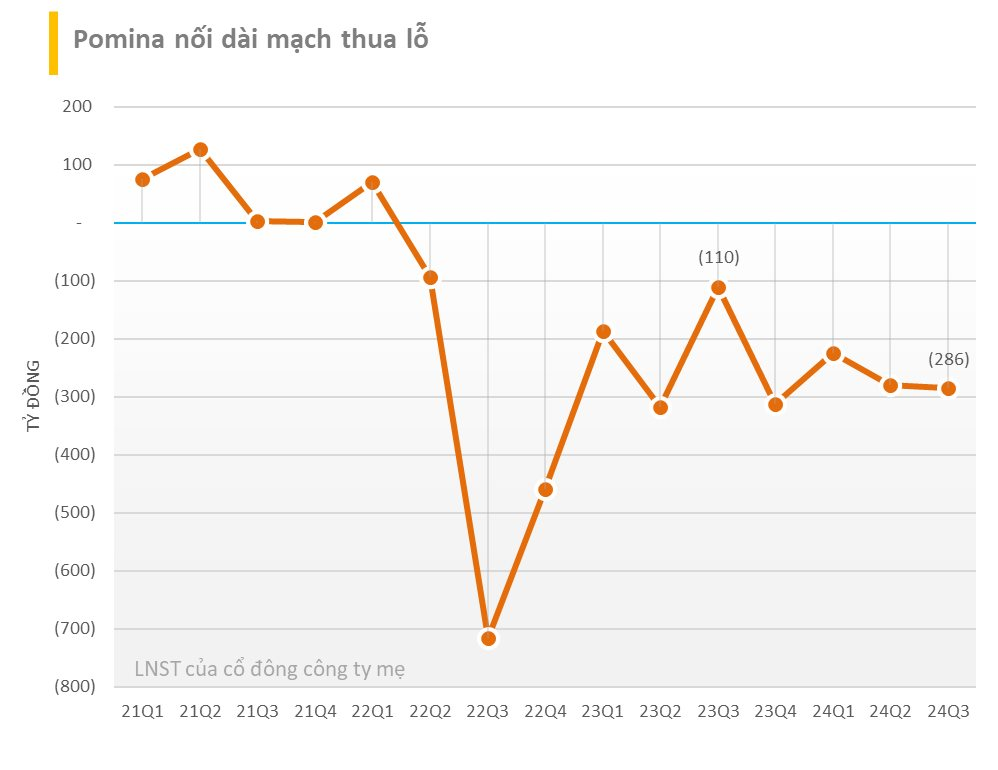

CTCP Thép Pomina (stock code: POM) has released its Q3 2024 financial report, albeit nearly a month late, revealing a consolidated after-tax loss of 286 billion VND. In the same period last year, the company posted a loss of 110 billion VND.

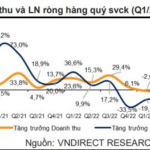

Net Loss in 7 out of 9 Quarters from Q3 2022 to Present

Pomina attributed the loss to the fact that Pomina 3 and Pomina 1 steel mills remain inactive yet incur management and interest expenses. The company is still seeking investors for restructuring and hopes to resume operations as soon as possible.

Despite only a slight 3% decline in revenue compared to the same period last year, Pomina continues to sell goods below cost, posting a gross loss of 32 billion VND this quarter.

In the nine quarters from Q3 2022 to the present, the company has incurred gross losses in seven quarters, particularly in the first three quarters of 2024.

The “knockout punch” in Q3 2024 was a surge in financial expenses to 206 billion VND (including 169 billion VND in interest expenses).

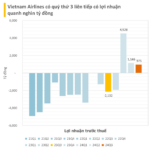

For the first nine months of the year, Pomina recorded 1,576 billion VND in revenue, a 47% decrease, and a net loss of 791 billion VND. Unless there is a dramatic improvement in profits in the final quarter, Pomina will have posted losses for three consecutive years, with losses ranging from 791 billion to 1,000 billion VND.

As a result, the cumulative loss as of September 30, 2024, reached 2,356 billion VND, eroding equity to just over 500 billion VND, pushing the debt-to-equity ratio to 17.4 times.

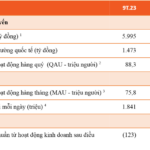

VIETINBANK IS THE LARGEST CREDITOR

Pomina currently has nearly 5,500 billion VND in short-term debt and finance leases, along with 719 billion VND in long-term debt. A large portion of its assets are tied up in construction work-in-progress for the blast furnace and EAF furnace projects (belonging to the Pomina 3 plant) valued at 5,823 billion VND. This project involves the construction of a 1 million-ton capacity steel billet plant in the Phu My Industrial Park.

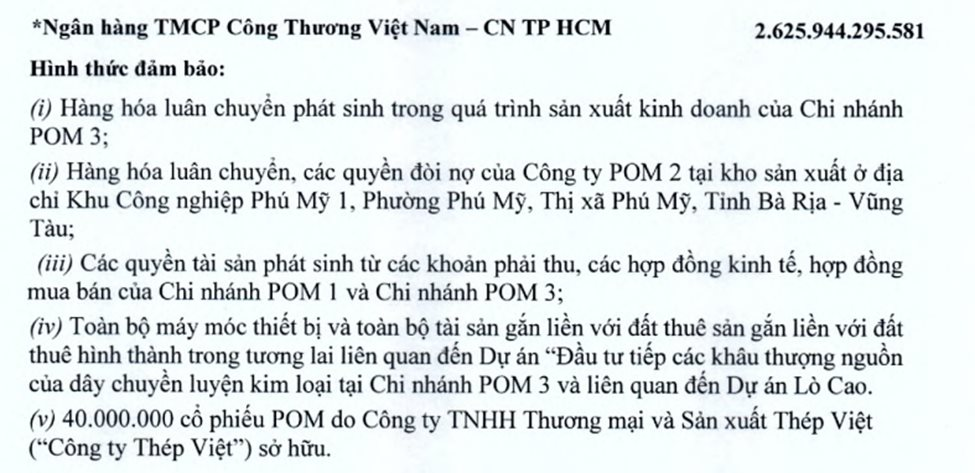

The two largest short-term lenders to Pomina are BIDV HCMC Branch (nearly 1,700 billion VND) and Vietinbank HCMC Branch (over 2,600 billion VND). The loans are secured by land use rights and shares.

The long-term loan for the blast furnace project is also financed by Vietinbank, with a total disbursed amount of 1,035 billion VND, secured by the project itself.

Pomina also cited a system server issue at one of its plants as the reason for the delay in submitting its Q3 2024 financial statements, which caused a delay in data entry and subsequent collection of financial data.

A notable event in Q3 2024 occurred on September 10, 2024, when Pomina officially signed an Investment Cooperation Contract with its strategic partner, Nansei Steel Company of Japan, and an MOU with another professional investor, whose name was not disclosed, with the aim of restarting the blast furnace project in early 2025.

At the Extraordinary General Meeting in March 2024, Pomina announced its plans for corporate restructuring, which included the establishment of a new legal entity, Pomina Phu My Joint Stock Company, with a chartered capital of approximately 2,700-2,800 billion VND (accounting for 40% of the capital structure) and bank loans of approximately 4,000 billion VND (accounting for 60% of the capital structure). Pomina would contribute in kind all the land, workshops, and equipment of POM 1 and POM 3 in exchange for a 35% stake in the new company, while the other investor would contribute cash for a 65% stake.

According to the asset valuation results by AFC Audit Firm and Savills Consulting Firm, the total value of the assets of the two factories contributed in kind is 6,694 billion VND (excluding VAT). POM 1 was valued at 336 billion VND, while POM 3 was valued at nearly 6,358 billion VND.

The company expects to recover approximately 5,100-5,800 billion VND from the new legal entity after deducting the planned capital contribution. Pomina intends to use the recovered funds to repay short-term and long-term bank loans totaling 3,757 billion VND and settle 1,343 billion VND in debts to suppliers.

This is the new restructuring plan after POM temporarily halted its earlier plan to raise 700 billion VND by privately offering more than 70 million shares (over 20% of its charter capital) to Nansei (Japan). According to the initial plan, the proceeds from this capital contribution would have been used to restart the blast furnace and restructure the company to improve its financial capacity.

There is currently no further information available regarding the restructuring project.

A Luxury Condo Development on Prime Real Estate: Catalyzing a Company’s Transformation; 9M2024 Profits Soar 1,254 Times, EPS Nears 20,000 VND.

Introducing the visionary residential development, Hoang Thanh Pearl Apartment Project, located in the heart of Cau Dien Ward. This vibrant community rises from the grounds of what was once an old factory, bringing a new lease of life to the area.