,368 billion, the lowest since April 2023. Despite this, the breadth showed a balanced differentiation.